This is such a tricky game we play. Macro theory says we get a stronger currency with higher yields. Until we don't. Because macro theory also says higher inflation gives us a weaker currency,

And catching that inflection point is critical to all the commodity bets denominated in dollars.

As the old-timers used to say: "Pay attention or pay the offer."

From ZeroHedge:

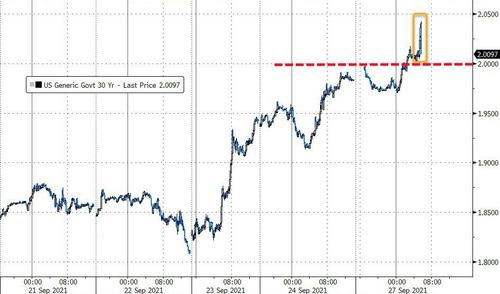

Following the hotter than expected durable goods headline data, 30Y Yields briefly spiked up to almost 2.05%, but fell back on the core data - although they are still holding above 2.00%

Source: Bloomberg

This has been a key level to watch in recent months...

Source: Bloomberg

The short-end of the curve is really suffering with 2Y back above Fed Funds and at its highest level since March 2020 (and 10Y back above 1.50%)....

....MORE