From ZeroHedge:

Wall Street Reacts To Today's Huge CPI Miss

“Remember that one month does not make a trend. But also remember that every trend starts with one month.” - Leon Brittan

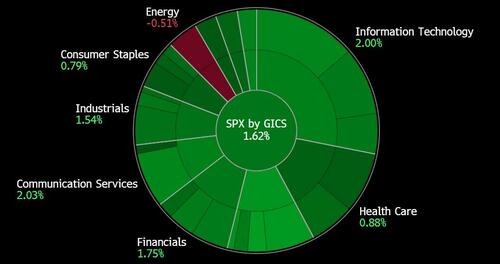

For a look at just how big of a surprise today's CPI miss (which we said would be a miss in our preview), look no further than the market where it's a sea of red with every asset class soaring (except energy)...

... and where the plight of the shorts - which these days is most hedge funds - can be summarized with one image:

Why this tremendous market reaction, where - when one strips away the rhetoric - all we have seen is one month's drop in energy prices, which will only rise now that the market is starting to anticipate a Fed pivot.

Bloomberg asks a similar question, namely "what’s behind the surprising slowdown in July?" and notes that according to a new Bloomberg Economics model, US inflation decomposes into four factors: supply, demand, energy prices and monetary policy.

The model found that lower energy costs and a slightly tighter Fed stance were the main drivers of the deceleration to 8.5% last month.

At the same time, sizzling demand paired with supply constraints continue to put upward pressure on inflation. With these last two factors harder to contain, Bloomberg writes that "the Fed has a tough task ahead of it and will likely need to be more hawkish then currently expected", or in other words, echoing what we said yesterday when we warned that "a miss will make Powell's life extremely hard."

Why? Well, here is a good thread summary from Dan Alpert:

And the answer is: Headline: ZERO M/M; Core: 0.3%

The end is nigh!

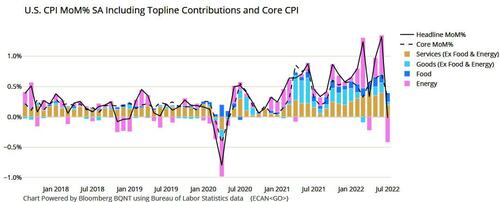

That headline reading was with food UP 1.1% in July, offset by energy falling -4.9% on the month. (Energy commodities -7.6%)

Core commodities (goods) only rises 0.2% on the month as supply chains reopen and production inventories build to backlog. On the services side, the price rise falls to 0.4% driven by a -0.5 decline in transportation services in July.The shelter rise moderates a bit to +0.5% M/M on the back of a 2.7% monthly decline in lodging, which fell for the second straight month after pandemic reopening demand and supply squeezes (this will accelerate into the fall).

Rent and Owners Equivalent Rent of Primary Residences, the primary drivers of core inflation, remain high at 0.7% and 0.6% M/M respectively. But that is lagging data and the housing market has already been thrown into decline by Fed interest rate hikes and building oversupply.

Housing is, these days, the principal channel through which Fed monetary policy operates (the mortgage market). >>

While Fed hikes are not responsible for inflation slowing in this report (the prior inflation itself - "the cure for high prices is high prices", opening supply chains and lower global energy prices were), higher interest rates will have a huge impact on housing (and CPI) soon.

In October of last year, before Omicron and the Ukraine War disturbed pricing metrics around the world, I noted that inflation would be a first half of 2022 story (I said it would subside by Q2, but the foregoing events got in the way).

Yet here we are.

While these M/M sectoral declines will not be repeated every month, we will see housing costs gradually subside for sure, core goods stabilize and consumer purchases driven most by pandemic reopening "revenge spending" see material price retrenchment as inventories rebuild.

The only real wild cards are exogenous (not demand driven) supply risks associated with oil and gas, and their bleed over impact on food (think fertilizer and food transportation) costs.

All in all, this report is as I expected and the trend is reorienting itself.

We are at the point where the annual (Y/Y) CPI figures cease to have meaning. Prices are what they are now, as are wages and incomes. The only issue is where they go in the future. And that is not a function of expectations, it is the discipline of supply and demand.

One last data point FWIW: CPI All Items less Shelter fell by -0.3% in July.

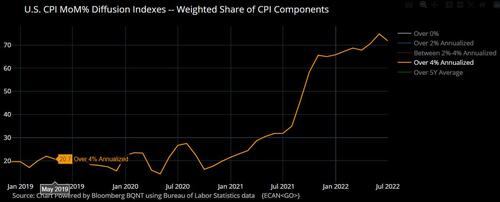

While we are confident that those who don't actually have a corporate charge card will disagree with Dan's cheerful take on today's inflation print, there was another reason for the market's euphoric reaction - the chart below from Bloomberg shows the breadth of inflation. The July reading of 71.8 is saying that 71.8% percent of the CPI basket is increasing in price at more than a 4% on an annualized basis from the MoM data, which represents relief for the Fed after June’s high of 74.8%.

....MUCH MORE, including the analyst roundup.

Callin' out around the world -

Are you ready for a brand new beat?

Summer's here and the time is right

For dancin' in the streets.

They're dancin' in Chicago,

Down in New Orleans,

Up in New York City....

As we said last week in "This On The Other Hand May Signal The End Of The Stock Market Rally Is Close", depending on the numbers from the Fed on their QT efforts we will probably be calling the top in the rally this week.

DJIA 33,294.44 up 520.03

Nasdaq 12,828.33 up 334.41

S&P 4205.85 up 83.38