From Moneyness:

Bills of Exchange 2.0

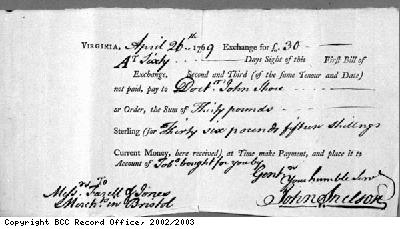

Bill of exchange for £30 for tobacco sales, on April 26th 1769

Here's some interesting news. Ripple is finally being implemented.

What is Ripple? Ripple is an open source P2P credit system dreamt up by Ryan Fugger in 2004. Its mission is to provide a non-banking payments alternative by decentralizing the process of creating and circulating highly liquid IOUs. Put differently, Ripple offers an environment in which individuals can be their own credit-issuing and credit-accepting banks. Ripple has always remained conceptual. But now a team of developers lead by Jed McCaleb, founder of MtGox, the world's largest bitcoin exchange, are implementing a living breathing Ripple network.

Ripple might seem to be unprecedented, but the decentralized credit system it envisions existed centuries ago in the form of the historical bills of exchange system. We tend to assume that all transactions conducted by people living in the 16th, 17th and 18th centuries were naive barter or coin-based transactions. But Adam Smith, Henry Thornton, and Sir James Steuart all provide lucid accounts of what was actually a very complex credit-based economy. Just like modern bankers have been busy dreaming up MBS, CDOs, and CLOs, medieval innovators in their own time spawned a broad variety of credit instruments including bills of exchange, promissory notes, cash credits, deposit accounts, accommodation bills, bank notes, shares, exchequer bills, and more.

Bills of exchange are particularly interesting. I'll bring this all back to Ripple in a bit, but in order to do so I need to explain how a bill of exchange worked. Let's start with a horse-drawn buggy merchant who, having received a shipment of buggies from a buggy distributor, must pay the distributor. The merchant writes an IOU, or bill, indicating that he promises to pay the distributor x pounds of gold three months hence.

In the early days of the bill of exchange, the distributor would hold this bill for three months and take delivery of the gold upon maturity. Later on a new use for the bill of exchange emerged. The distributor, unwilling to hold the bill for so long, might decide to "endorse" it onwards before maturity. Endorsement meant that the distributor would write his name on the back of the original bill, thereby promising to stand as a cosignatory to the carpet merchant's debt. The distributor could then spend the original bill by, say, purchasing more buggies from a buggy manufacturer. The buggy manufacturer might in turn use the very same bill to purchase lumber from a lumber merchant, and the lumber merchant might endorse that bill onward to purchase wood from a forest owner....MORE