Two terabytes on the 2000-2001 Western Energy Crisis were unpublished by FERC, and not even its custodians know why

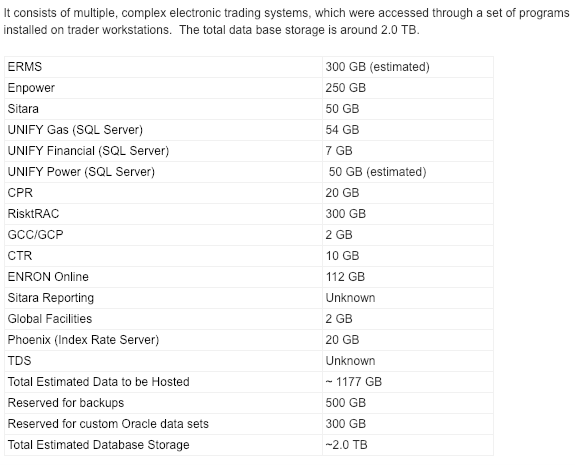

Government investigations into California’s electricity shortage, ultimately determined to be caused by intentional market manipulations and capped retail electricity prices by the now infamous Enron Corporation, resulted in terabytes of information being collected by the Federal Energy Regulatory Commission. This included several extremely large databases, some of which had nearly 200 million rows of data, including Enron’s bidding and price processes, their trading and risk management systems, emails, audio recordings, and nearly 100,000 additional documents. That information has quietly disappeared, and not even its custodians seem to know why.

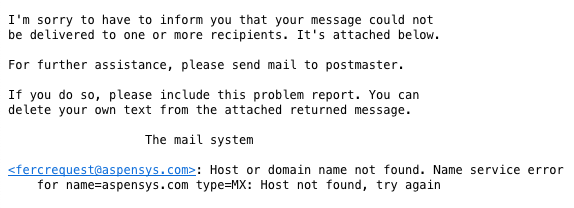

According to FERC’s website, some of the information is maintained by Lockheed Martin, which will provide members of the public with copies of the data “for a fee” if they contact Lockheed Martin via a non-existent e-mail address, fercrequest@aspensys.com.

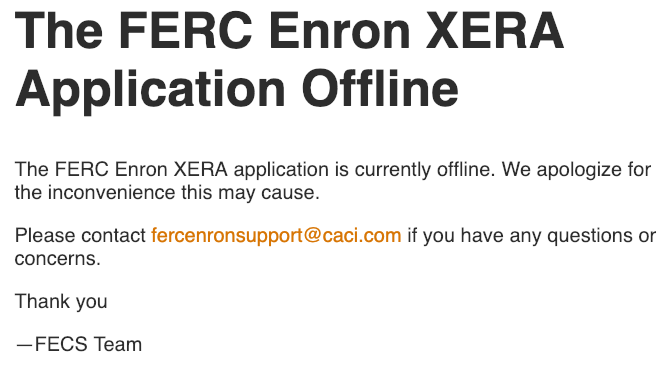

The collection of emails, scanned documents, and transcripts, on the other hand, is hosted by another defense contractor - CACI. Unfortunately, that portion of their site is down. According to the Internet Archive’s Wayback Machine, it’s been down since at least August 2013.

An inquiry was sent to the support email address listed on their error page. A month later, CACI responded that the data was “under review by the FERC and is currently not accessible.” Asked why the information was being re-reviewed despite having been previously released, CACI informed MuckRock that they didn’t know and that the information might not be available again...MOREHT: MetaFilter

We are fans of the databases and have a dozen posts referencing/linking them e.g..

Fun With Enron Emails II (ENE, JPM)

Those boys were a chatty bunch.

Back in 2009 we posted "Fun With Enron Emails" (I):

... Anyhoo, I was at Trampoline's Enron email database and remembered some of the finds that other people had unearthed:The database is just wonderful that way. Unfortunately it does not contain the most interesting (among the cognoscenti) Enron email, which John Palmisano infamously wrote from Kyoto:

RE: Lunch

- From:

- randy.g.kruger.jr@us.andersen.com

- To:

- Sent:

- 09/01/2002 at 16:49

Email metadata

The message

This week is not good. I have too large a pile of documents to shred.

Next week is better. I suggest Wednesday, Thursday or Friday.

To: dgiron@enron.com, Randy G. Kruger Jr.@ANDERSEN WO,

mikeshaw@andrews-kurth.com, todd.w.taylor@bakernet.com

cc:

Date: 01/09/2002 10:26 AM

From: SSCHROED@us.ca-indosuez.com

Subject: Lunch

OK you slackers (excluding Shaw), I'll give you another chance to respond.Schroeder

Lunch this week or next, let me know what's good. If meeting after work is

better for you, let me know. Certainly all of you can stop shredding

documents for 5 minutes to respond.

*******************Internet Email Confidentiality Footer*******************

If implemented [the Kyoto Protocol] will do more to promote Enron’s business than will almost any other regulatory initiative outside of restructuring of the [electricity] and natural gas industries in Europe and the United States…. The endorsement of emissions trading was another victory for us…. This agreement will be good for Enron stock!!It was time to turn deeds into dollars, he added:

Enron now has excellent credentials with many ‘green’ interests including Greenpeace, WWF [World Wildlife Fund], NRDC [Natural Resources Defense Council], GermanWatch, The US Climate Action Network, the European Climate Action Network, Ozone Action, WRI [World Resources Institute], and Worldwatch [Institute],” reported Palmisano. “This position should be increasingly cultivated and capitalized on (monetized).Good times, good times at the Crooked E.

If you're interested 2008's "California's cap-and-trade won't work" has some links:

Here at Climateer Investing the comparison between California electricity deregulation and carbon trading seemed self-evident, based, if for no other reason, on the fact that the pals and alumni of Enron are the ones pushing the trade. Now the media is picking up on where the trade part of cap-and-trade is going. The LA Times gets it....

Blackout: Enron and the California Power Crisis (Transcript)...