"Commodity prices and exchange rates"

From Econbrowser:

The dramatic decline in the prices of a number of commodities over

the last 16 months must have a common factor. One variable that seems to

be quite important is the exchange rate.

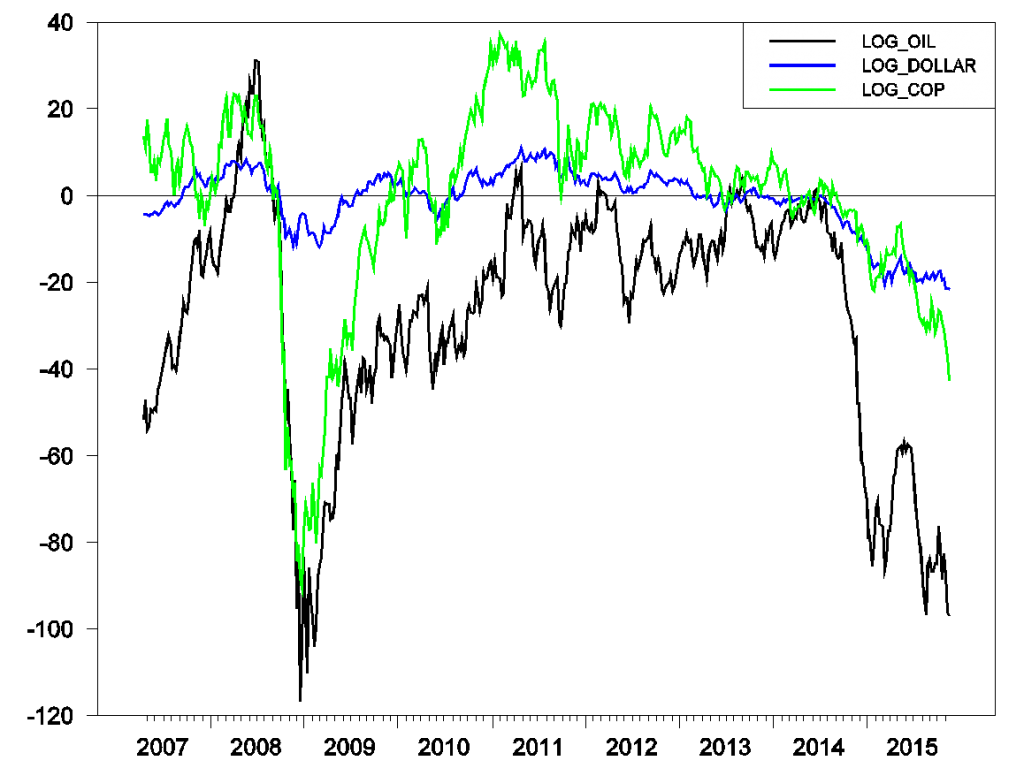

Here’s a graph over a longer period of the dollar price of oil, the

dollar price of copper, and the dollar price of a weighted average of

other countries’ currencies with weights based on the volume of trade

between the U.S. and each country. The graph is plotted on a logarithmic

basis, so for small changes the height of each series corresponds to

the percent difference between the price at the indicated date and the

price at the end of June 2014 (see my primer on the use of logarithms in economics

if you’re curious about those statements or why it might be helpful to

plot series this way). The plunge down in all three measures since June

2014 that was highlighted in the first set of graphs is seen to be a

broader pattern of striking positive co-movements among these variables.

Price of West Texas Intermediate (black), copper (green), and inverse of trade-weighted value of the dollar

(blue), end of week values April 20, 2007 to November 20, 2015. Graph

plots 100 times the difference between the natural logarithm at the

indicated date and the natural logarithm on June 27, 2014. A value for

the blue series below zero means that the dollar was worth more on that

date than it had been on June 27, 2014.

One would expect that when the dollar price of other countries’

currencies falls, so would the dollar price of internationally traded

commodities. But it is a mistake to say that the exchange rate is the

cause of the change in commodity prices. The reason is that exchange

rates and commodity prices are jointly determined as the outcome of

other forces. Depending on what those other forces are, one might see

stronger or weaker co-movement between commodity prices and exchange

rates.

