This piece seems to frame the central banker as a reactor when the reality is she is an actor or even a pre-actor. She and the Finance Ministry and Gazprom didn't just pull the roubles for gas idea out of their backsides, they forced the strong rouble as one lever where they could really apply pressure.

She is very good at what she does, though I can't for the life of me understand why so much of Russia's foreign reserves were left at risk of confiscation. China was baffled as well and has been dropping not-so-veiled hints that should the West attempt such sanctions on Beijing there would be a hellstorm starting with the take-over or leveling to the ground of the TMSC chip fabs on Taiwan.

From Bloomberg via Yahoo Finance:

Bank of Russia Rode Ruble’s Rally When War Left Few Options

The ruble was one of the first economic casualties of Russia’s war in Ukraine. Soon, it became the central bank’s lifeline.

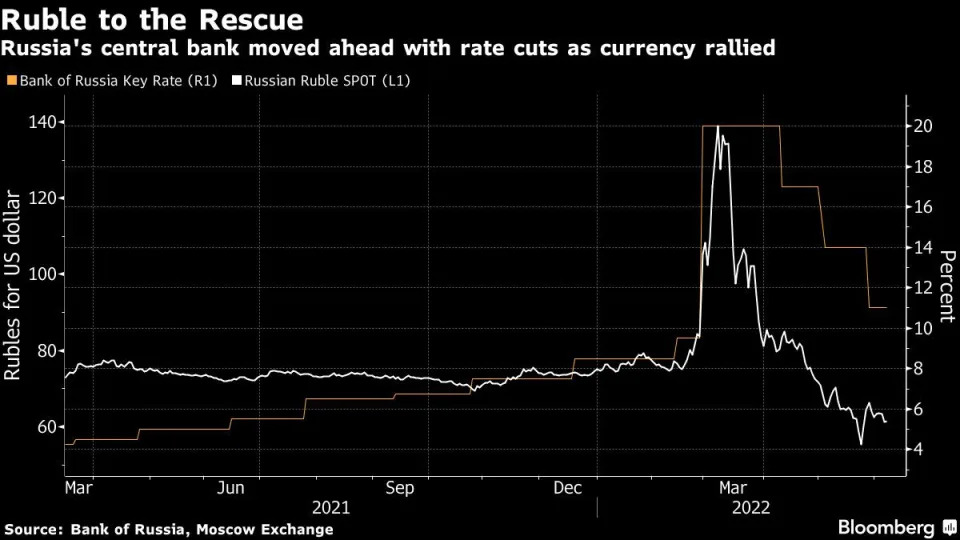

With stiff capital controls in place, imports collapsing and billions in petrodollars flooding in, a rally in the currency took hold by March. It was then that Governor Elvira Nabiullina decided to harness its strength to subdue inflation, according to people familiar with central bank discussions at the time.

Instead of acting faster to dismantle restrictions on the cross-border flow of money, the choice three months ago was to hold out as long as possible even at the cost to the budget, the people said. Only once a stronger ruble made enough of a dent on inflation would the central bank move aggressively to lower interest rates from the highest in almost two decades, they said, requesting anonymity to speak openly about the deliberations.

The culmination of what insiders describe as Nabiullina’s tactical maneuver may come on Friday, when some economists think the central bank could lower the benchmark below its pre-war level of 9.5%. It would be the fourth straight cut, a series that started as the ruble wiped out the losses incurred after the invasion began.

“The strategy is clear, first let the ruble strengthen to fight inflation,” said Oleg Vyugin, a former top central bank and Finance Ministry official. “But there is one catch: this tactics makes sense if imports recover and then bring at least a relative balance to trade. But imports aren’t recovering yet. And that’s a problem.”

On Wednesday, the ruble closed stronger than 60 per dollar for the first time since May 25, when the central bank called an extraordinary meeting for the following day and then proceeded to lower rates by three percentage points.

Russia’s currency appreciated as much as 3.4% on Thursday in Moscow, before trading little changed at 59.36 against the greenback. It rallied to as high as 55.80 on May 25.

The central bank didn’t respond to a request for comment.

Turnaround JobJust days before the start of her third term later this month, Nabiullina might feel vindicated because inflation has cooled off so much that Russia saw rare weekly declines in consumer prices.....