No ‘Dollar’ Bottom Yet

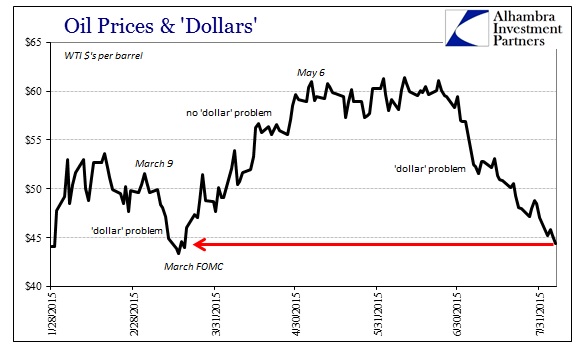

By most accounts, crude oil prices are still nearing their March lows. That would suggest that this version of “dollar” turmoil might be yet working its way toward levels of disorder previously seen in that last episode. That is misleading, as even crude prices are appreciably more stressed now than they were in March. From that, it follows that other “dollar” indications would also signal that wholesale conditions have surpassed those prior lows, meaning that we have been treading new warnings for some time.

It starts with the spot price of crude, which at $44.50 is a little more than a dollar above the March depression.

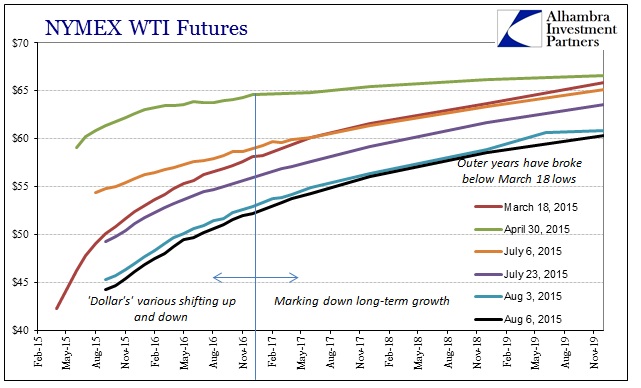

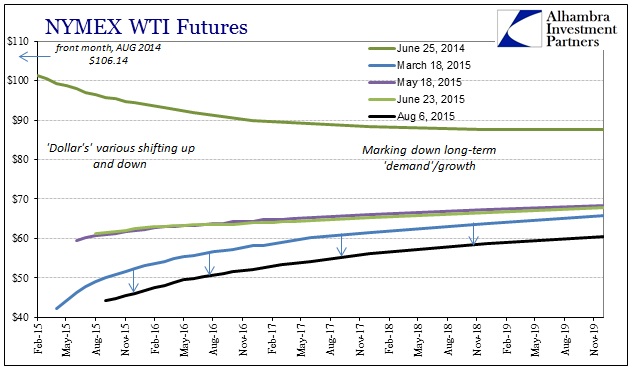

Examining the rest of the crude “complex” beyond the shortest maturity reveals just how much more there is to oil’s contribution to the “dollar” interpretation. The entire WTI curve, only minus the very front month, is significantly below what it was in March. More importantly, it is much, much flatter in relation. That suggests the limitations of contango as a matter of hope for a quick and more durable rebound which have succumbed to the reality of the restarted “dollar” dysfunction.

Again, we see the interplay and intersection between finance and the “dollar” and economic expectations and physical commodity fundamentals. When crude was suppressed in March by mostly the financial side at the front end, the back end built enormous contango as a means to express that more hopeful outlook that the “dollar’s” travails were a short-term disruption to be overcome in relatively short order. The attractiveness of contango was in that storage possibility, and it seems to have shifted around July 6 (or one of those days in early July).

The curve in this renewed “dollar” fight is, again, far flatter and thus expunged largely of those quick turnaround projections. Some of that is surely due to storage capacity issues, as space is running out; but that, too, is the same type of interplay between fundamental outlook in supply and demand and financial factors which affect pricing all down the curve. In short, the “dollar” “won” the argument in that the negative view of the short end and has now brought the rest of the curve down with it – by a lot.

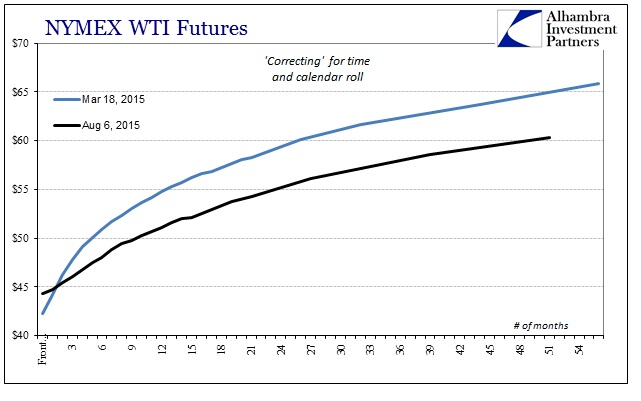

This is revealed fully when recalibrating the curve for calendar roll, where all but the front month is seriously underneath that prior March low point. There is still contango in the current curve, but the difference or relative change is what is significant.

That view is expressed not just in crude oil prices, but copper (which is pretty tame this morning, sticking at multi-year lows so far), gold, and the major currency exposures. Like copper, gold is angling to remain near its multi-year low which is still in close proximity to the Brazilian real – finance of the “dollar” connecting all these various pieces....MORE