From Bloomberg:

Weather forecasters are fairly confident that the world is experiencing the strongest El Nino phenomenon since 1997-1998, a climate pattern that features increased ocean temperatures and disruptive rainfall and drought events around the world. You'd expect anything that wreaks meteorological havoc to drive up food prices. But surprisingly, it may also boost both inflation and gross domestic product -- which if true would be great news for central bankers struggling to combat the twin threats of faltering growth and stagnating consumer prices.

Economists Paul Cashin, Kamiar Mohaddes and Mehdi Raissi published an International Monetary Fund paper earlier this year making just that case. They argue that weather patterns are important for the global economy and that El Nino events typically lead to higher growth and faster inflation in the following year:

Our focus on El Nino weather events is motivated by growing concerns about their effects not only on the global climate system, but also on commodity prices and the macroeconomy of different countries. The economic consequences of El Nino shocks are large, statistically significant, and highly heterogeneous across different regions.

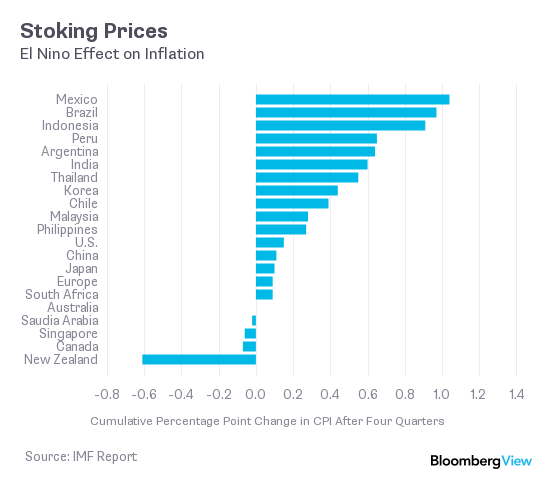

El Nino has different consequences for different nations. In Australia, drier summers mean more bush fires and reduced wheat exports. Drought in Indonesia hurts coffee, cocoa and palm oil crops, as well as nickel production that's dependent upon hydropowered mining. Heavier rains in Chile make it harder to dig copper out of its mountainous regions. There are also unexpected positive effects. The effect on Peru is both positive and negative; the world's biggest exporter of the fishmeal that's used in animal feed suffers as coastal waters rise, but benefits as wetter weather boosts agricultural output. Argentina's soybean production gets a boost, while rising oil prices are good news for Canada.

Jonathan Allum, a strategist at Nikko Securities in London, summarizes their findings:

If El Nino is, surprisingly, positive for growth, it is also, less surprisingly, positive for inflation. Given that we are all worried about global deflation, this may not be a bad thing.

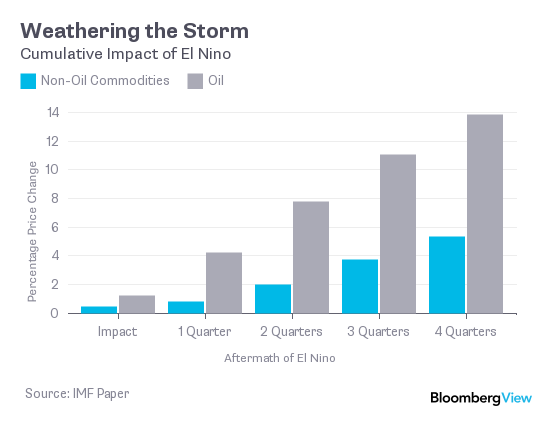

On a worldwide basis, the report says El Nino is unambiguously good for those wanting higher commodity values, including both oil and non-fuel prices. Demand for coal and crude rises as hydroelectric and thermal power output declines, at the same time as farmers needing to pump more irrigation water boost fuel demand and reduced foodstuffs supplies lead to higher prices.

For most countries in the study, that in turn stokes faster inflation in the quarters following an El Nino event:

The biggest surprise in the report is the finding that most of the world enjoys a bounce in growth in the year after El Niño. The U.S., the economists found, gets wetter weather in California which helps crops, fewer disruptive tornadoes in the midwest and fewer hurricanes slamming into the east coast. The 1997-1998 weather pattern added $15 billion to the U.S. economy, or 0.2 percent of GDP. That boost in turn benefits Canada, which depends upon the U.S. for 67 percent of its trade, and Mexico, at 68 percent. The El Nino winners outstrip the losers; and the net effect is a better global economy -- albeit with the caveat that predicting the drivers of growth and their likely path is about as easy as foretelling next month's weather....MORE