I'm deadly serious. I don't want it to ever end.

From Bloomberg:

Here's How Much QE Helped Wall Street Steamroll Main Street

Wall Street is counting its winnings from seven years of easy money.

In a report sent to clients on Sunday, Bank of America Corp. strategists totted up the results of 606 global interest-rate cuts since the collapse of Lehman Brothers Holdings Inc. and the $12.4 trillion of central bank asset purchases following the rescue of Bear Stearns Cos.

The results represent a clear victory for Wall Street over Main Street, according to the team of Michael Hartnett, BofA’s chief investment strategist.

For every job created in the U.S. this decade, companies spent $296,000 buying back their stocks, according to the New York-based bank.

An investment of $100 in a portfolio of stocks and bonds since the Federal Reserve began quantitative easing would now be worth $205. Over the same time, a wage of $100 has risen to just $114.

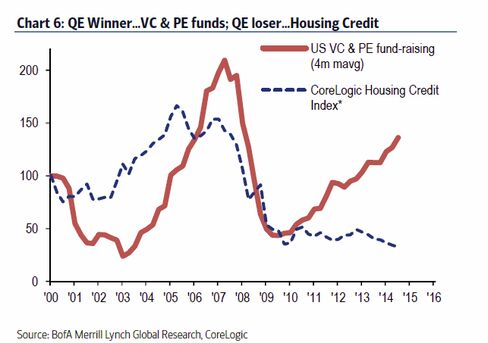

For every $100 U.S. venture capital and private equity funds raised at the start of 2010, they are now raising $275, but for every $100 of U.S. mortgage credit extended five years ago, just $61 was extended and accepted this June, BofA said.

‘Deflationary Expansion’

Meantime, prime commercial real estates gained 168 percent, compared to a 16 percent increase of all U.S. residential property. In the U.K., London accounted for 26 percent of the value of all housing sales last year even though it accounts for just 1 percent of the land.

Such experiences have Hartnett and colleagues continuing to predict “deflationary expansion” in the world economy in the form of a slow, jerky transition to higher growth rates led by the U.S.

“Zero rates and asset purchases of central banks have, thus far, proved much more favorable to Wall Street, capitalists, shadow banks, ‘unicorns,’ and so on than it has for Main Street, workers, savers, banks and the jobs market,” the BofA team wrote.

The risk is that the bull markets driven by central banks swoon if further central bank monetary easing from outside the U.S. forces the dollar up and commodities down rather than spurs demand, they said....MORE