In the U.S. we saw in-your-face lying denial of inflation from political hacks to squeeze the last bits (which amounted to hundreds of billions of dollars) of stimulus/grift, whatever you want to call it, into the hands of politician's preferred recipients, the people who donate to their political campaigns.

From Brownstone Institute, March 24:

The outrageous prices at the grocery store and gas stations – the highest ever recorded and increasing at rates too fast to calculate with precision – are yet more collateral damage from the initial lockdowns two years ago. The story unfolds over two years but the line of causality is direct.

Apparently it’s going to get much worse. I wonder if at some point, no one will remember how this all began. Maybe everyone has already forgotten.

I asked a friend: do you think people understand the relationship between the March 2020 lockdowns and the wild price increases two years later? The answer came: no way.

That surprises me but I also understand. There has been so much flimflam coming from the media and government spokespeople for so long, so many many attempts to demonize and scapegoat.

In addition, for many people, the past 24 months have seemed like one big blur when everything they thought about the world has been blasted to pieces. It’s extremely disorienting. After a while, one can get used to the chaos and just accept it without attempting to account for it. The lines of causality too become blurry.

The latest mess – and this doesn’t even account for the shocking talk of nuclear war that is now in the air – profoundly affects all states in the US, not just the blue ones that stayed closed much longer than red ones. Red states have felt normal but now they too must deal with incredible price increases in everything plus strange and random goods shortages on the shelves.

No one is spared when we all use the same currency and inhabit the same global economic environment.

Cash and MattressesThe cash you hold is losing value. Financial markets are volatile, but even when rising, portfolios can’t keep up. Even the best-managed funds are scrambling for returns. Savings seem ever less like savings. Even with cost-of-living increases in salaries and wages, the purchasing power is shrinking day-by-day.The promises of “transitory” inflation turned out to be as credible as the promises to control the virus.

Persistently high inflation becomes a tragedy for the poor and working classes, who are daily astonished at the new terrain of high prices for everything that makes life good. But it is especially awful for the savers. They are all being punished for frugality and exercising good personal stewardship over their resources.

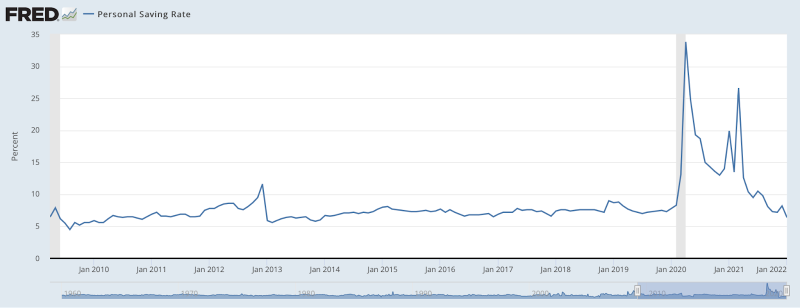

It was not a surprise to any economist that personal savings soared during lockdowns. This is not only due to few opportunities to spend money. That was the least of it. When a crisis hits, risk aversion dominates confidence. The pace at which money changes hands collapses. The cash stays in the mattress. This is due to fear, and it is entirely reasonable.

This boost in savings during a crisis normally prepares the way for recovery. Once it ends, deferred consumption in the form of savings becomes the basis of investment in capital that then becomes the basis of the rebuilding. It’s a natural economic phenomenon. You can call it the silver lining of any crisis. There is recovery and it is built on the real economic behaviors inspired by the crisis itself.

You can see this happening in the data from 2020 in personal savings. It ballooned from 7% of income to 33% practically overnight. In fact, we’ve never seen anything like this before. It’s a measure of just how awful things became so quickly.

Of course, it was brief but still valuable. Household savings soared 120%. Corporate and business savings also showed risk aversion, as they socked away a clean $600 billion in so many months.

Counterfactual: let’s say that “two weeks to flatten the curve” had been real. All restrictions were removed in a fortnight. Everything opened. Congress had done nothing. Everyone wondered why we had behaved so egregiously and then we got to work dealing with the pandemic like intelligent adults. Might we have recovered quickly? Surely so, even if it would be the trauma of a generation.

Instead, however, Congress went absolutely nuts with spending money that they did not have. I’ve previously explained the events:....

....MUCH MORE

The

disease didn't cause the collapse of business, activities deemed

essential such as stocking the grocery store shelves continued, but

petty dictators with their state and local crazy sure as hell wiped out

hundreds of thousands of smaller businesses while leaving big businesses

not only unscathed but thriving.

See also "Covid-19: "Lockdown Harms and the Silence of Economists"" if interested.

WSJ: "The Fickle ‘Science’ of Lockdowns""Covid-19 Lockdown Cost/Benefits: A Critical Assessment of the Literature"

The tricks were: First, conflate lockdowns with quarantines when in truth no one in history had ever attempted to shut down entire HEALTHY populations and Second, use the camel's nose under the tent technique, also known as, among political scientists, the 'I'll just put the tip in' method of coercion. Just two weeks, that's all. Two weeks to bend the curve.

And finally an amazing story, well told:

Money, Money, Money: "A Self-Fulfilling Prophecy: Systemic Collapse and Pandemic Simulation"

Is this why we had lockdowns?