- "It's snowing still," said Eeyore gloomily.

- "So it is."

- "And freezing."

- "Is it?"

- "Yes," said Eeyore. "However," he said, brightening up a little, "we haven't had an earthquake lately."

From ZeroHedge:

It's a dead horse that has been beaten to a bloody pulp, but that doesn't stop SocGen's resident "permabear" Albert Edwards from listing what he believes are the two main reasons for the market's "miraculous", and record, rebound from the Christmas Eve "bear market" lows: 1) the abrupt U-turn in Fed policy reducing fears of an imminent US recession, and 2) a similar easing of Chinese monetary conditions resulting in a firming up in their economic data.

But, Edwards asks in his traditionally skeptical voice, "what happens if the market is wrong in presuming that monetary easing will bring about a rebound in the economic data? What happens if, as the savvy David Rosenberg believes, the Fed has overdone the tightening cycle and the economy is already headed into recession?"

To answer that rhetorical question, Edwards looks at recent recessions.

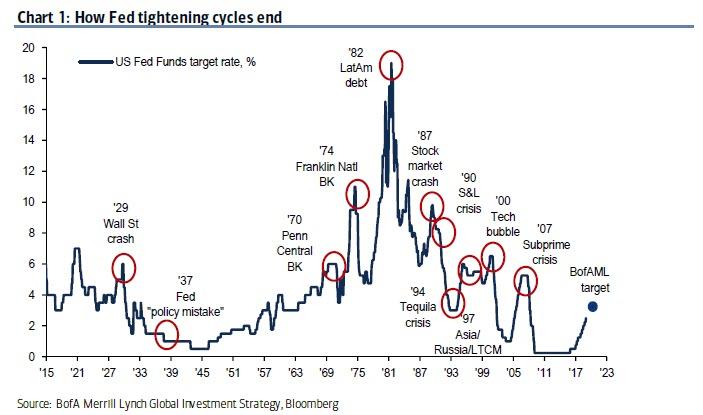

First, the SocGen strategist echoes what we showed several months ago, pointing out that equities always rally after the final Fed tightening, even when it later becomes clear that the Fed has tightened too much and recession looms. That said, the endgame is far less rosy, because despite the equity rally, the odds of a soft landing are not good since the last 13 Fed tightening cycles have ended in 10 recessions and/or financial crises.

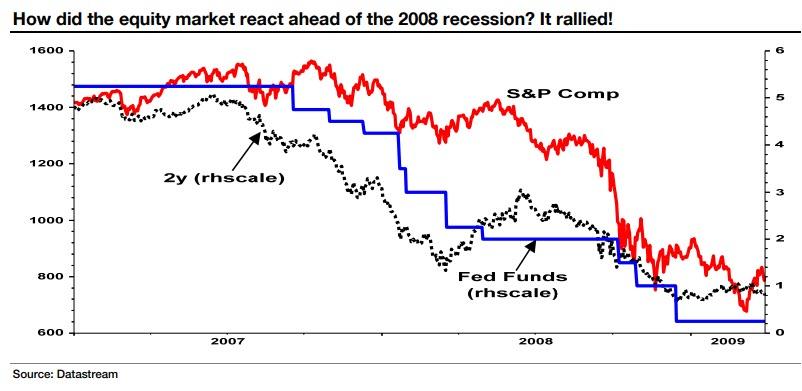

As Edwards highlights, the experience of the last two recessions in 2008...

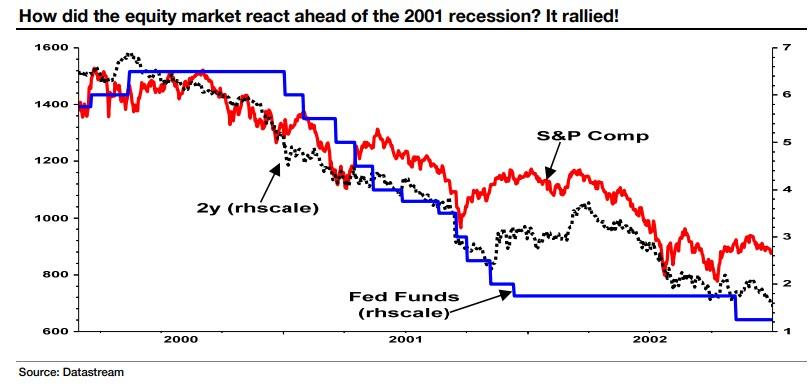

... and 2001..

