$179.06 last. A trend appears to be emerging.

Well now it is down to $173.04 and the old analyst line has been modified to "A trend appears to be accelerating."

Down another 3.35% in a week. As the retail guys say: "And if you annualize that Mr. Bigg..."

From StockCharts:

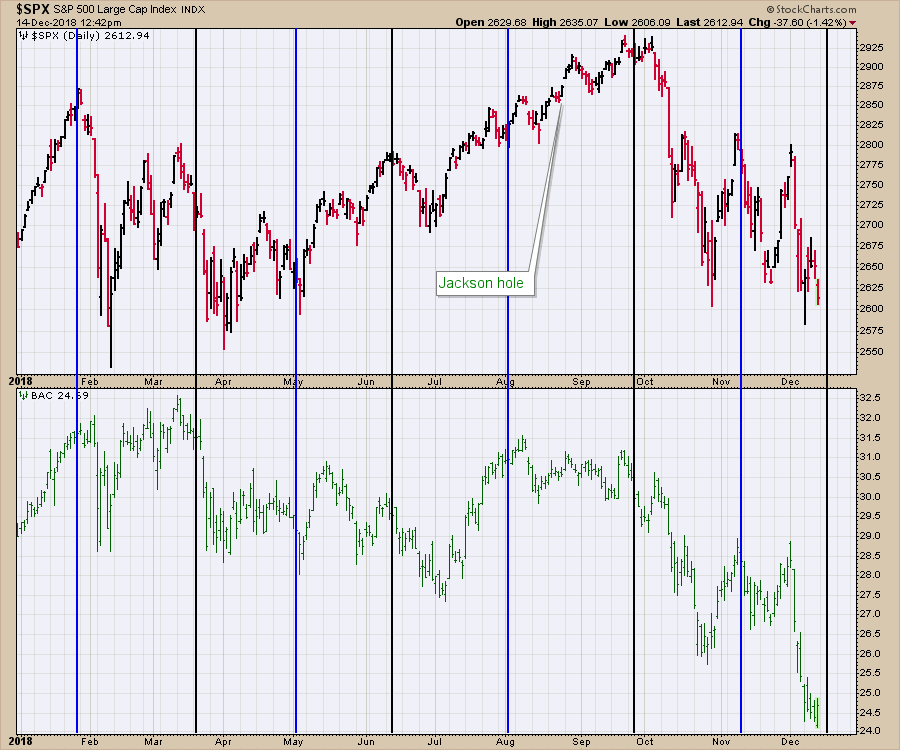

The banking sector has been drilling holes in the bottom of empty Christmas stockings this year. All the big name US stocks are making new lows, but the real concern is the sheer size of the drop. Citi (C) is down 16% in just 2 weeks! BAC is down 25% from the annual highs! Wells Fargo (WFC) is down 28% this year! With the $SPX just slightly negative on the year, you can see the real pain for investors. While these banks are bleeding, there might be some hope showing up next week in the form of the Fed meeting.

You'll notice BAC is plotted on the lower half of this chart. The Fed meeting dates are visualized on the chart as vertical lines. The increasing Fed rates have pushed this stock around as most of the Fed meetings have the stock rolling over shortly after. If the Fed indicates any level of dovishness towards interest rates, this may be a nice inflection point for the stock.

The last few days have seen the stock trying to stabilize. The bullish outside bar on BAC is a positive while the overall market is down 1.42% on the chart above. I think we all know that weak bank charts are not bullish.

At this point, I'd be looking for the Fed to move in line with what the market is expecting, but any dovish comments could be a big accelerator. We also have quadruple witching on Friday December 21st, which is usually a high volume event. If the banks can start to rally, I think it will set the stage for a big bullish push.

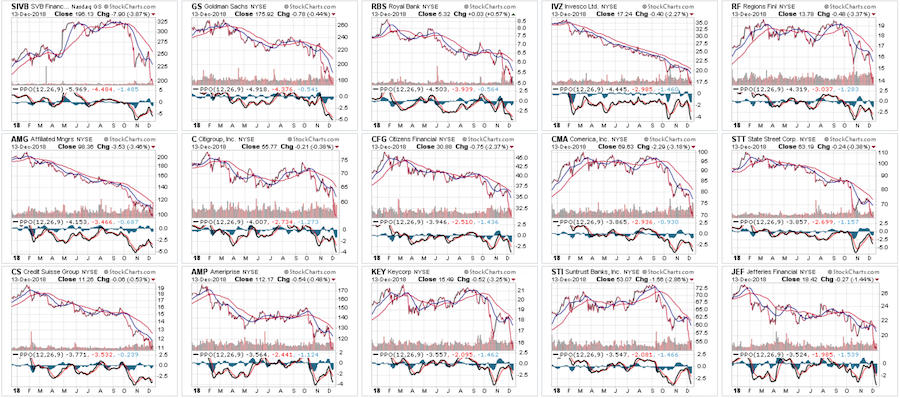

While some are looking at the yield curve as "the problem," it is definitely just one of the factors. The global picture for banks is horrific and has been for some time. To offset my expectation of a bounce above, look at this global banking chart display. These charts look terrible.

...MORE