Mo Money.

From ZeroHedge:

Fed Chair Powell did it yesterday... unleashing his uber dovishness to save stocks and today has done the same by reaffirming just what a shitshow the US economy is how long it will take to mend... (yeah seriously)

“There is a long way to go to maximum employment.”

Additionally, Powell says it could take more than three years to hit that 2% average inflation target.

“I’m confident that we can and that we will and we are committed to using our tools to achieving that. The three-year time frame is actually an arbitrary 3-year time frame chosen by us. And you know, we’re just being honest about the challenge.

“We live in a time where there is significant disinflationary pressures around the world and where essentially all major advanced economy’s central banks have struggled to get to 2%. We believe we can do it, we believe we will do it. It may take more than three years but we’ll update -- every quarter we update that assessment and we’ll see how that goes.”

Then Fed Governor Lael Brainard, who has become an increasingly vocal and potentially influential policy maker, has released a speech that echoes Powell in its dovishness:

“The economy remains far from our goals in terms of both employment and inflation, and it will take some time to achieve substantial further progress.”

That sent stocks soaring...

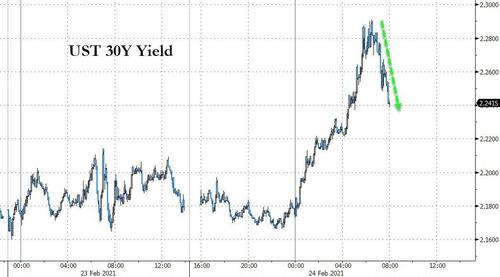

And also put a bid under bonds, with 30Y yields now down 5bps from the intraday highs...

Source: Bloomberg

...MORE

Also Mo Hotta, Mo Betta. (hot sauces)