... shows equities peaking after the end of the tightening cycle.

Edwards next makes a key point that we have repeatedly stated previously when focusing on the hypocrisy of the permabulls who say to always buy... just forget to advise when it's time to sell:

"Traditionally the equity market rallies after the final rate hike and any rally should be sold into if you believe the economy is headed into recession. The problem is that no-one ever forecasts imminent recessions. The closely followed BAML Global Fund Manager Survey shows that in April 70% of investors surveyed expect a global recession to start in H2 2020 or later and most shocking, 86% believe yield curve inversion does not signal an impending recession!"So are you going to pile into equities along with the ‘dumb money?’ Are you feeling that lucky?" Edwards asks, and then proceeds to muse that if this equity market rally is in fact a head fake, what should we be looking out for aside from the lack of recovery in the real economic data?

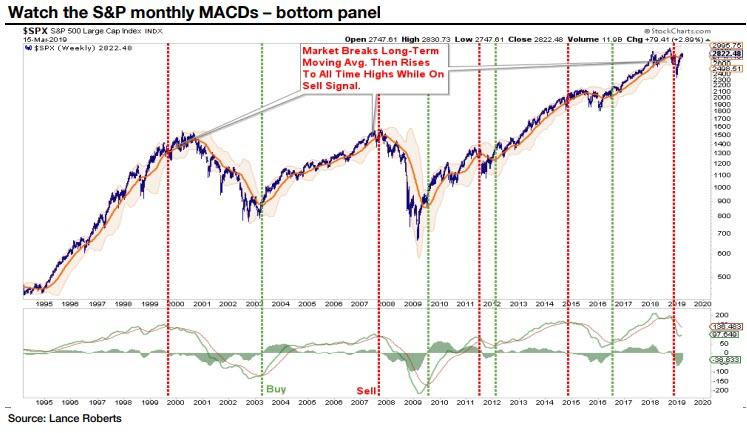

One thing that the SocGen strategist believes is worth watching is the technicals within the equity market itself. Here he highlights the work of regular Zero Hedge guest Lance Roberts who several weeks ago "presciently noted that it is entirely plausible the then ongoing equity rally could break record highs, but that this could still be consistent with a bear market starting in Q4 last year. He highlighted that instead of focusing on any record high, we should be keeping a very close eye on the monthly MACDs (Moving Average Convergence Divergence indicator). These combinations of moving averages are used in technical analysis as market timing tools and are momentum indicators highlighting market turning points."

In the chart above, Edwards notes that prior to the two previous bear markets a sell signal was given by the monthly MACDs (shown by the red dotted vertical line). In both cases the equity market (top panel) went on to make new highs but the monthly MACDs did not confirm this as a bullish signal and it was prudent to stay out of the equity market until a ‘buy’ signal was confirmed by the green vertical dotted lines. (We note that sell signals in 2012 and 2015 did not lead to full bear markets, but the indicator recorded a buy re-entry point without missing out on much upside)....MOREThe tragedy of Albert is that his equity analysis is a throwback to a more rational world, a world without negative interest rates or central banks buying equities. His understanding of credit markets is second-to-none but...

Société Générale's Albert Edwards Says "My Reputation For Calling Stocks Is In Tatters"

But it isn't for the equity calls that Albert gets paid, and they're not why pros still listen to him:

The House Fed has thwarted his House Stark at every turn.

Now he's getting ready to roll but it may be too late for him.

"I fought. I lost. Now I rest. But you, Lord Snow… you'll be fighting their battles forever."

Albert addressing another standing room only investment conference crowd

Last seen in "Société Générale's Albert Edwards: Winter Is Coming".

Albert's twenty-year bullishness on bonds and what declining yields tell us about the underlying economy is why SocGen keeps him around....