We were already at an inflection point when Baker Hughes came out and said oil directed rigs fell by 26 to 614.

From Econbrowser:

Supply, demand and the price of oil

Could the price of oil be a value such that the current quantity produced exceeds the current quantity consumed? The answer is yes, and indeed that has been the case for much of the past year.

Suppose for illustration that even at a price of $40, there would be enough producers with sunk costs on projects already begun who would be willing to bring sufficient oil to the market to fully meet current consumption. But suppose further that at a price of $40, few new investments are undertaken, so that next year supply is much lower than it is this year, such that next year’s production would equal next year’s demand at a price of $60.

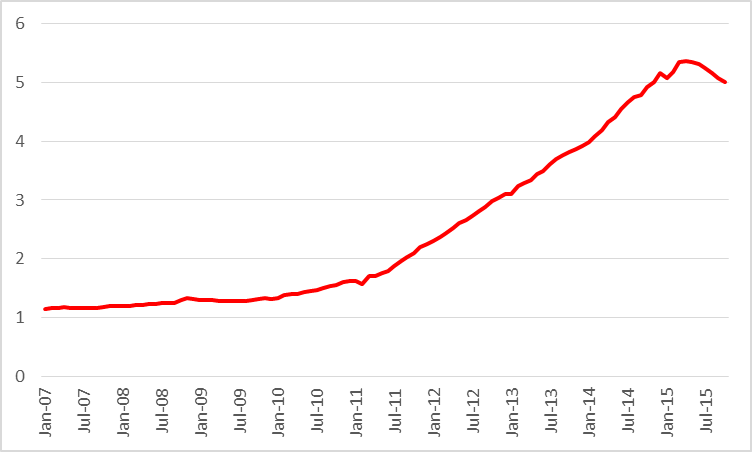

What’s wrong with this picture? Under the above scenario, if you were to buy oil today at $40, store it for a year, and sell it next year for $60, you’d make a huge profit. And if right-minded capitalists tried to do exactly that in huge volumes, the price of oil today would be bid up above $40, as the inventory demand is added to current consumption demand. As that oil is sold next year, it would bring the price next year below $60. In equilibrium, the difference between this year’s price and next year’s expected price should be close to the storage cost.

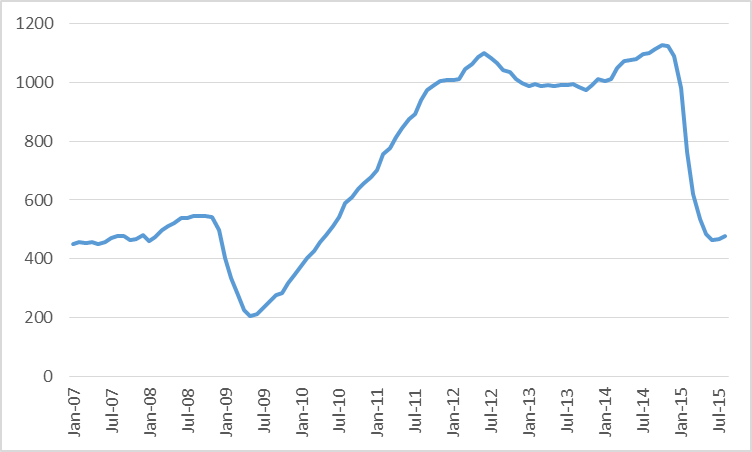

That arbitrage is clearly an important aspect of what has been going on over the last year. In response to lower prices, capital expenditures in the oil patch are being slashed. The number of drilling rigs active in the U.S. areas associated with tight oil production is only 43% of its level a year ago.

U.S. oil production is falling, though so far the decline in production has been relatively modest. U.S. tight oil production is only down about 7% from a year ago.

If current lower investment results in lower future production, the arbitrage forces described above would mean the current excess supply would go into inventories, which would then be gradually drawn down as field production declines. And that seems to be what we have observed....MOREHowever, the contango is not huge with November's at $46.46 up 92 cents and May's at $49.62 up $1.02.

With storage and insurance it is not an overly profitable trade unless the producers are using 'in situ' storage which we are actually seeing in North Dakota.

More on that later today.