From Klement on Investing, July 17:

I mean really bad. So bad indeed that one has to wonder what is going on there. And I know what that says about me as a German working in the investment industry. But let me explain…

There is a bit of a conundrum when it comes to Germans and their living standards. On the one hand, Germans are famously productive and inventive, creating a lot of income from their economic activities. Also, Germans are famously frugal with a rather high savings rate (particularly when compared to Americans or Brits).

But when one looks at living standards, the Germans typically lag the Americans and are not that much ahead of the Brits, French or other nations. In theory, if you have higher income and higher savings you can invest these savings and let the money work for you so that you end up with even more savings and higher income and thus higher living standards. Unless you do not make your money work for you…

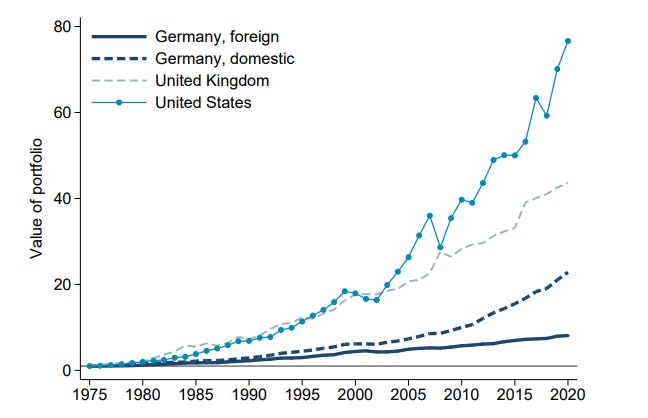

I know I am mixing things here that aren’t the same but stay with me for a minute and look at the chart below which is taken from an analysis by the Kiel Institute for the World Economy. It shows the cumulative return on German domestic and foreign investments as well as the foreign investments of the UK and the US.

Cumulative return of German, UK and US foreign investments

Source: Hünnekes et al. (2023)

The chart above shows that German foreign investments are not only worse than their domestic investments but miles behind the UK and the US. Now, be aware that this is the cumulative return of all kinds of foreign investments, which includes foreign direct investments, foreign portfolio investments in stocks and bonds, central bank reserves invested abroad and other investments such as trade credit.

But, and this is where things become relevant to most readers, one can show the same by just looking at equity funds located in different countries that invest abroad. Here is the average performance of international equity funds from 2000 to 2021 by location of the fund. German fund managers have among the lowest average returns and much lower average returns than their peers in the UK or the US....

....MUCH MORE

A possibly related post from 2009:

German pensioners ‘kidnap and torture their investment adviser’

A group of well-to-do pensioners who lost their savings in the credit crunch staged an arthritic revenge attack and held their terrified financial adviser to ransom, prosecutors said yesterday.

The alleged kidnapping is the latest example of what is being dubbed “silver crime” — the violent backlash of pensioners who feel cheated by the world.

“As I was letting myself into my front door I was assaulted from behind and hit hard,” the financial adviser James Amburn, a 56-year-old German-American, said. “Then they bound me with masking tape until I looked like a mummy. I thought I was a dead man.”

He was freed by 40 heavily armed policemen from the counter-terrorist unit last Saturday. The frightened consultant was in his underwear, his body lacerated by wounds allegedly inflicted by angry pensioners.

It appears that two couples had entrusted Mr Amburn’s investment company with €2.4 million (£2 million), which he ploughed into Florida’s boom-and-bust property market. The properties became forfeit during the sub-prime mortgage crisis but the couples wanted their money back.

After being bundled into the boot of an Audi in the west German town of Speyer, Mr Amburn was driven southwards to Chieming, close to the Austrian border, where one of the couples Roland K, and his wife, Sieglinde, 79, had a holiday home.

The financial adviser claims he was held there in a cellar for four days almost naked, fed soup twice a day and beaten. Another couple, Gerhard F, 63, and his wife, Iris, 66, both retired doctors, allegedly helped to torture the prisoner....

Maybe it's not Germans but rather their advisers.