As we've seen with Western sanctions on Russia, the failure to think through and anticipate the effects and ramifications of our actions can lead to disaster.

Of course "Ready, Fire, Aim" is more spontaneous and attuned to the adolescent spirit of the age, feelings over rationality and leadership by undeveloped frontal cortexes.

From the Milken Institute Review, March 7, 2022:

Daniel Raimi is a fellow at Resources for the Future (RFF), an

independent nonprofit environmental research institution in Washington.

When assessing the costs of the transition to clean energy, policymakers and the media generally focus on one word: jobs. This is understandable and, to a large degree, appropriate. In America, work shapes identity, creates a shared sense of community — and, of course, supports families in a society with a limited safety net.

But another loss may prove be just as important in the energy transition: the loss of government revenue.

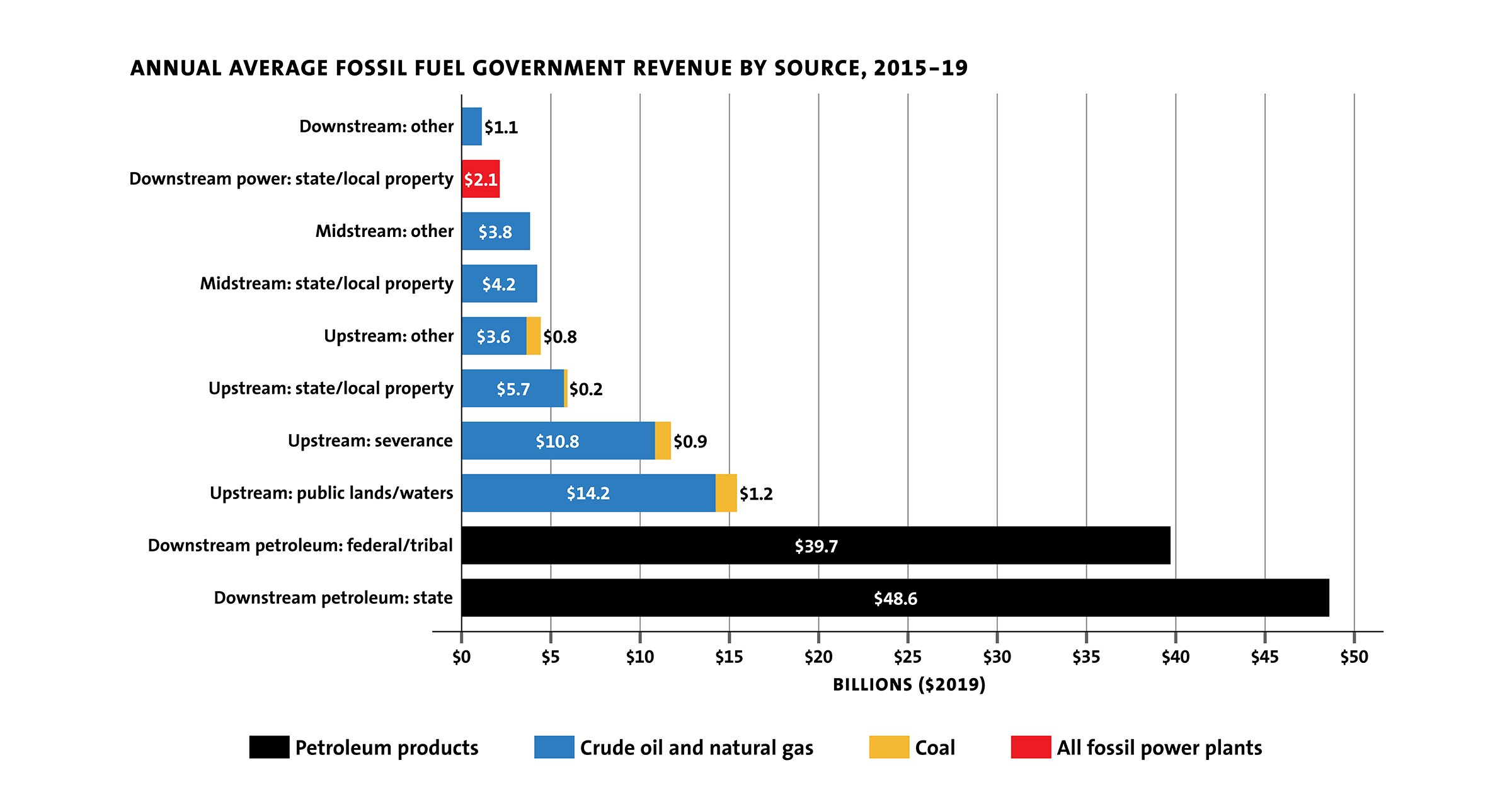

Putting the Pieces TogetherIn a working paper from RFF, I partnered with Emily Grubert, Jake Higdon, Gilbert Metcalf, Sophie Pesek and Devyani Singh to assess the impact of fossil fuels as a source of government revenue. We also estimated how those revenues might change over the next 30 years under different transition policy scenarios.We found that between 2015 and 2019, fossil fuels generated, on average, about $138 billion per year to governments across the United States. The largest sources are petroleum product excise taxes, which have yielded $48 billion for states and $40 billion for the federal government annually. Oil and gas production (also known as upstream development) has generated about $34 billion annually. Of those upstream revenue sources, some $14 billion came from production on federal, tribal and state lands and waters, about $11 billion from state severance taxes and $6 billion from local property taxes. Other major sources of funds include oil and gas pipelines, oil refineries, coal production and power plants.

NOTE: "Other" includes corporate income, personal income and sales taxes, along with the federal coal excise taxes and local property taxes on natural gas distribution.

Now, let’s get one thing clear: $138 billion is a lot of money, but it is peanuts compared to the cost of delay in containing climate change. If we use the federal government’s interim estimate for the social cost of carbon emissions ($51 per metric ton), annual damages from energy-sector greenhouse gas emissions in the United States amount to roughly $261 billion per year. And that number is almost certainly an underestimate, as recent scholarship points to a social cost that is two or three times larger. Moreover, those higher estimates neglect non-climate damages that emissions from fossil fuels impose on human health and the natural environment.

Nonetheless, it’s important to recognize that the transition to clean energy will create fiscal pressures, particularly in rural areas where fossil fuels are an economic and fiscal linchpin. We estimate that fossil fuels account for more than 10 percent of all state and local government direct, own-source revenue in Wyoming (59 percent), North Dakota (31 percent), Alaska (21 percent) and New Mexico (15 percent). Five more states rely on fossil fuels for more than 5 percent: West Virginia (9.4 percent), Montana (7.9 percent), Oklahoma (7.7 percent), Louisiana (7.2 percent) and Texas (7.0 percent). Consider, too, that in some other states fossil fuels don’t provide a large share of state revenue, but they play an outsized role in certain localities — among them are Kern County, California; Weld County, Colorado and Uintah County, Utah....

....MUCH MORE