This is a pretty good roundup of the the information that was released. I'm getting the impression that ZH is yearning to be able to say they saw the economic turnaround but despite that (it may just be me hallucinating ZeroHedge's intent) they seem to be forthright in their presentation, giving fair weighting to each of the datapoints and factoids.

From ZeroHedge, October 17:

With Xi preparing to address delegates from 130 nations around the world at the third Belt and Road Initiative Forum, we should not be too surprised if the deluge of Chinese macro data tonight - headlined by Q3 GDP - will beat expectations.

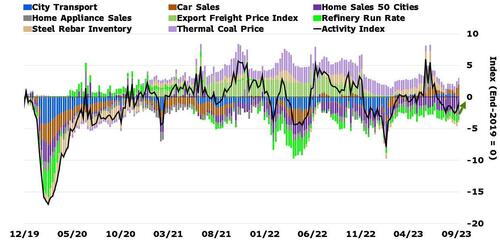

In fact, as Bloomberg's Chang Shu and David Qu noted, China’s recovery could be starting to get some traction, supported by stronger public investment and monetary easing, as weekly activity data rebounded in September...

...and overall China data has surprised more to the upside in recent months (admittedly against very weak expectations)...

However, bear in mind that base effects will dampen the year-on-year readings.

Growth in 2Q23 was flattered by a comparison with a depressed performance in 2Q22 caused by the Zero-COVID lockdowns. That boost will be gone in 3Q23, so most economists will be focused on the QoQ growth.

The Yuan has been relatively stable since the end of Q2, after plunging in Q1 and Q2...

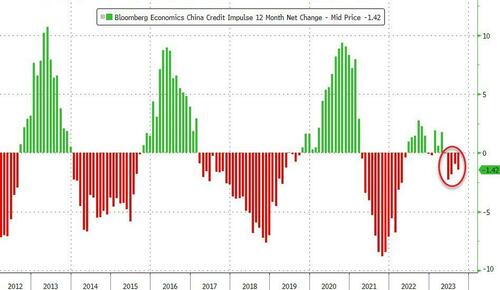

And, despite all the pumping and support, China's Credit Impulse remains negative (for the 5th month in a row) as its real estate market continues to implode sucking up every yuan to fill the hole-filled bucket balance sheet of Chinese citizenry...

Oh and while we are discussing that, China Property Stock gauge plunged to its lowest since 2009...

So, eyes down for a fun night of 'adjustments' from Beijing.

China's GDP growth YoY in Q3 was expected to come in at +4.5% (down from +6.3% in Q2) but most eyes will be focused on the QoQ number (+0.9% exp) due to base effects from the COVID lockdowns.

The headline QoQ GDP printed +1.3% (better than expected).

Helped by a downward revision for Q2 from +0.8% to +0.5%. The headline YoY data beat expectations (+4.9% YoY vs +4.5% exp and +5.2% YTD YoY vs +5.0% YTD YoY exp)...

....MUCH MORE