One important caveat: Be careful with ExOne and Voxeljet. We've looked and not been wowed. The fact the writer uses them as comparables is not the sharpest thing we've seen. Other than that, we've found engineering.com to be a pretty good source.

From engineering.com:

Alphaform AG (AFRMF): German Engineering AND Value in a 3D Printing Stock

With the 3D printing industry projected to have a CAGR (Compound Annual Growth Rate) between 25-30% for the next 5-7 years, well-known 3D printer manufacturers such as 3D Systems (DDD), Stratasys (SSYS), XONE (XONE), and voxeljet AG (VJET) reached extraordinarily high valuations in 2013. Many expressed their belief that the valuations of these stocks had gone beyond the fundamentals required to support their share prices. Year-to-date, Stratasys (SSYS) has dropped 17.4%, 3D Systems (DDD) is down 32.0% ExOne (XONE) down 36.5% and Voxeljet is down 26.4% due to valuations not supported by fundamentals. That said, there is a stock that provides exceptional value for investors who want exposure to the 3D printing industry’s forward growth that they may wish to consider, and that stock is the subject of this article.

“3D Printing Services” to Account for Majority of 3D Printing Industry Growth

The 3D printing industry as defined by Wohlers Associates consists of “all products and services” worldwide, yet many have been investing in only the “products” side of the industry…the “3D printer stocks”, while ignoring the services side of the industry. I believe this played a role in the overvaluation of well-known 3D printer stocks mentioned above.

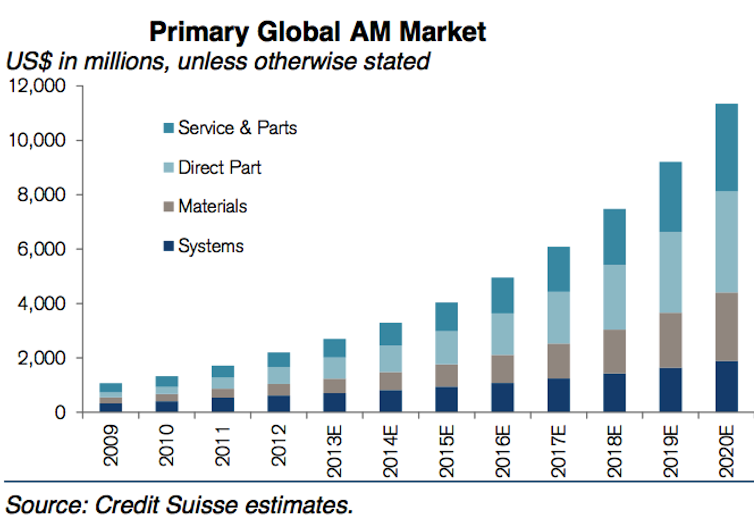

Many industry analysts predict 3D printing services will account for the majority of growth in the 3D printing industry for the next 5-7 years, not the sale of consumer and industrial grade printers. Many investors focused on the systems/3D printer stocks may be surprised by the following global Additive Manufacturing market estimates by Credit Suisse.

Meet Alphaform AG- German Engineering AND Exceptional Value in a 3D Printing Stock

Headquartered outside of Munich, Germany, Alphaform AG (AFMRF) and (ATF:Xetra ) is a leading European contract manufacturer of complex and sophisticated components using 3D printing, see Alphaform’s services brochure.

A 1996 spinoff from the industry giant EOS, Alphaform is a smaller company with about 235 full time employees, 5.3 million shares outstanding, and a tiny market capitalization of $23 million* (EUR to USD exchange rate of 1 EUR = 1.35 USD used in all instances).

The company’s current share price offers great value when compared to U.S. listed companies that operate in the additive manufacturing space as an OEM, a 3D printing service provider, or both.

I’ll chart some comparative financial metrics later in the article. For now I will say that the current Alphaform AG valuation of $23 million USD is remarkably inconsistent with full year 2013 revenue expected of $35.1 million USD. This translates to $6.62 in revenue/share…which is more than the ttm of revenue generated/share of 3D Systems and voxeljet combined. Moreover, Alphaform’s trailing twelve month revenue is 2.5X the trailing twelve months revenue of voxeljet AG (VJET) and yet voxeljet is valued over $500 million while Alphaform is valued at $23 million. When you then consider that “3D printing services” is projected to show the lion’s share of growth in the 3D printing industry by many analysts including Credit Suisse, the current valuation of Alphaform is astonishingly low....MORE