"At This Point You Realize Something Has Gone Very Wrong"

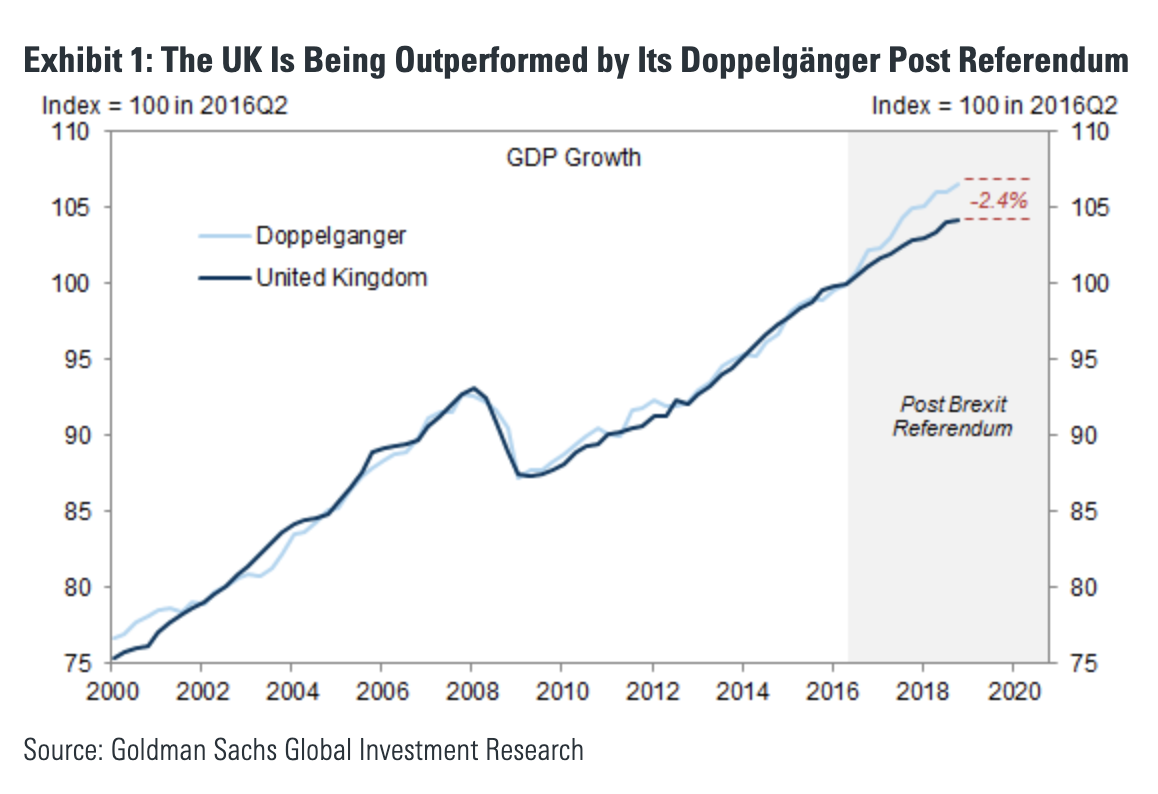

In his latest note published last week, SocGen's Albert Edwards - never at a loss subjects that inspire his outrage - rages on the topic of Brexit, and specifically the often repeated assertion (discussed here as well), that post-Brexit referendum UK has lost 2% of its GDP output, or about £800m a week.

We won't dwell on that for a simple reason: as UBS' chief economist Paul Donovan put is best last week, "A few things have happened in the EU-UK divorce. Does anyone care? No, they do not."

Another reason why Brexit is largely meaningless despite resulting in countless, pound-moving newswire headlines each hour: the final outcome is clear - with Theresa May a remainer, and with both sides seeking to perpetuate the status quo by delaying and delaying and delaying some more until it appears that it's the public's desire to reverse the outcome of the 2016 referendum, it is just a matter of time before the entire idea of Brexit is scuttled.

Instead we will focus on an anecdote that Edwards brings up in relation to his now 30-year-old son, Newcome, who was 10 back in 1999, and was reportedly stealing Albert's Financial Times "to look at Nasdaq share prices:"

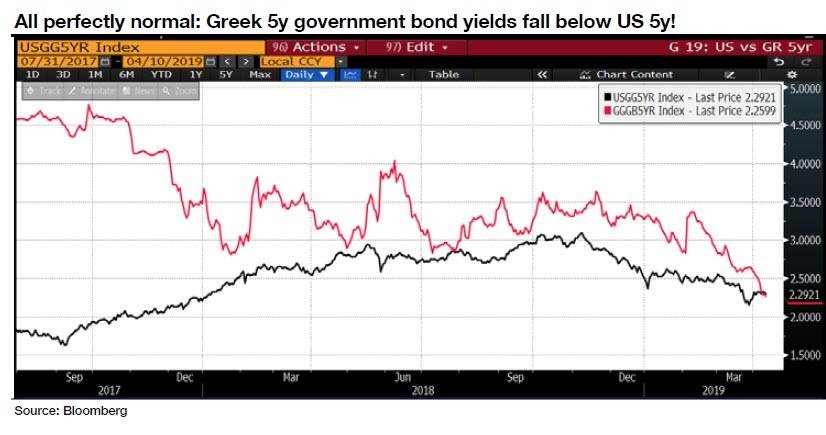

It was at that point that I realised the tech bubble was really getting out of hand (I have reproduced part of this weekly explaining what happened, at the end of this note).As Edwards further explains, "discovering my 10 year old son looking at Nasdaq share prices alerted me to the extent of the madness that had gripped the markets by end 1999. Similarly there are moments in this job when something you hadn’'t been following particularly closely is highlighted to you and you stagger back in shock. At that point you realise that something has gone very wrong."

So unlike 1999, when it was Nasdaq prices that set Edwards off, this time it was the yield on the Greek 5Y government bond that inspired shock in the SocGen strategist, to wit: "I certainly think the decline in the 5y Greek government bond yield to 2.28%, below that of the US, counts as such an event (they were recently yielding 20%!). @mnicoletos on Twitter highlighted the chart below with the comment, “if you can’t find anything wrong with this chart then I’m afraid there isn’t much to say…."

Aside from the shock of 5Y Greek govt bonds yielding below their US equivalents, there were a few more topics that "surprised" Edwards when he returned from his latest business trip to the US, the first of which is that while fears of a global hard landing receded at the start of last week in the wake of the bounce in the official NBS Chinese PMI back above 50.0 in March, even though most of the components of the official manufacturing PM rose, the important employment component fell further to 47.2 (see chart below). As Edwards points out, "this has now slumped below the levels that helped trigger the 2015 Renminbi devaluation! In addition despite recovering, non-manufacturing employment remains below the critical 50 level, meaning employment is still contracting."...MORE

And as the SocGen strategist correctly notes, "at the end of the day, what matters to the Chinese Government far more than the GDP growth numbers most commentators focus on, is employment growth. For it is job losses, rather than whether GDP grows at 6% or 5%, that might be a prelude to social unrest."...

He has a point. Truth be told we don't track Chinese employment, instead using electrical production as a proxy for all things growth related.