They seem to be on the right side of the trade for the three weeks since this piece was published.

From Ninepoint, February 5:

Step 1: Inventory Surplus Normalization

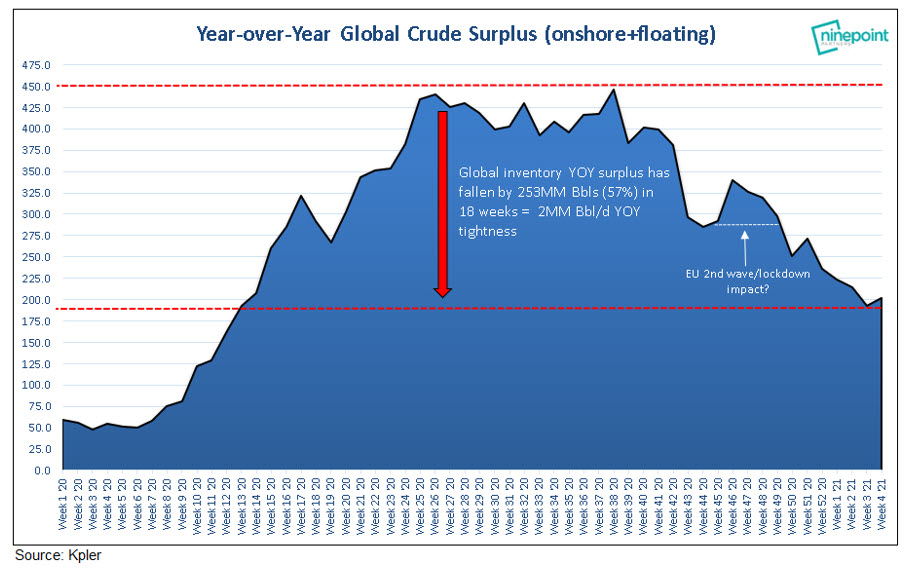

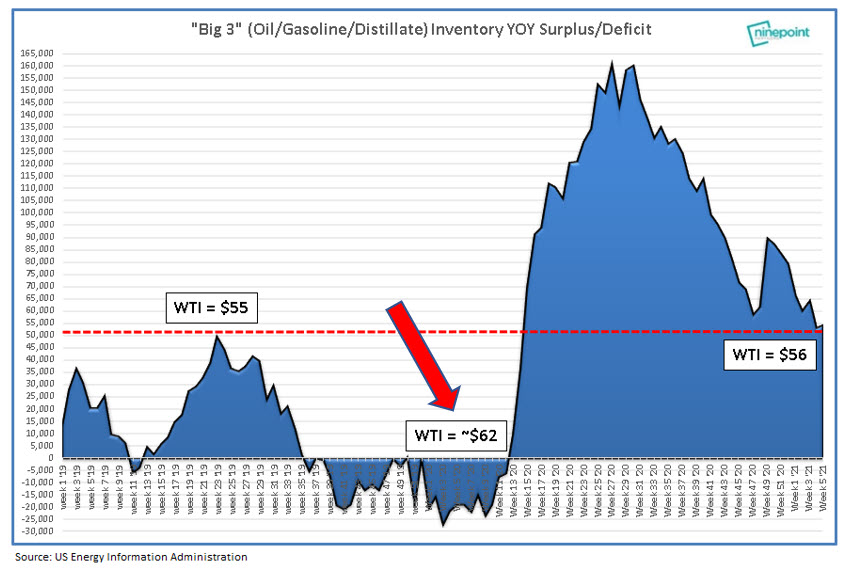

We track oil inventories very closely, both US and global as inventories are the nexus of supply and demand and are the best real-time indicator of an undersupplied/oversupplied market. Since inventories peaked ~ June 2020 from the COVID demand shock they have fallen by 57% globally to now 197MM Bbls falling at a pace of 2MM Bbl/d. This was before Saudi Arabia voluntarily decreased production by a further 1MM Bbl/d for February/March (i.e. 59MM Bbls). At the current pace we see normalized inventories by early Summer. The last time inventories were at such levels WTI was over $60WTI…hence our short-term target of $60WTI by Q3.

Step 2: OPEC Spare Capacity Exhaustion

OPEC has about 5.2MM Bbl/d of shut-in production in addition to about 1.8MM Bbl/d of Iranian production shut-in due to trade sanctions which we expect to be softened this year (note: Iran is rumored to be exporting ~1MM Bbl/d higher than their official number via pipelines in Iraq and offshore ship-to-ship transfers). OPEC’s primary goal is higher (yes still) oil prices as few of the member countries are going concerns in a sub $70 Brent world. We expect OPEC to gradually bring back shut-in production as demand normalizes in 2021. Why will demand normalize? Because it already has in much of the world! Oil demand in China, India, and Brazil are generally back to pre-COVID levels and we expect Europe and the United States to achieve this milestone by YE’21 as vaccine rollouts accelerate. You may think OPEC adding barrels to the market is a negative price signal…it is the opposite! OPEC has not been able to invest in additional capacity due to distressed revenue over the past several years due to oil’s collapse. Once shut-in production is returned OPEC will effectively be out of spare capacity…this is the most bullish scenario one can imagine...

....MUCH MORE.