Sometimes a company or a government issues bonds that never mature. They are called perpetual bond, and as the name suggests, they remain in force for as long as the issuer wishes to. This allows the bond holder to reap benefits for long periods.

While perpetual bonds sound like great long-term investment instruments, they are not. The only party that benefits from this kind of an arrangement is the bond issuer, because it allows them to raise money without ever needing to pay it back since these bonds never mature. The investor gets a yearly payout according to an interest rate defined by the issuer, which can change at any time and is usually kept low enough for the company to make a profit. And once inflation is factored into the equation, the value of the yearly payout starts diminishing the longer the investor holds on to the bond.

What makes a perpetual bond appealing is that they are transferable. The company will not buy them back, but the investor can sell it on the market and somebody else will start earning the interest. Some perpetual bonds have been bought and sold countless number of times across generations spanning centuries.

One of the most famous perpetual bonds was the British Consols, first issued in 1751. They were traded for more than two hundred fifty years until they were fully redeemed in 2015—that is, the British government bought the bonds back and fully paid back the investors.

But there are some bonds issued way back in the 17th century that are still paying out interest. These bonds were issued by Hoogheemraadschap Lekdijk Bovendams, a Dutch water board responsible for managing dikes and canals in the lower Rhine region in the Netherlands. In 1648, the water board floated a perpetual bond to raise money for the construction of a series of piers to regulate the flow of a river and prevent erosion....

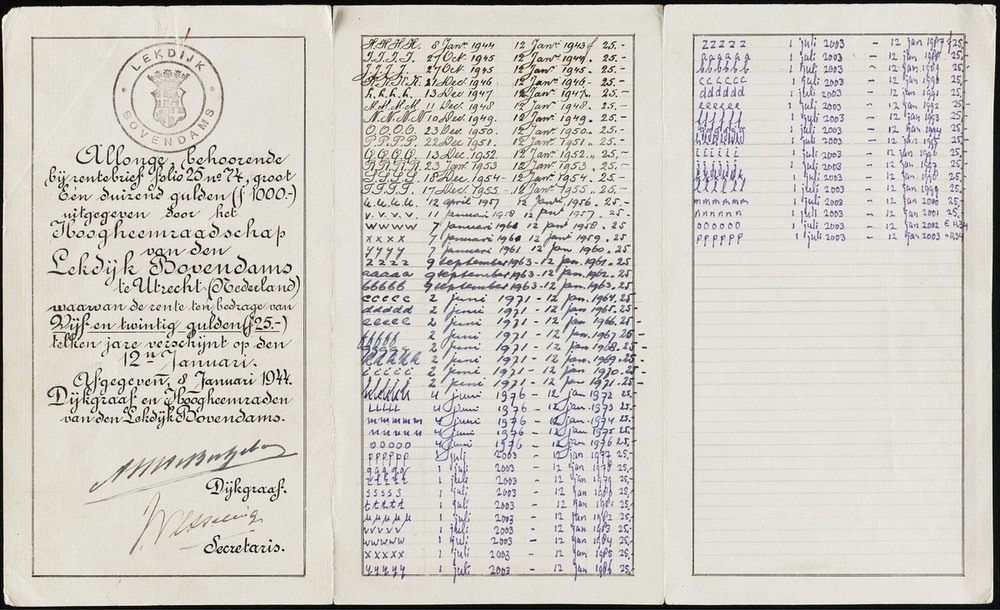

***...The bond is made not of paper but goatskin, and interest payments were recorded directly on the bond. By 1944, when the goatskin had run out of space, a paper addendum was added to record new payments....

The paper addendum to the original bond.

...MORE