Sorry to get all conditional early in the morning.

A wonderful catch by FT Alphaville:

...What sub-6% Chinese growth will do to various assets

Massive kudos to Societe Generale for attempting to answer a question we’ve long wondered (but figured would be insanely difficult to estimate).

The question is: if China does have a ‘hard landing‘ — or anything significantly below the consensus — how will that affect assets x, y, and z?

SocGen have modelled this by defining 6 per cent as the hard landing threshold (although they point out this isn’t their core scenario; they forecast growth of 7.4 per cent this year). In their hard landing scenario, 6 per cent becomes a tipping point that pushing growth temporarily as low as 3 per cent:

We define a hard landing in 2013 as one where the official, full-year, real GDP growth rate plummets to below 6%, which we see as the minimum level needed to keep the job market stable and avoid systemic financial risk. As China undergoes demographic ageing and growth of the working-age population slows, this minimum stable growth level will decline further. However, if progress in rebalancing and structural reform remains slow, the probability of a hard landing will rise over the medium term. In the tail risk scenario set out below, 2013 will see several quarters with just 3% growth and full year growth would stand at just 4.2% compared to our central scenario of 7.4%.So, here are the goods:

Currencies: dollar appreciates 10 per cent (trade-weighted)

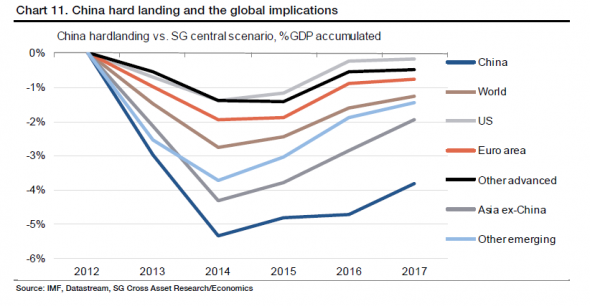

- World GDP: -1.5 per cent (0.3 per cent a direct effect of China’s slowdown and the remainder through transmission mechanisms outlined below)

- Trade partners:

- Taiwan: -4.5 per cent

- South Korea -2.5 per cent

- Malaysia: -2.5 per cent

- Australia: -1.2 per cent

- Japan: – 0.6 per cent

- Eurozone: -0.3 per cent

- US: -0.2 per cent

our China hard landing scenario assumes a 10% dollar appreciation in the first year and this despite additional QE from the Fed. It does not take any great stretch of the imagination to paint an even bleaker scenario in which a China hard landing triggers outright currency wars and protectionist measures on trade flows.Of course, central banks and governments around the world would throw all they could at such a scenario. But the SocGen strategists think this wouldn’t have much effect, “other than to limit negative tail risk”, because in developed countries at least arsenals are already so depleted. Emerging economies might have more room to stimulate, though they would also probably be buffeted by outflows as investors fled risk assets (though the consequent currency weakening would help).

There are some bright spots, however. Small commodity exporters, particularly in metals, would be hurt but slumping Chinese demand would provide support for commodity importers through lower prices.

And here’s their take on commodities:

Almost 50% drop in base metals: Our demand model suggests that a Chinese hard landing would drive prices sharply lower over the first two to three months. Critically, however, the impact would be less than in the Lehman bankruptcy, when copper prices dropped by almost 75%. Though prices could fall to the 60th percentile of production costs in some cases, the cost of production would ultimately limit declines....MORE