This was only the second-most-impressive of his market and macro calls.

First posted February 10, 2020, i.e. about six weeks into the slowly dawning awareness of the Covid (apparently it had been circulating for up to five months but this was when some anomalies were popping up in the capital markets)

Société Générale's Albert Edwards Not His Usual Jolly Self: Sees The End Of His Ice Age Thesis

From ZeroHedge, February 9:

"This Is A Ticking Timebomb": Here's The Chart That Convinced Albert Edwards That Helicopter Money Is On Its Way

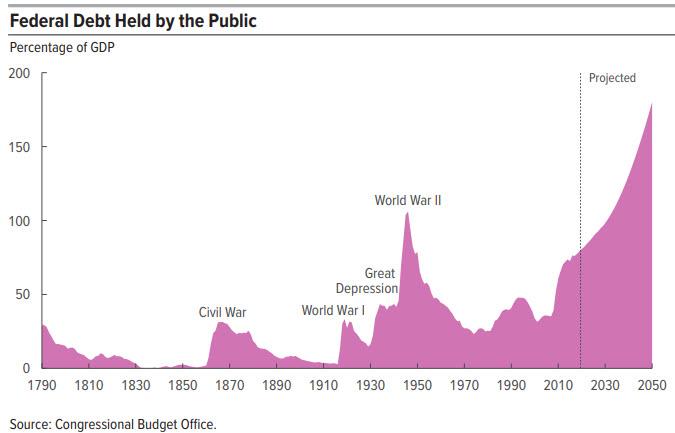

Two weeks ago, when looking at the latest CBO forecast which predicted that the cumulative US deficits would increase by $13.1 trillion over the next decade, we highlighted perhaps the most troubling chart in all of finance right now, namely the CBO's long-term forecast for US debt, which can be described in one word: exponential.

Commenting on this chart rather laconically, we said that "in other words, the MMT that will be launched after the next financial crisis, and which will see the Fed directly monetize US debt issuance from the Treasury until the dollar finally loses its reserve currency status, is now factored in."

Neither the chart, nor the comment was lost on SocGen's resident bear Albert Edwards, who after living through a harrowing earthquake during his vacation in Jamaica, chimed in on the chart above, writing in his latest Global Strategy Weekly that "this is a ticking timebomb and the chart... is screaming out for attention. The sources of this debt explosion are well known and documented with, for example, the unfunded liability of an aging population boosting Medicare expenses and the off-budget social security deficit spiralling upwards over the forecast period."

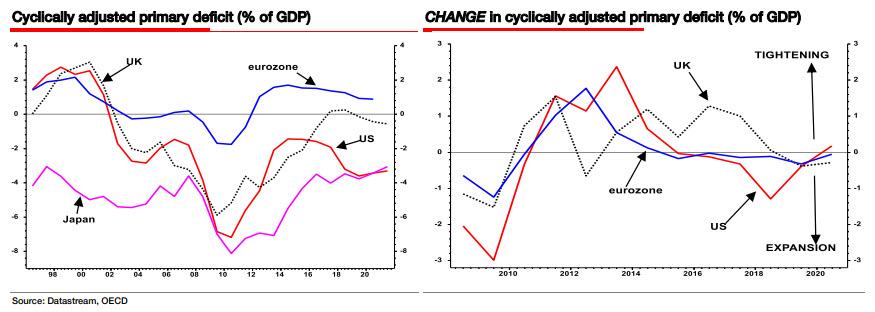

To underscore his Japanification thesis, Edwards also points to the chart below to the left, and observes that this will be "the first year in which the US cyclically adjusted primary deficit will have exceeded Japan’s since 1992, when Japan was beginning to suffer the serious fiscal impact from the bursting."

But, as Edwards notes, "it is the change in the cyclically adjusted primary deficit – which economists think measures the discretionary fiscal impulse – that slows or stimulates the economy (see right-hand chart above). The almost 1½% US fiscal stimulus a couple of years back has given way to a slight tightening of policy. Indeed, it is notable that in contrast to all the market chatter about fiscal expansion – and with central banks pressing governments to do more – all major countries are basically fiscally neutral this year. But fiscal neutrality won’t defuse the ticking government debt bomb of their 1980s bubble. This does indeed mark a new level of fiscal debauchery for the US."

