Two from Alhambra Investments, first up, Mr. Frowny Face in toto:

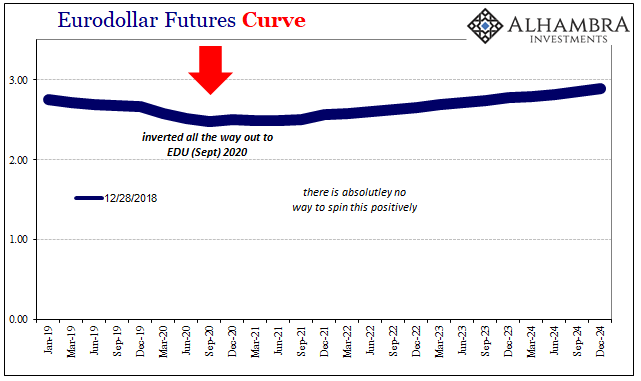

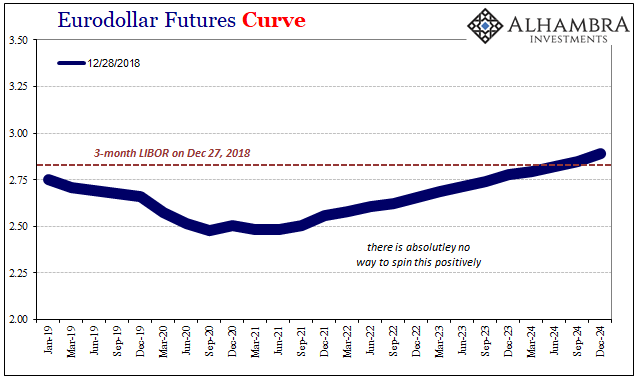

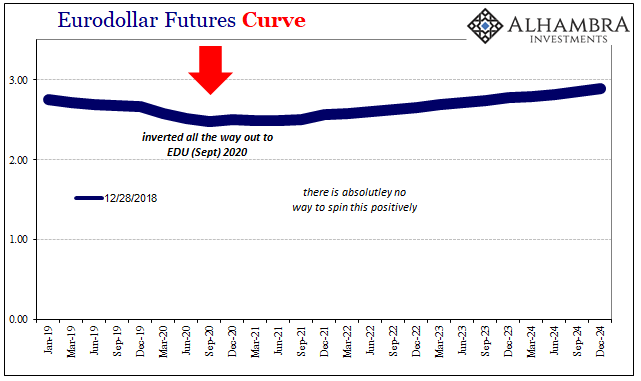

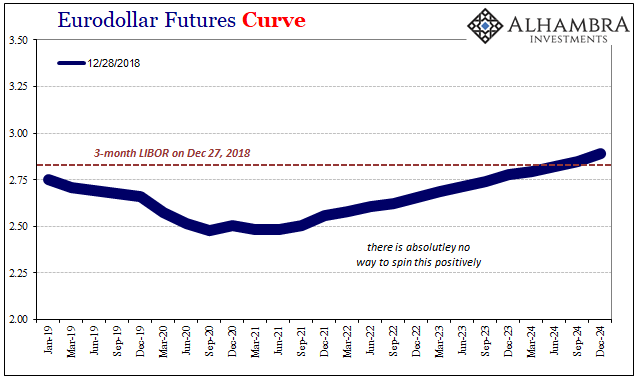

I’m going

to break my personal convention and use the bulk of the colors in the

eurodollar futures spectrum, not just the single EDM’s (June) contained

within each. The current front month is January 2019, and its quoted

price as I write this is 97.2475. The EDH (March) 2019 contract trades

at 97.29 currently and it will drop off the board on March 18.

Three-month LIBOR was fixed yesterday

at a fraction higher than 2.80%, meaning that if it stays around or

above that level someone is losing money on it. The futures price isn’t

directly translatable but back-of-the-envelope it works out to an

expectation for 3-month LIBOR on that date in March to be less than what it is fixed now.

In other words, the market is seriously betting LIBOR is coming down not two years from now but in the short run. That expectation only grows the further out in time (down the curve).

Inversion, as noted earlier today,

had been limited to more distant years centered around 2020. The

eurodollar curve now sports inversion from the front month all the way

out to September 2020. This is not a curve, not a normal one anyway, it

is a clear signal of trouble right in front of us.

In fact, almost the entire curve is currently below yesterday’s 3-month LIBOR. But strong economy or something. They really don’t know what they are doing. Central banks are not central.

Happy New Year Jay Powell, the curve

sarcastically frowns upon your ridiculously overoptimistic forecasts.

From here on, you are going to want to avoid taking any advice from Bill Dudley on the topic of eurodollar futures and inversions.

And a question:

Yields Falling, Who Could Be Buying Without QE’s?

In the US

Treasury market, the situation has been a little different. The BOND

ROUT!!! theory posits that without the Fed to buy up additional supply,

yields as a technical factor have to rise putting more upward pressure

on rates than already exists from a booming economy. Add to that foreign selling in 2018, it left many expecting an epic selloff. Any day now.

The common battle cry was “who is left to buy up all these UST’s?” The answer, as always, is the banks themselves.

The ECB’s end to QE hasn’t sparked the

same worries. A lot of it has to do with similar misperceptions about

how bonds work, only in Europe particularly Germany the magnitude is

checked. Europe’s central bank went further and ate up a huge chunk of

government bond supply during its LSAP run.

That left a smaller float for the

private markets, therefore more margin for bond demand even as the ECB

exits the auctions. Still, yields were supposed to rise across Europe even Germany if not to the same extent as what was figured for the US BOND ROUT!!!

While the ending of QE will

put some upward pressure on yields, low supply from Germany’s robust

economy is likely to act as a counterweight, keeping that risk in check.

“For some time now, we have observed a

big disconnection between real Bund yields and real economic activity,”

said Chiara Cremonesi, a fixed-income strategist at UniCredit. “The

scarcity of German paper — and of safe eurozone government paper in

general — triggered by QE will remain a key driver of Bund performance

next year, and in our view will slow down the increase in real Bund

yields towards positive territory.”

As usual, that’s not what happened up to and including the robust Germany part.

The ECB will begin 2019 without any QE but things in Europe are not

consistent with how it was supposed to go at its end. At least the

mainstream gets that part right, meaning if QE had worked (anywhere)

economies would actually be booming and yields would be uniformly upward

if to varying degrees.

Instead, yields are falling pretty much

everywhere – the mysterious, confounding “strong worldwide demand for

safe assets” has returned with a vengeance. There’s supposed to be

nobody left to buy up these things, and yet “someone” remains out there

in the markets with a voracious appetite for the most liquid assets. Might be a clue or something...MUCH MORE

He raises a really really good point.