From FT Alphaville, September 11:

When the wind blows your money away

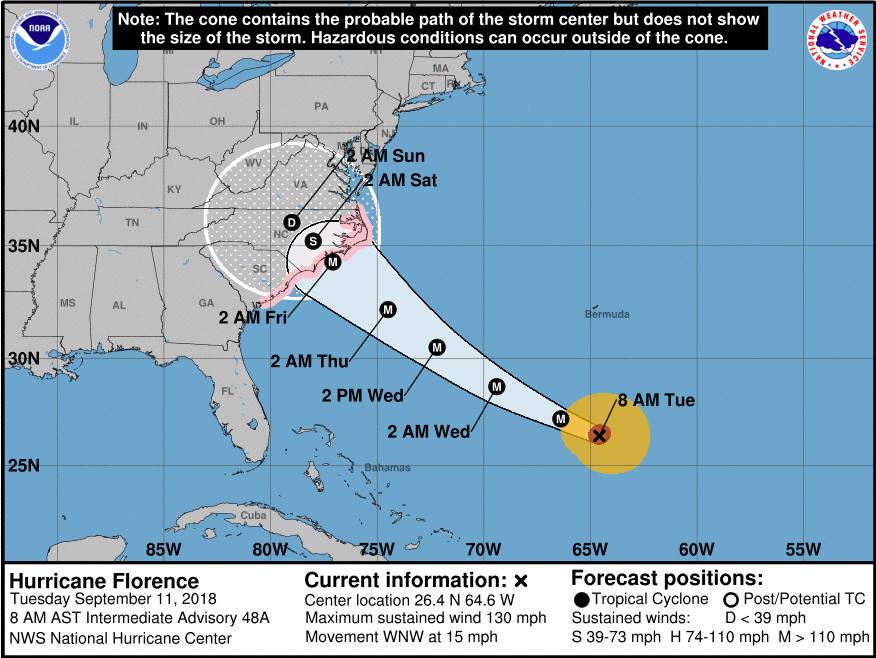

Peak hurricane season is on us, with Florence heading straight at the Carolinas:

Which means it is the traditional time to contemplate reinsurance rates and the state of an industry which has a complicated relationship with destruction.The first 5 - 10 comments are pretty good as well and a couple mention Berkshire-Hathaway's Ajit Jain, Warren Buffett's insurance guru (along with the GenRe folks) and as noted back in 2014, BRK's thinking on maintaining market share versus risk pricing

The news isn't exactly terrific. The recent conclusion of S&P Global Ratings was that the global reinsurance industry will barely cover its cost of capital this year:

In 2017, the reinsurance sector generated returns on capital of only 1.2%. At 6.3% below its cost of capital, this represents the worst level in more than 13 years. The impact of the 2017 U.S. hurricane season was a significant factor, but even during the benign first half of 2017, returns were only 1 percentage point higher than the cost of capital. S&P Global Ratings expects the sector's return on capital to increase to around 6%-8% by year-end 2018.A persistent story has been the flood of capital into the reinsurance business, as rich people and hedge funds have looked for places to put their money to work:...MUCH MORE

Despite modest price rises following the 2017 catastrophes, this remains close to reinsurers' cost of capital, which we anticipate will increase modestly through the rest of 2018 and in 2019, remaining within the 7%-8% range.

Buffett has pulled General Re back to avoid guaranteed-loss underwriting.As Mr. McCrum hammers home, the time when the insurance companies could raise rates at will seems to have passed. Even as late as 2011 they still could but then came the hedge funds and the ILS tourists and the happy time was over.

March 2010

"No Surprise: Chile Leads to Reinsurance Rate Increase Debate" BRK-A; BRK-B

No kidding.

A brisk breeze gets the boys in Omaha, Zurich, Munich and London (Lloyds) talking about premium increases.

Not to mention the herverzekering crowd in Amsterdam, they're tough bastards....