So what to do? Below we present Edwards' thoughts on what comes next and, you guessed it, it involves MMT, i.e., helicopter money being used to thaw the ice age that over the past 30 years sent bond yields to never before seen lows:

... based on the fiscal projections from the CBO above, I expect the US will likely join Japan in giving up any serious attempt to reduce its government debt to GDP ratios back to the historically ‘normal’ levels. It simply ain’t going to happen. Does anyone seriously believe that any democratically elected government would be willing to raise taxes or cut government spending and future pension/health benefits in a bid to delay the fiscal timebomb? Of course they wouldn’t! And any government that attempts to do so will be hounded from office by an indignant public armed with pitchforks and much else besides.The CBO chart above showing US federal debt spiralling exponentially out of control screams one indisputable outcome to me (and these sorts of charts are similar for most industrialised countries). Helicopter money is on its way. You can call it Modern Monetary Theory (MMT), you can call it ‘Fiscal and Monetary Co-operation’, or you can call it whatever you like, but there is only one realistic way out of this mess – and that is for governments to inflate away their debts. However, since much of these liabilities will rise with the CPI, like state pension benefits and healthcare, and cannot be inflated away, there will have to be more emphasis on deflating the liabilities that can actually be shrunk via rapid inflation.Russell Napier reaches the same conclusion in his Macrovoices interview. Like him, I believe the regime change will be such a major event that it can only be implemented during a crisis – and for both of us, the next recession will be that crisis as it will be a deflationary bust! But my views are well known on that topic.If this outlook of Russell’s and mine is correct, one other thing is likely: helicopter money, and it will be a very effective tool. Mainlining liquidity directly into the veins of the global economy will be much more effective in boosting GDP than QE, which has largely injected liquidity only into the veins of the financial markets. Helicopter money will work for Joe Sixpack much more effectively than it will for Mike Moneybags – and so it will be much more widely popular. And that is the problem. Once politicians have their hands on this policy tool, make no mistake, they will never ever hand it back to the Central Banks. And any policymaker that ever dares try to turn off the monetary taps would be well advised to read about the fate of Korekiyo Takahashi , Japan’s Finance Minister and former Governor of the Bank of Japan.Takahashi, who is credited with pulling Japan out of the early 1930’s depression with extremely loose fiscal policy financed by helicopter money, is regarded as Japan’s Keynes link. He resisted fiscal tightening in 1935 as too early because of the continued fragility of the economy, but by 1936 with the economy having returned to full employment he set about turning off the fiscal and monetary taps and called the helicopters back to base.As in all these things, the beneficiaries of super-loose fiscal and monetary largess were not happy when it looked as if the fiscal taps were about to be turned off. The Japanese military, who had been a major beneficiary of his fiscal spending, were especially miffed – so they had Finance Minister Takahashi assassinated.As helicopter money becomes increasingly inevitable, the big news is that we are calling for the thawing of the Ice Age after the next recession – whenever that arrives. But a deflationary bust, which will take US 10y yields to around -1% (and 30y yields negative), will come first and enable this massive shift in policy to occur.

And within a few years I have not one scintilla of doubt that helicopter money will be so successful that CPI inflation will return like a long-lost relative. But, like a distant uncle we only see every now and again, we will have forgotten just how out-of-control he can become after a few drinks, and woe betide anyone who tries to stop him in his tracks, or in policy terms tries to stand down those confetti dropping helicopters....

....MUCH MORE

I believe this was when ZH was experimenting with paywalling their archives after 30 days but someone had the sense to save ZeroHedge's remarkable catch of Alberts remarkable commentary at The Internet Archive.

Although the yield didn't go negative, it did drop from 1.56% on Monday February 10 to a generational low 0.54% during the first week of August, 2022:

As for the helicopter money, as we now know that was delivered in the trillions of USD equivalent.

