In a series of posts over the course of the last year, I argued that you can value users and subscribers at businesses, using first principles in valuation, and have used the approach to value Uber riders, Amazon Prime members and Spotify & Netflix subscribers. With each iteration, I have learned a few things about user value and ways of distinguishing between user bases that can create substantial value from user bases that not only are incapable of creating value but can actively destroy it. I was reminded of these principles this week, first as I wrote about Walmart's $16 billion bid for 77% of Flipkart, a deal at least partially motivated by shopper numbers, then again as I read a news story about MoviePass and the potential demise of its "too good to be true" model, and finally as I tripped over a LimeBike on my walk home.User Based ValueMy attempt to build a user-based valuation model was triggered by a comment that I got on a valuation that I had done of Uber about a year ago on my blog. In that post, I approached Uber, as I would any other business, and valued it, based upon aggregated revenues, earnings and cash flows, discounted back at a company-wide cost of capital. I was taken to task for applying an old-economy valuation approach to a new-economy company and was told that that the companies of today derive their value from customers, users and subscribers. While my initial response was that you cannot pay dividends with users, I realized that there was a core truth to the critique and that companies are increasingly building their businesses around their members.Consequently, I went back to valuation first principles, where the value of any asset is a function of its cashflows, growth and risks, and adapted that approach to valuing a user or subscriber:

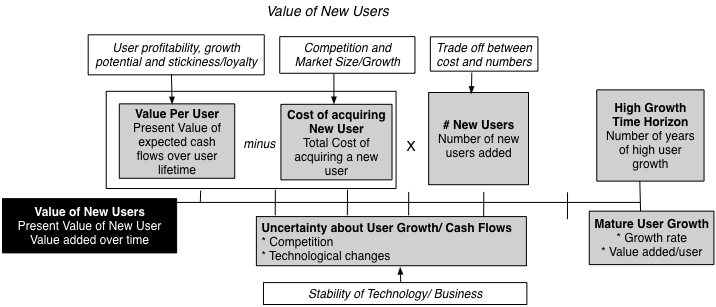

To get from the value of existing users to the value of an entire company, I incorporated the value effect of new users, bringing in the cost of acquiring a new user into the value:

I applied closure by consider all corporate costs that are not directly related to users or subscribers in a corporate cost drag, a drag because it reduces the value of the business:...

...MUCH MORE