For example, the most striking episode in the graph above is the

Great Recession in 2008-2009. Falling GDP around the world meant falling

demand for commodities. It was also associated with a flight to safety

in capital markets, which showed up as a surge in the value of the

dollar. It’s not the case that the strong dollar then was the cause of

falling dollar prices of oil and copper. Instead, the Great Recession

was itself the common cause behind movements in all three variables.

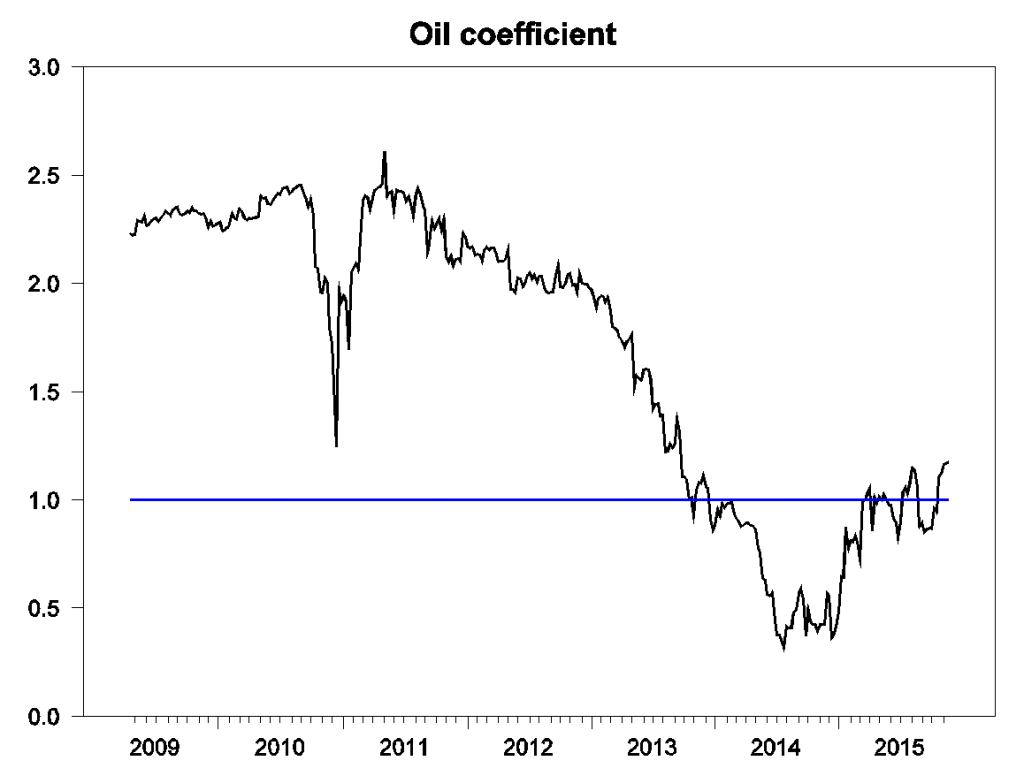

One way to get a sense of how the driving factors have changed over

time is to look at a regression of the weekly logarithmic change

(approximately the weekly percentage change)

of the dollar price of oil on the weekly logarithmic change in the

exchange rate using a rolling 2-year window. Each point in the graph

below plots that estimated coefficient using a sample of two years’ data

ending at the indicated date. The coefficient was above two during and

after the Great Recession– if the dollar appreciated 1% during the week

in that period, you would expect to see more than a 2% decline in oil

prices. The coefficient fell below one in the first half of 2014 but has

since risen back above one.

I had been giving a similar interpretation to the correlation since

June 2014 as to the data from the Great Recession– news about weakness

in the world economy seemed to be a key reason for strength of the

dollar over the last year and a half, and would also be a reason for

declining commodity prices.

However, developments of the last three weeks call for a different explanation. The October 28 FOMC statement and subsequent statements by Fed officials

have made clear that a hike in U.S. interest rates is coming December

16. An increase in U.S. interest rates relative to our trading partners

is the primary reason that the dollar appreciated 4% (logarithmically)

since October 16. Over that same period the dollar price of oil and

copper each fell 16%....MORE