ZeroHedge's daily roundup touches on pretty much everything we've been posting, which is a bit scary.

Commodities, real yields, techpocalypse etc..(the one thing we haven't mentioned is today's relief rally in gold, didn't see it coming this soon)

From ZH:

Big Tech, Bitcoin, & The Buck Battered As Commodities Crash-Up

Inflationary impulses are showing up everywhere.

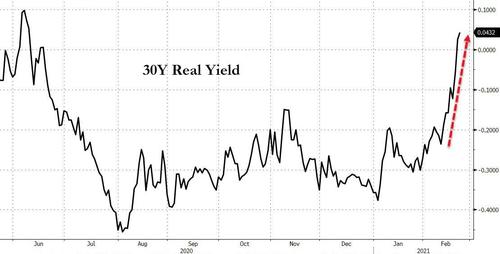

Real yields are rising rapidly (with 30Y no longer negative)...

Source: Bloomberg

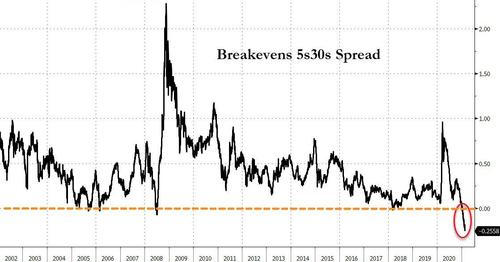

Breakevens have soared, but we do note that the BE curve implies beyond 5Y will see a disinflationary process...

Source: Bloomberg

Commodities are soaring to the highest since 2013...

Source: Bloomberg

And even gold was on the rise today, back above $1800...

Source: Bloomberg

But, that reflationary rise (the good growthy reflation, not the bad hyperinflationary dollar collapse one, oh no) is having some unintended consequences that Jay Powell and his pals are going to have to deal with soon.

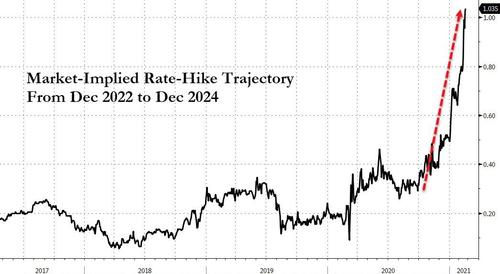

Money markets are hawkishly tightening with expectations for rate-hikes being brought forward...

Source: Bloomberg

... and the rate-hike-trajectory steepening (100bps of tightening from Dec 2022 to Dec 2024 now priced in)...

Source: Bloomberg

The question is - Will Powell "cut the rope" tomorrow?

Spoiler Alert: No!...

***

On the day however, The Dow managed to hold gains as Big Tech (Nasdaq) was clubbed by a baby seal - 2nd worst day since October (5th down day in a row) - and Small Caps puked along with Nasdaq late on, starting at 1430ET which smells a lot like margin calls...

The Dow massively outperformed the Nasdaq today, erasing all the YTD underperformance...

...MUCH MORE

And as we've been babbling, because the ESG marketeers have put so much big giga-tech into their funds and ETFs their performance will not be good vs. small caps and non-cap-weighted indices.