We will be referring back to this post.

From Wolf Street, October 15:

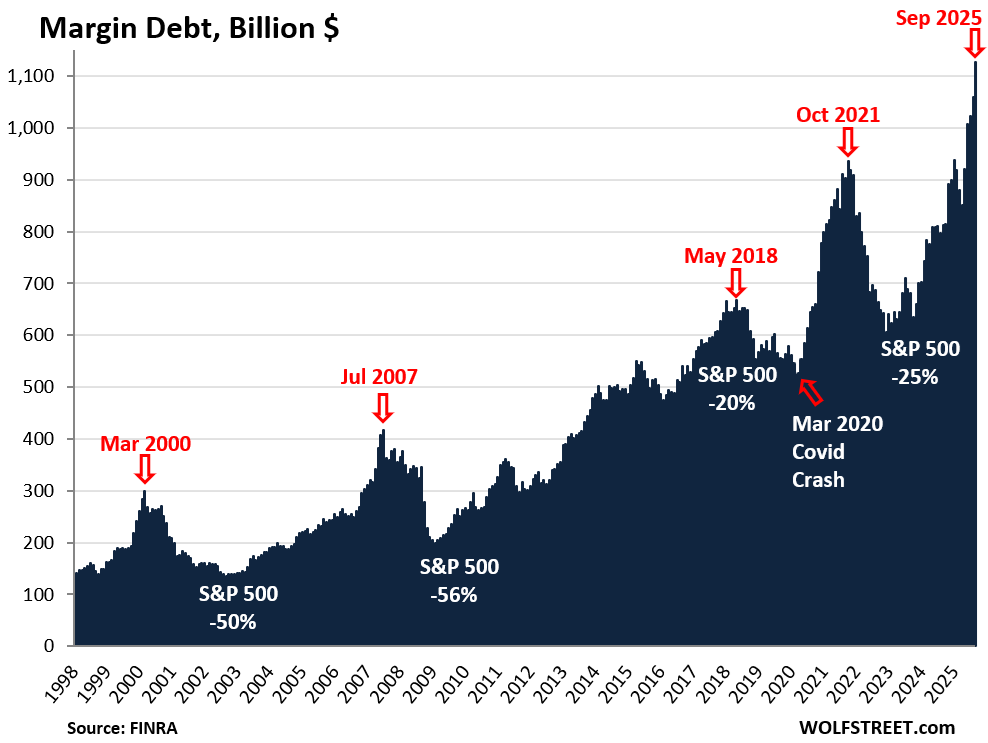

Everyone is talking about the AI bubble – proclaiming it or denying it – but this is what it looks like from the leverage point of view.

Leverage in the stock market has been spiking since April. In September, margin debt – the amount investors borrowed from their brokers – spiked by another 6.3%, or by $67 billion, from August to a record $1.13 trillion.

Since April, margin debt has spiked by 39%, the biggest five-month increase since October 2021; it was in early November 2021 that stocks began to tank, with the S&P 500 ultimately dropping by 25%.

The additional leverage – borrowed money flowing into the stock market – creates buying pressure and drives stock prices higher. Leverage is the great accelerator on the way up, but it’s also the great accelerator on the way down. Multi-month surges in margin debt, jumping from new high to new high, indicate excessive speculation and risk-taking and have invariably led to sharp selloffs:

Everyone has been talking about the AI bubble, either proclaiming it or denying it – Is it Really Different this Time? – but this is what it looks like from the leverage point of view, and it’s scary: A massive spike in risk-taking and excessive speculation in the stock market, as demonstrated by this multi-month spike in margin debt from record to record, that is creating big vulnerabilities and risks....

....MUCH MORE