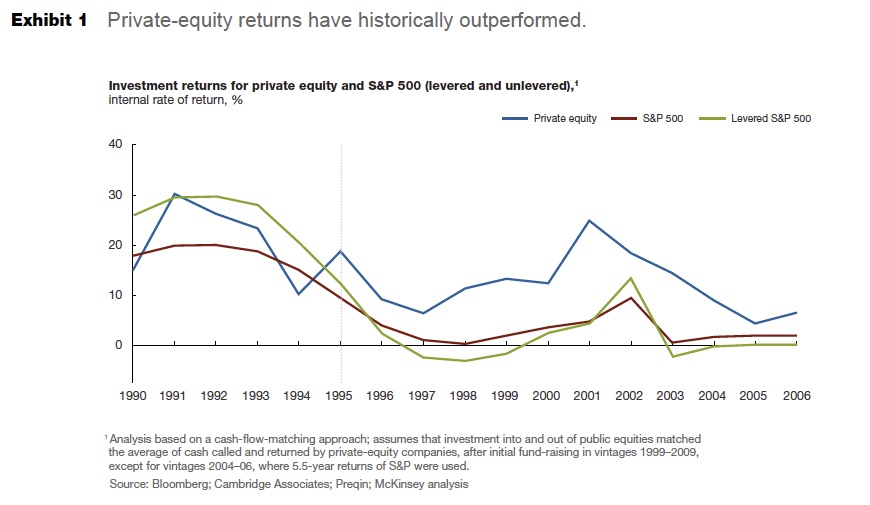

McKinsey has issued a new report on the private equity industry that ought to give any investor cause for pause. The consulting firm, which just happens to have private equity firms as as major source of revenue, is a bit too obviously engaging in porcine maquillage. The report describes enthusiastically how private equity has been an even better investment strategy than most people thought. The white paper makes only passing allusion to the fact that returns in recent years haven’t been all that good; “many general partners are struggling to raise new funds on the heels of disappointing recession-era vintages.” Industry average returns have been lower than plain old stock indexes. Notice how McKinsey omits the recent crappy years from this chart:

I’m also curious as to how they constructed that levered equity return line. Intuitively it doesn’t look right, but I don’t have a way to check the data.

By calling lower returns “recession era,” the article implies that the economy is to blame. But a more probable culprit is too much capital chasing too few promising companies. Private equity has more than doubled relative to the size of global equity markets since 2000: it was 1.5% of global equity market cap (and remember, this was the peak of the dot com bubble) and rose to 3.9% as of 2012. The competition for deals is fierce; I’ve been told for more than 7 years that any middle market company that was auctioned would get at least 40 bids. If you have to pay a full price for companies, it’s a lot harder to make juicy returns. And that raises the specter that underwhelming performance will persist.

One rationale for investing in private equity has been that the top quartile funds (meaning the best 25%), showed persistent good performance. McKinsey has to admit that this justification for investing in private equity is also a thing of the past:

Other McKinsey analysis finds that the persistence of returns—in particular the tendency of top firms to replicate their performance across funds—is not nearly as strong as it once was. Until 2000 or so, private-equity firms that had delivered top-quartile returns in one fund were highly likely to do so again in subsequent funds. Knowing that yesterday’s winners were likely to excel again today enabled limited partners to focus their due diligence on identifying top-quartile funds.

Since the 2000 fund vintage, however, this persistence has fallen considerably.

Notice that McKinsey tacitly accepts that it was reasonable to believe that investors could identify and invest exclusively in these top-quartile funds. We pointed out that logical fallacy in a recent post....

...MORE