The legacy marques simply can't compete.

From the Dunne Insights Newsletter, September 18:

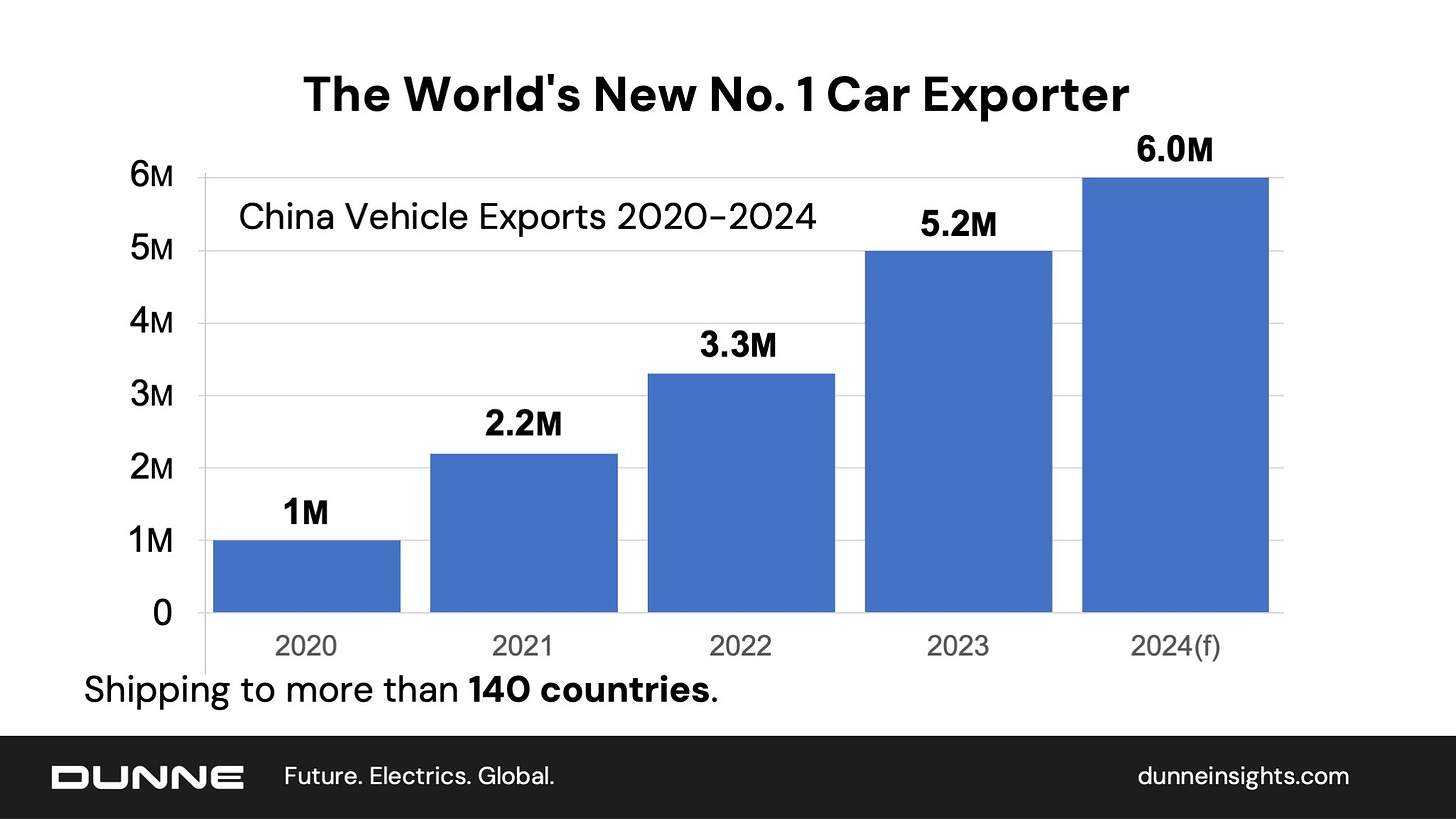

Record Exports Are Shattering 100 Years Of Western Car Dominance

Officials in Beijing may deny it. But – make no mistake – China has launched a global car blitzkrieg.

China will export a stunning 6 million cars to more than one hundred countries this year, cementing its position as the world’s No. 1 exporter.

The average price of those made-in-China cars: $19,000. That’s less than half the average price of a new car in America and Europe.

Consumers in every time zone are leaving their Chevys, VWs and Hondas in favor of new models from Chery, MG, Changan and BYD.

Dramatic Changes

The sudden flood of Chinese cars is upending decades of stable market shares and profits.

Take Thailand for example. A friend – and veteran car dealer based in Bangkok – gets frequent quotes from Chinese automakers these days.

“One guy in China – and he sounded very confident – said he can deliver a Territory replica for just $8,000,” recounted my friend. “Look, I sell the real Ford Territory here starting at $32,000. Can you imagine?”

His words gave me a flashback to the 1990s and 2000s when I was building our first company in Bangkok. Thailand was then known as “Japan’s backyard.” And for good reason. Japanese brands utterly dominated the market, year in and year out, taking more than 90% of the market.

No more.

In the first half of 2024, BYD’s market share jumped to 5%. Every Japanese brand, including Toyota, saw sales drop. Honda was forced to close a plant. And Suzuki is exiting the Kingdom.

Brazilian Boom

Thailand is just one example. Another is Brazil, the world’s 6th largest car market. Chinese automakers sent 175,000 cars there in the first half, a 450 percent increase over the same period in 2023.

You read that right – 450 percent. How to explain the sensational growth?

“The governments of China and Brazil are getting closer,” an executive from a leading dealer group in Sao Paulo told me this week, hinting at China’s geopolitical charm offensive. “Aggressive pricing and good products are part of it, too.”

Chinese gains means fresh pain for existing automakers. Count Chevy, Jeep and Fiat among the walking wounded. As a group, they lost more than 125,000 Brazilian customers to Chinese brands in the first half in 2024.

Source: CAAM, Dunne Insights.

Who Are These Guys?....

....MUCH MORE

Today we see VW contemplating layoffs of up to 30,000 of their German employees.