ERX is Direxion's triple-leveraged bullish energy ETF.

Quite dangerous. $103.37, up 3% last.

Here are a couple other portents. From CNS News:

Electricity Price Surged to All-Time Record for March

The average price for a kilowatthour (KWH) of electricity hit a March record of 13.5 cents, according data released yesterday by the Bureau of Labor Statistics. That was up about 5.5 percent from 12.8 cents per KWH in March 2013.

The relative price of electricity in the United States tends to rise in spring, peak in summer, and decline in fall. Last year, after the price of a KWH averaged 12.8 cents in March, it rose to an all-time high of 13.7 cents in June, July, August and September.

If the prevailing trend holds, the average price of a KWH would hit a new record this summer.

The BLS’s seasonally adjusted electricity price index rose to 209.341 this March, the highest it has ever been, up 10.537 points—or 5.3 percent--from 198.804 in March 2013....MOREAnd from All Star Charts:

Why Energy Is Better Than Technology

Throughout 2014 I’ve tried to maintain a neutral to bearish strategy in the stock market. I’m a much bigger fan of owning bonds and commodities. But within the equities space, there are still opportunities to make money while keeping that neutral position within the asset class....MORE

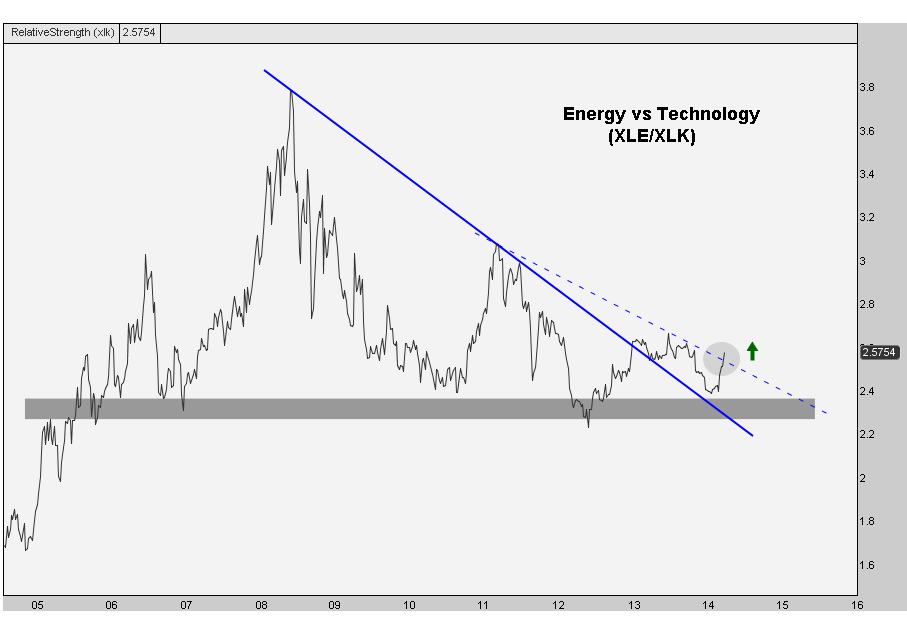

Today I wanted to share what I think is a great opportunity for the second quarter. As we enter what appears to be the end of the traditional bull market cycle, the late-cycle sectors should outperform the early cycle sectors. Technology tends to lead at the beginning of a bull market cycle, and it did just that off the 2009 lows. But that outperformance came to an end over a year ago. On the flip side, Energy has been underperforming for what seems like forever. But I think we’re currently seeing this change.

Here is a longer-term chart of the SPDR Energy Sector ETF $XLE vs the SPDR Technology Sector ETF $XLK. The price of this ratio held what has been support for over 8 years. But more importantly, we’re now seeing a breakout above a 6-year downtrend line (solid line). In addition, this ratio is now attempting to break out above a shorter-term 3-year downtrend line (dotted line):