It's Not An Organic Market!

From Bloomberg:

Louis Redshaw, the former head of carbon trading at Barclays Plc, returned to the market amid a jump in permit prices since he left the bank in April.

Redshaw, who resigned from Barclays in London after more than eight years at the company, is buying and selling European Union permits for his own account from his home in the southeast of the capital, he said Feb. 4 by phone, declining to provide further details. Allowances climbed 24 percent this year, the fourth best performance of 80 commodities tracked by Bloomberg. They rose to their highest level in more than a year today, trading at 6.25 euros ($8.45) a metric ton on the ICE Futures Europe exchange in London.

EU lawmakers are completing details of a plan to curb an unprecedented oversupply and boost prices, which fell to a record in April. Allowances may rise to as high as 15 euros by 2015, according to Patrick Hummel, an analyst at UBS AG.

“There’s no reason why the market shouldn’t double within the next 18 months,” said Redshaw, who also worked as a trader at Enron Corp. and Electricite de France SA. “At 6 euros, it’s still cheap.”

Carbon trading volume on ICE jumped 21 percent to a seven-month high in January compared with December.If they didn't like the play on words they should at minimum have understood the sentiment of the first inductee into the Climateer Hall of Fame back in April 2007:

As well as postponing the sale of some permits, the European Commission is proposing a permanent reserve of allowances to smooth future surpluses or shortages starting 2021....MORE

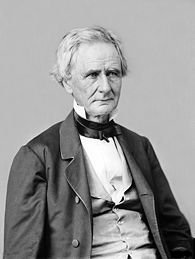

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."