Just confirming our priors, that China's economy is actually sicker than they (and many Western commenters) have told us.

Via ZeroHedge:

By Ye Xie, Bloomberg Markets Live reporter and strategist

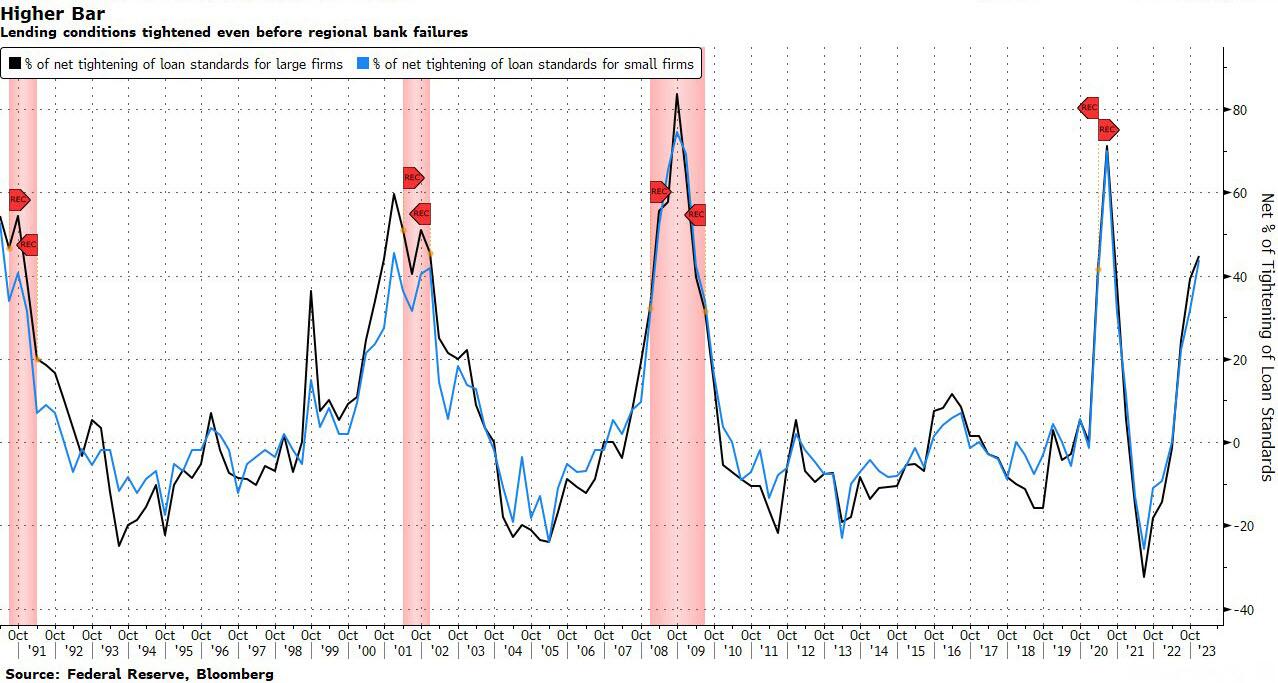

While the US banking turmoil has eased lately, the economic damage from an inevitable tightening in lending may only be starting.

In China, the opposite seems to be happening. The latest central bank survey shows that credit demand surged to the highest in more than a decade. That lending boom, though, may overstate the recovery in business and consumer confidence.

On Monday, the US ISM manufacturing index slumped to the lowest level since May 2020. It may be one of the earliest signs of the knock-on effect from bank failures last month. While the deposit outflows at small banks seem to be stabilizing, the underlying issue is far from being resolved. The yield advantage of money-market funds is likely to force banks to raise rates to compete for deposits. The resulting higher funding costs could cap banks’ willingness and capacity to lend.

In China, a different dynamic is on display. The PBOC’s quarterly survey of bankers released Monday showed loan demand surged to the highest in 11 years.

The survey result is in-line with the actual bank lending data, which show long-term corporate loans are shooting through the roof, thanks to lower borrowing costs. It is in sharp contrast with the deleveraging in the household sector amid housing turmoil.****At first glance, strong long-term borrowing seems to suggest a resurgence of business confidence as entrepreneurs expand factories or invest in new businesses.But the central bank’s surveys of businesses and households cast doubt on this interpretation. The macroeconomic heat index of entrepreneurs only recovered in the first quarter to a level seen a year ago, with domestic and export orders showing only marginal improvement. The profitability index actually fell to the lowest level since March 2020. On the household side, the survey also shows a modest recovery in consumer confidence....

....MORE

One takeaway: Even if Chinese GDP growth exceeds the 5—5.5% growth figure being bandied about, there is no reason to think there is a Sino cavalry coming to rescue the Western the little people trapped in the stagflationary morass that Wall Street, the Administration and The Fed seem to have agreed is the best of all possible worlds.