From ZeroHedge, May 9:

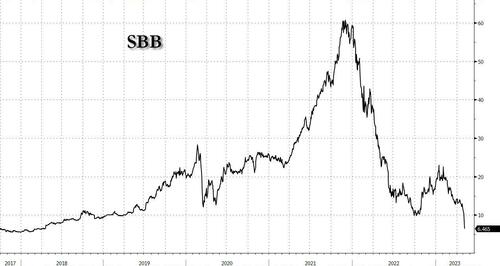

The US Commercial real estate crisis - which according to Jim Cramer "isn't going to destabilize the system" thus guaranteeing another global crash - has crossed the Atlantic and made landfall in Sweden where commercial landlord SBB - one of the most-owned stocks in Sweden - saw its share price crater to the lowest level since 2018 years after the company announced plans to postpone a dividend and cancel a rights issue intended to shore up its finances.

Shares in Samhallsbyggnadsbolaget i Norden AB — as SBB is formally known — plummeted more than 20% and have fallen 14 out of the last 15 trading days. Today's plunge compounded the losses from Monday when the stock cratered 20% following a credit rating cut to junk by S&P Global Ratings. Its market capitalization has dropped from over $17 billion in late 2021 to less than $1.5 billion, a historic collapse for its more than 260,000 shareholders.

In a statement issued at 11 p.m. Stockholm time on Monday, the property company said that “the market reaction thereafter has made it impossible to carry out the rights issue of ordinary D-shares on the intended terms”, Bloomberg reports, noting that it is seeking to push back its dividend payment date until next year’s shareholders meeting “at the latest.” The Stockholm-based company also said it will not carry out the issuance of 2.6 billion kronor ($260 million) worth of new class D shares.

The dividend cut comes one day after SBB’s credit rating was cut to junk by S&P Global Ratings, which warned a further downgrade is possible if the company is “unable to secure sufficient funding sources in the next couple of quarters to sustainably cover its short-term financial obligations." The ratings firm said it no longer believed the landlord could meet its thresholds for investment-grade debt; the downgrade adds to the company’s costs by triggering so-called “step-up” coupons on its existing debt. That adds up to an additional 285 million kronor in financing costs.

The developments raise serious questions for one of Sweden’s biggest landlords as it grapples with an $8.1 billion debt load amid sharply rising interest rates and ballooning credit spreads. It’s also symptomatic of the problems facing the wider commercial property sector in Sweden.....

....MUCH MORE