A topic near and dear.

From Bloomberg, May 24:

- Weather woes from Russia to Australia lift farm staple prices

- Bloomberg Agriculture Spot Index turns higher on the year

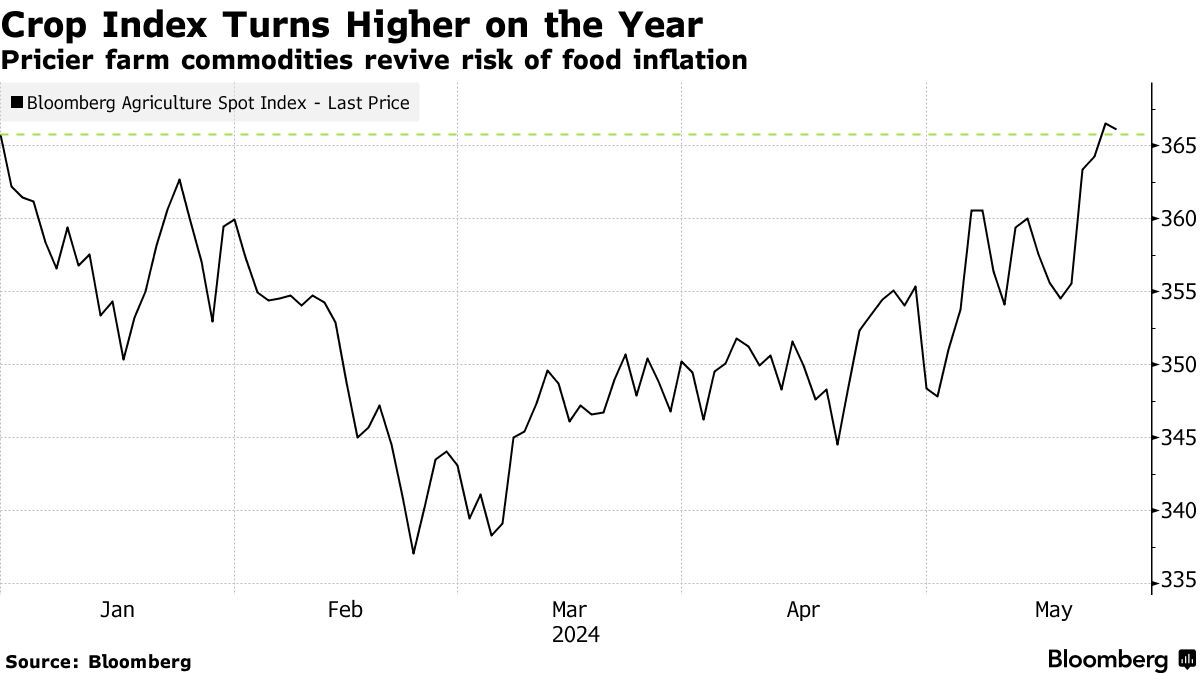

An index of major crops wiped out its 2024 loss as bad weather stokes worries about harvests from wheat to coffee, reviving concerns about rising food prices.

Droughts, frosts and heavy rain are popping up across key growers, threatening tighter supplies and lifting the cost of agricultural staples. A Bloomberg gauge tracking nine farm commodities has turned higher on the year and is headed for the largest weekly gain since July.

While the measure remains far from its 2022 peak, the gains could eventually spell higher consumer prices from bread to beverages after a period of subdued inflation in the grocery aisle. Climate change and geopolitical concerns are likely to keep crop prices elevated, said Paul Bloxham, HSBC Holdings Plc’s chief economist for global commodities.

Chicago wheat futures on Friday traded near the highest since July as poor weather in major exporters from Australia to Russia raises concerns over supplies.

Deteriorating harvest prospects in top shipper Russia have fueled the gains, with more downgrades likely in the next couple of weeks, Dennis Voznesenski, associate director of sustainable and agricultural economics at Commonwealth Bank of Australia, said in a weekly report.

Robusta coffee prices — another component of the index — are headed for a roughly 9% weekly gain, the biggest since last December as dry weather in key producer Vietnam puts the world on track for a fourth year of robusta deficits. Orange juice set a fresh intraday record Friday on the back of a sinking Brazilian harvest, and weather woes have also lifted benchmark Asian rice prices to the cusp of a 15-year high....

....MORE

Weather woes? Ha! From our From our 2008 post "A Black Swan in Food":

...Donald Coxe, chief strategist of Harris Investment Management and one of my favorite analysts, spoke at my recent Strategic Investment Conference. He shared a statistic that has given me pause for concern as I watch food prices shoot up all over the world.

North America has experienced great weather for the last 18 consecutive years, which, combined with other improvements in agriculture, has resulted in abundant crops. According to Don, you have to go back 800 years to find a period of such favorable weather for so long a time.

Well we are now at 34 years of near perfect weather for row crops.

The thought was repeated in February 2018's "Simultaneous harvest failures in key regions would bring global famine, says the Met Office"

We're probably a couple years from this concern even becoming a possibility so there's no immediacy and additionally the choice of the U.S. and China as the location of the crop failures is a bit problematic, based as much on ease of modeling as on the probability of the scenario unfolding.

Agricultural catastrophe could just as easily strike via a combination of cool/damp in Ukraine and western Russia along with drought in India.

You'll hear more over the next few years but the point to be made right now is: We have just experienced 30-some years of near-perfect conditions for industrial scale agriculture and are at risk of complacently forgetting the lesson of Tennyson's "In Memorium".*

Historically, the conditions that have reduced supply the most were cool/damp in northern Europe and the ENSO-induced crop failure in India in the late 1800's, exacerbated by British Colonial rule, the effect of which was popularized by "Late Victorian Holocausts".

Recently:

USDA World Agricultural Supply and Demand Estimates (WASDE): Food Inflation Down The Road

...These won't show up in the CPI or PCE deflator for months so in the meantime we should get a nice little inflation headfake lower from the housing component of the indices; setting up the next Presidential administration for a real mess in 2025 and 2026.

Food Inflation: "Wheat prices charge higher on Black Sea temperature drops"

Again, it takes a while for moves in food commodities to work their way into retail prices but as the best equity analyst I ever met said when looking at a 25-year stock chart whose price line ascended from bottom left to upper right, "A trend is emerging."

***

....And the reason we harp on food inflation? First and most importantly it is the inflation that messes earliest with peoples lives—housing inflation does as well but it takes a while before the precariat become homeless. With food, one bad season can have people deciding between food, heat and medicine.

We first posted this research in December 2020....

Secondly because, of all the leading indicators of future general inflation, food seems to be the most accurate. At least it allowed us to stay off team transitory 2021 - 2023.