If your investment counsel can't explain the importance of this fact-set, you may be in for an excruciating surprise. TL;dr: the U.S. economy and markets are somebody else's fantasy (i.e. not real) world that we are just living in.

From the Mises Institute post, "Don't Call It Capitalism", January 19:

....While the Fed has long bought government debt in its so-called open-market operations to manipulate the interest rate, wholesale buying of financial assets began in 2008. This included both US government Treasurys and—in a new development—private-sector mortgage-backed securities (MBSs). This was done to prop up banks and other firms that had bet on the lie that “home prices always go up.” The value of mortgage-backed securities was falling fast, so beginning in 2008, the Fed bought up MBSs to the tune of $1.7 trillion. That was all before covid.

Source: Federal Reserve Economic Data (FRED) (“Balance Sheet: Total Assets: Securities: U.S. Treasury Securities” [QBPBSTASSCUSTRSC], Federal Deposit Insurance Commission [FDIC], last modified December 2, 2022; and “Assets: Securities Held Outright: Mortgage-Backed Securities: Wednesday Level” [WSHOMCB], Board of Governors of the Federal Reserve, last modified January 12, 2023).

The Fed attempted to begin selling off its portfolio in 2019, but by then the market was already so addicted to Fed money that the economy began to slow and a liquidity crisis in repos ensued. The covid panic was what prevented a full-blown recession in 2020: the federal government began a spree of deficit spending, and the Federal Reserve hoarded even larger amounts of assets, bringing totals to new record-breaking highs.

The MBS portfolio climbed to $2.7 trillion.

These sorts of volumes of assets are not an insignificant part of the overall market, either. Since 2020, the Fed’s MBS stockpile has equaled at least 20 percent of all the household mortgage debt in the United States. In early 2022, Fed-held MBS assets peaked at 24 percent of all US mortgage debt, but they still made up over 20 percent of the market as of late 2022.

Source: Federal Reserve Bank of New York Research and Statistics Group, Quarterly Report on Household Debt and Credit, 2022:Q3 (Center for Microeconomic Data, November 2022); and FRED (“Assets: Securities Held Outright: Mortgage-Backed Securities: Wednesday Level” [WSHOMCB], Board of Governors of the Federal Reserve, last modified January 12, 2023).

One can only speculate as to the full extent to which markets are distorted by the central bank holding one-fifth of mortgage debt, but one thing is for sure: one cannot say that this is any sort of “capitalism” at work.

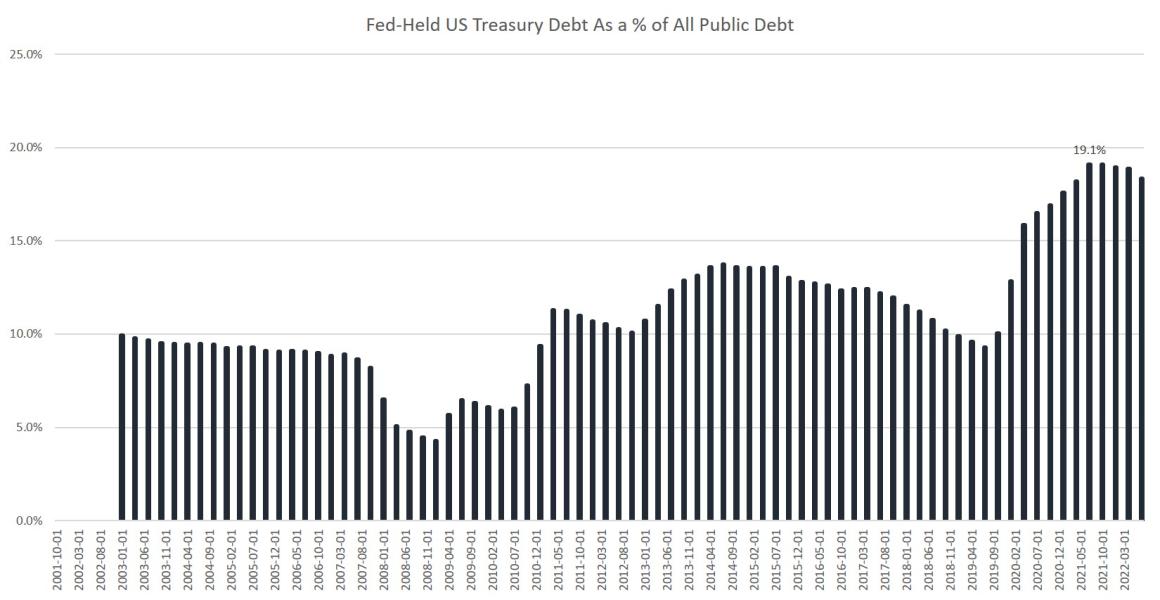

The story is similar with Treasury debt, and the timeline is largely the same as with the MBS assets. The Fed bought up about $2.5 trillion in US government bonds from 2008 to 2015. An attempt at scaling this back was aborted when the economy proved to be too fragile in late 2019. Then, the Fed gorged on Treasury debt in 2020 and 2021, bringing its government bonds total to nearly $6 trillion.

As a percentage, the Fed’s share of all Treasury debt has totaled more than 15 percent since 2020. It peaked at 19 percent in 2021. All foreign holders combined hold 33 percent of Treasury debt. This makes the Fed, by far, the largest domestic holder of US government debt: the Fed holds nearly 40 percent of all domestically held Treasury debt, putting it far ahead of entire sectors, such as mutual funds, which hold “only” around 22 percent of this debt.

Source: FRED (“Balance Sheet: Total Assets: Securities: U.S. Treasury Securities” [QBPBSTASSCUSTRSC], Federal Deposit Insurance Commission [FDIC], last modified December 2, 2022).

It’s also helpful to keep in mind that US Treasurys are a huge portion of the debt markets overall. For example, corporate debt in the US totals around $11 trillion. Even if we add this to the US Treasury debt, we still find that the Fed holds more than 10 percent of debt assets.

Of course, it would be absurd to call this situation anything resembling even “mostly” laissez-faire, let alone a free market. Imagine if a federal government agency—which is all the Fed is—owned 10 percent of all supermarkets or 10 percent of all Wal-Marts or 10 percent of all stocks. We would say that the agency in question possessed an enormous amount of power to move and manipulate markets as it willed.

That is where we are with these debt markets, and it’s become increasingly so since 2008.

Fannie and Freddie Do It Too...

....MUCH MORE

The shape-shifting and reality-bending effects go far beyond just the debt markets. More on that coming up.

And here it is: "An Interesting Chart: Equities and Central Bank Balance Sheets"