The next day, Tuesday February 11 we posted:

Just So No One Thinks Société Générale's Albert Edwards Is Wrong About The Helicopter Money, Here's The Dallas FedFollowing up on yesterday's "Société Générale's Albert Edwards Not His Usual Jolly Self: Sees The End Of His Ice Age Thesis" here is a presentation put together by Evan F. Koenig,Vice President, and Jim Dolmas, Senior Economist, Research Department, Federal Reserve Bank of Dallas.

The presentation literally uses this image on page 7:

Not to put too fine a point on it but that is a U.S. Army CH-47 Chinook helicopter in a presentation by a couple Fed Bank honchos with the boilerplate disclaimer:

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.Here's "Monetary Policy in a Zero-Interest-Rate Economy", May 2003

Introduction

If short-term interest rates fall toward zero, it may be necessary for the Fed to re-think how it conducts monetary policy. In this document, we examine why conventional policy loses its effectiveness at very low interest rates, and review some of the alternative policy tools that are available. We’re hopeful that this entire discussion will prove to be academic–that our economy’s natural resilience, together with the easing the Fed has already undertaken,will be sufficient to get employment and output growing again. But it’s nice to know that if additional stimulus is required, there are still arrows left in the quiver.

The Recovery May Be Stalling Despite Low Interest Rates As shown in Figure 1, short-term interest rates are as close to zero as they’ve been at anytime since 1958. Any further rate reduction will make life difficult for banks and money-market funds, which will either have to start paying out less than a dollar for each dollarinvested, or to begin charging explicit management fees....

....MUCH MORE

But, as we said at the top, that was not Albert's finest hour. This was. From 2011's:

UPDATED *****Alert***** Société Générale's Albert Edwards Bearish *****Alert***** (Sept. 6, 2011)

We passed a three year anniversary yesterday.

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

***Alert****Economic and equity market meltdown imminent****Alert***

A good call.

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a Reg. T shut-down when markets re-opened.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia gobbled up.

Good times, good times.

And then there's the reserve currency stuff...

Every time I am asked why we post on Mr. Edwards "when he's been wrong so often" I debate whether to explain or just give a glib answer.

The flippant rationale would be we get to go with headlines such as:

Société Générale's Albert Edwards Descends Into A Nightmare World of Dream Demons and Market Depravity

Société Générale's Albert Edwards: "Many Think I am Mad..."

Société Générale's Albert Edwards Sees Blue Skies, Sunshine, the Lame Shall Walk Again

Of course it's possible I have misinterpreted the meaning of

"the US economy is on crutches, and they are about to be kicked away"

Société Générale's Albert Edwards Has Some Troubling News He Reluctantly Shares

Société Générale's Albert Edwards Not His Usual Jolly Self (II)

Société Générale's Albert Edwards: "I Have Been Wrong – I’ve Been Too Bullish"

It May Be Time To Put Société Générale's Albert Edwards On Suicide Watch

Société Générale's Albert Edwards: Cry Havoc and Let Slip the...Ah Screw it

And many, many more.

The straight-up answer is: I can't think of anyone else who nailed the

deflationary bias in credit markets as well as he has for as long as he

has, pretty much the last 15-20 years.

And as far as equities go, absent the extraordinary measures of the

world's central banks the landscape would look very, very different.

The biggest criticism you can lay on the guy is he didn't realize what he was up against re: the powers that be.

Plus that whole Albert-in-the-bathtub period was just stupid.

You do have to be careful you don't personally get into a David

Koresh/Jim Jones-Drink-the-Kool-Aid frame of mind when gazing upon the

dark side, whether Albert or Ambrose Evans-Pritchard or Jim Chanos. I

mean it's okay to play around with melancholy:

Music For Albert Edwards. On A Cold Day. In February

In F flat minor.*

And it's raining.

Season's Greetings From Société Générale's Albert Edwards (Nov. 14, 2012)

Expect the New Year to bring nothing but disappointment....

But be attuned to when to take Mr. Edwards with utmost seriousness.