Three quick observations:

Did I say that out loud?

2) Chanos sure is getting a lot of ink (pixels) recently.

3) I don't recall what he was saying 15 months ago with oil prices in three figures.

WTI $45.47 down 82 cents, Brent $47.95 down 76 cents.

From Bloomberg:

Shale firms have relied on eager capital markets for growth.

"Energy Investments After The Fall: Opportunity Or Slippery Slope?"

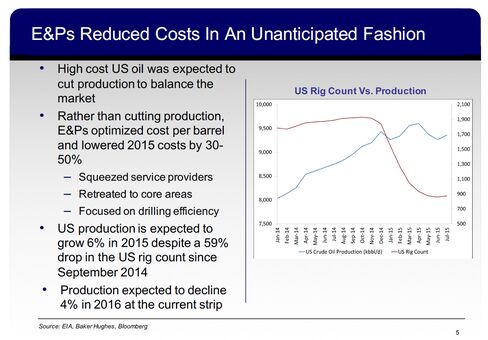

So begins the latest presentation from renowned short-seller Jim Chanos. What follows is a powerful outlining of the spirally debt dynamics now dominating the future of the oil industry. At the heart of Chanos's thesis is the contention that years of low interest rates, cheap financing, over-eager investors and ambitious managers have helped propel the boom in U.S. shale and imbue it with near unstoppable momentum; U.S. oil production is expected to grow 6 percent in 2015 despite a stunning 59 percent drop in the U.S. rig count over the past year.

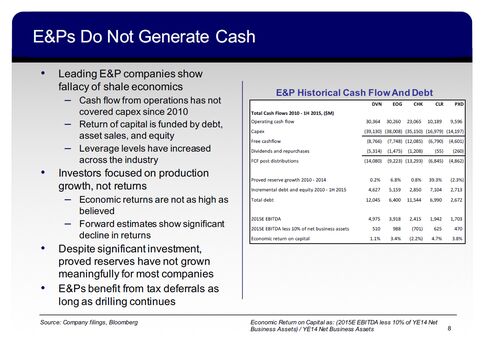

The extent of the capital market's support for energy over the past half-decade is laid bare in the financial figures. According to Chanos, cash flow from operations has not covered capital expenditure since 2010 at some of the most prominent exploration and production companies since 2010, meaning the firms have consistently outspent their income. That trend is present even at the larger "big oil" firms such as Exxon, Chevron and Royal Dutch Shell, Chanos claims, with cash flow following distributions to shareholders also firmly in the red.

The question hovering over the energy sector now is whether the continuous flow of capital investment that has propped up shale firms for so long continues. There are signs that it might not. Spreads on the bonds issued by energy companies are currently 480 basis points wider than average yield on the debt of junk-rated companies, meaning investors are (finally) demanding extra return to compensate them for the added risk of E&P.

Many oil companies have large revolving credit facilities from which they could draw financing to help replace the hole left by suddenly skittish investors -- an argument that has been picked up by energy bulls and managers with some aplomb. However, Chanos says that even the most reliable E&P firms will be reluctant to tap such revolvers, given the negative publicity around such a move....MORE