From FT Alphaville:

This is nuts. When’s the crash?

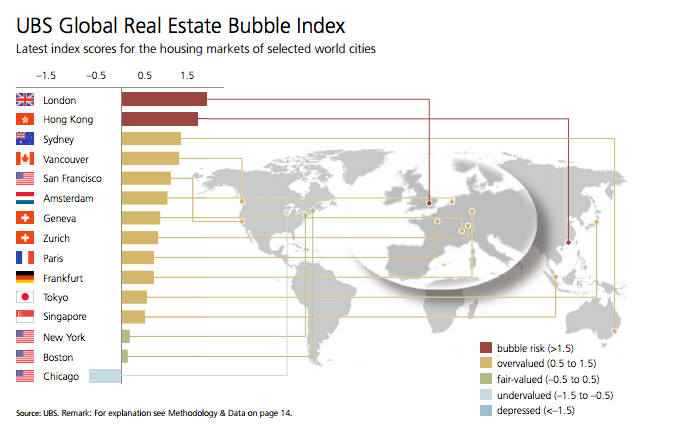

Congratulations London, your housing market is indeed the most nuts.

UBS wealth management have you right at the top:

And:

Average real dwelling prices have soared by almost 40% since the beginning of 2013, more than offsetting all losses triggered by the financial crisis. The increase has made London one of the most expensive cities in the world based on price-to-income and price-to-rent ratios that have surged to all-time highs. It takes a skilled service-sector worker approximately 14 years of average earnings to be able to buy a 60m2 dwelling; the expense of buying a flat is comparable to renting it for 30 years.

London house prices, in real terms, are 6% above their previous 2007 peak despite nationwide prices having declined by 18%. The decoupling of the London real estate market from the rest of the UK is even more drastic considering that, in the same period, real average earnings fell by 7% both in London and UK-wide....MORE*From October 2013, "Real Estate: It's Not Just London- Luanda and Juba Getting Pricey Too".

But it really depends on how you look at it: "Fun With Stats: Big Cities Are Actually Cheaper Than Elsewhere!".

And taking the long view, "London Property Will Always Be Affordable":

"The money is always there, it's only the pockets that change"

-Gertrude Stein,

Also attributed to Coco Channel as:

"Money is money is money, it's only the pockets that change".

...MORE

House for sale in Carlton House Terrace in London, with a reported asking price of £250m ©Getty