The problem with these situations is you don't know how deep the rot goes until the positions start to unwind. That's how a stupid (relatively) little family office, Archegos Capital, came close to causing serious problems, re-re-hypothecated collateral and 100:1 leverage in some of the positions meant no one was really aware of what would happen if the market for the collateral stopped ascending.

In the Evergrande case, if the mess gets into the trillions of US dollar equivalents, the Chinese may need more ammo than they posses to contain the fallout. Hence the question of Fed assistance.

Via ZeroHedge:

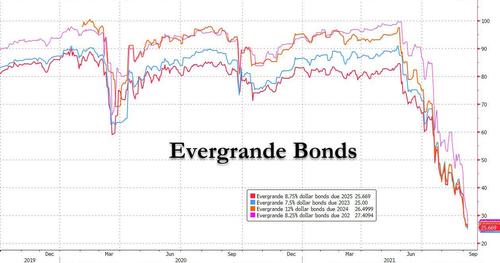

Another day, another dismal development for "China's Lehman", with Bloomberg reporting that just hours after Fitch joined Moody's in a triple-notch downgrade of China's property development giant (from CCC+ to CC), coupled with a warning that "default appears probable", the dollar bonds of China Evergrande fell to fresh lows, after a report from financial intelligence firm REDD that the firm plans to suspend interest payments on loans from two banks due Sept. 21, and asked a lender to wait for instructions about an extension plan..

For those saying that there is a word for this, you are right: it's technical default, or "selective default" in the parlance of rating agencies; it occurs when a borrower fails to pay one or more of their obligations but continues to meet other payment obligations, and usually precedes a full-blown default and/or bankruptcy although in China the distinction tends to be a little blurry.

Following the news, Evergrande's dollar bond due 2025 fell 1.5 cents on the dollar to 24.2 cents with all other USD bonds sliding in sympathy...

... having already been hammered earlier after Fitch said that its 3-notch downgrade "reflects our view that a default of some kind appears probable."

Evergrande itself warned last week of default risks if its efforts to raise cash fall short. Last Friday, the company also said its contracted sales in August, including those to suppliers and contractors to offset payments, dropped 26% compared with a year ago.

The insolvent Evergrande has become one of the biggest financial worries in China, the epicenter of a potential default shockwave given its massive pile of $305 billion in liabilities to banks, shadow lenders, companies, investors, vendors and home buyers. Investor fears that a default is imminent have led to a crash in the firm’s bonds in recent weeks, which are now trading as if the company is already broke, and triggered fears about contagion risk in the broader credit market....

....MUCH MORE

I might have been too dismissive with yesterday's "Attention: The Black Swan In The Center Of Beijing's Tiananmen Square Meant Nothing, Please Go About Your Business".