Bringing to mind one of the better quips in finance:

"He lied like a finance minister on the eve of a devaluation"

-Warren Buffett*

*The 1988 Berkshire-Hathaway Chairman's letter, one of my personal favorites (it has the cocoa bean arbitrage story), right up there with the '84 and '85 vintages.

The $300 billion? The Chinese can handle that. The real problem is the potential contagion. As noted last week:

The problem with these situations is you don't know how deep the rot goes until the positions start to unwind. That's how a stupid (relatively) little family office, Archegos Capital, came close to causing serious problems, re-re-hypothecated collateral and 100:1 leverage in some of the positions meant no one was really aware of what would happen if the market for the collateral stopped ascending.

In the Evergrande case, if the mess gets into the trillions of US dollar equivalents, the Chinese may need more ammo than they posses to contain the fallout. Hence the question of Fed assistance.

At the moment we really don't know how much of that Evergrande paper has been pledged (and re-pledged, and double pledged [fraud])

From ZeroHedge:

China Evergrande Group, the largest and most indebted, and certainly most insolvent property developer in China, is - together with its $300+ billion in debt - rapidly approaching its "China moment."

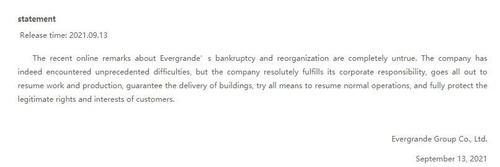

Five days after reports of a technical default at Evergrande, which slammed China's property market and sent Chinese junk bond yields to the highest level since March 2020, the company took the unprecedented step of publishing a statement on its website, according to which it is "indeed facing unprecedented difficulties but it firmly fulfills responsibilities." The company added that it will go all out to resume work and production, ensure to deliver buildings, do everything possible to restore normal operations, and protect the legitimate rights and interests of customers.

The company's statement was also prompted by the growing operational and liquidity crunch that has crippled Evergrande's business and balance sheet, and as Bloomberg reports this morning is now manifesting itself in mounting protests by homebuyers, retail investors and even its own employees, raising the stakes for authorities in Beijing as they try to prevent the property giant’s debt crisis from sparking social unrest.

According to Caixin, police descended on Evergrande’s Shenzhen headquarters late Monday after dozens of people gathered to demand repayments on overdue wealth management products. Protesters numbered in the hundreds on Sunday.

In what appears the sad - and inevitable - beginning of the end for Evergrande, the largest Chinese developer told employees at its office in Shenyang, near the border with North Korea, to work from home after staffers who bought the company’s WMPs staged a protest over the weekend, Bloomberg reported citing a person familiar with the matter said. In Guangzhou, angry homebuyers surrounded a local housing bureau last week to demand Evergrande restart stalled construction.

Videos of protests against the developer in other parts of China were being shared widely on China's microblogging platform, Weibo. For now, there has been indication [sic] that any of them have turned violent....

....MUCH MORE

Recently: