So there I was, searching to see what she's been posting and....

...This:

FT Alphaville, May 26

Italian markets: Redistribution risk revives “redenomination risk”

Markets have been spooked by the risk of Italy leaving the eurozone. But bank analysts and strategists are hesitating over assigning odds toQuitaly? In the Financial Times? Did she somehow contract Tyler Durden cooties?Quitalyan Italian exit, and are instead drawing attention to redistribution risk -- the type introduced by expansionary fiscal policy, which could come even if the country stays in the euro.

Investors are worried that upcoming elections in Italy will be an effective referendum on the euro. As such, Italian sovereign bond yields have jumped, along with daily trading volumes (which are more than 60 per cent higher than both last month and May of last year, according to Tradeweb). The prices of Italian bank debt have taken a dive as well.

The concern over “redenomination risk” -- the risk that Italy exits the euro, and tries to take its debt with it -- can be seen in Italy's credit-default swaps. Back in 2013, European government bond contracts changed to include collective action clauses (CACs) that require bondholder approval if an issuer wants to change the currency of bond payments. And since 2014, it has been considered a default if issuers pay bondholders in a different currency than initially agreed, as Rob Smith has noted. As a result, the spread between 2014 CDS and 2003 CDS can be seen as a measure of redenomination risk.

While Italy's CDS contracts broadly jumped today, the spread has blown out between dollar-denominated 2014 CDS and 2003 CDS. Find the full chart here (data from Bloomberg):...MORE

I was concerned enough to google around and... it's everywhere.

Australian Financial Review "Angela Merkel reaps with Quitaly what she sowed with Greek austerity"And it turns out it's not a neo neologism but has been around for a few years.

FT (the paper) "Measuring ‘Quitaly’ risk is harder than it looks"

ZeroHedge "Mapping The 'Real' Europe - From 'Swedone' To 'Quitaly'"

Google Trends

Sometimes I feel so out of it.

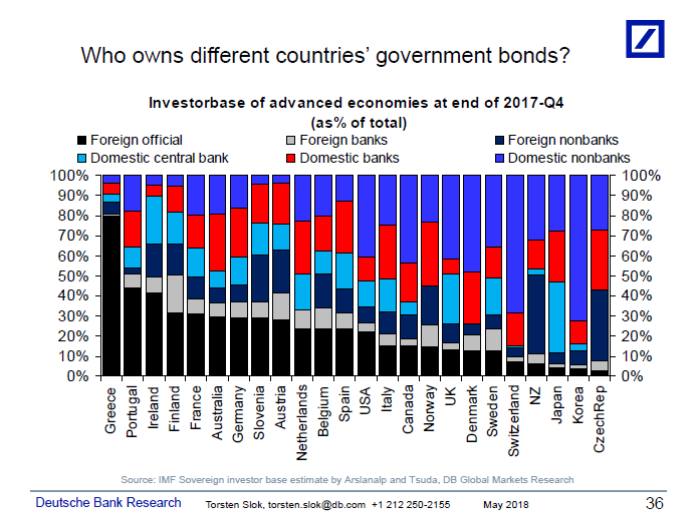

I went back to the Alphaville piece for the colorful charts.