From Afraid to Trade:

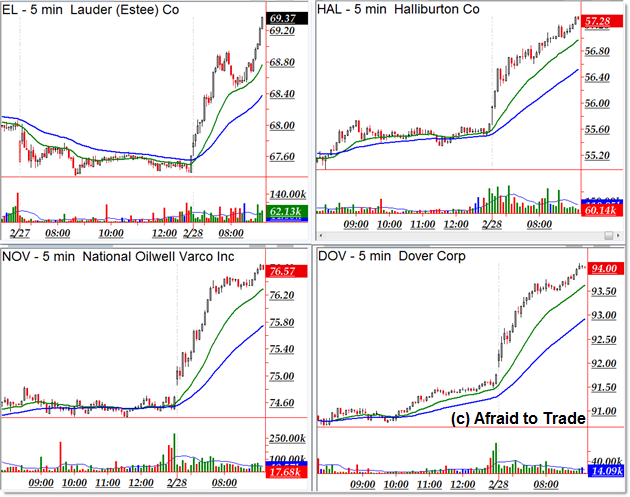

Trend Day Trading Stocks on the Breakout for Feb 28

It’s the last day of February 2014 and US Stock Market indexes are breaking to all-time highs.

Which stocks are leading the pack and topping our daily “Intraday Trend Day” scan list?

Let’s focus our attention on the bullish/uptrending names today:

And from Barron's on Monday:

Halliburton: Buy the Frac King

Raymond James analysts J. Marshall Adkins and Collin Gerry are big believers in the U.S. oil revolution and, as an extension, Halliburton (HAL) and Baker Hughes (BHI).HAL $57.33 up 2.94%

Adkins and Gerry explain why they like Halliburton, which they upgraded to Strong Buy from Outperform:

Baker Hughes’ rating got an even bigger boost from Adkins and Gerry, who upgraded the stock to Strong Buy from Market Perform. They explain why...MOREHalliburton derives 52% of revenues from North America and currently holds the market-leading position in the pressure pumping industry. We are updating our y/y NAM revenue growth assumptions to 20% in both 2014 and 2015 (versus prior estimates of 10% and 3%). Likewise, we now model exit rate 2014 NAM margins of 20.6%, up from our prior estimate of 19.3%. The net result is our new 2014 EPS estimate of $4.30, 10% higher than consensus and a $5.85 EPS estimate for 2015, 17% higher than consensus…

In the last upcycle, Halliburton’s FCF margin (FCF over revenues) was close to 4%. We expect it could be closer to 6-10% in 2014 and 2015 due to 1) significant working capital initiatives and 2) lower international capex. This should facilitate continued dividend and share buyback increases.

NOV $76.77 up 2.77%

SLB $93.75 up 1.27%

BHI $63.48 up 1.80%

Estee Lauder also moves a lot of oil but not our kind.