From ZeroHedge, 7:13 am EDT:

Evergrande Rocked By Report China "Making Preparations For Its Demise", Conflicting With Earlier News

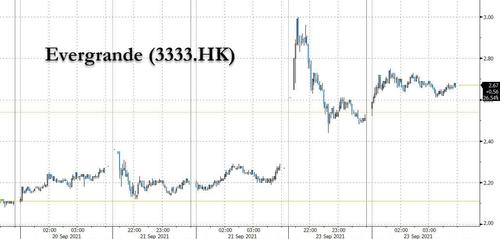

It has been a rollercoaster session for Evergrande this morning.

It started off optimistically enough, with Evergrande stock - which hit an all time low earlier this week in Hong Kong trading - soaring as much as 30% on furious short covering in early trading following news that the company would make an interest payment on local bonds...

... even though the big question for today was whether foreign creditors, who are also owed an $83.5 million interest payment Thursday, would get their money.

Evergrande pared its gains before the close as selling shareholders took advantage of the price spike to continuing unloading shares, although the mood was decidedly more hopeful than on previous day, and pushed US equity futures sharply higher this morning.

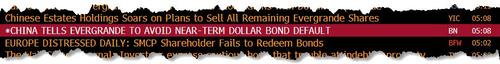

Said mood became even more euphoric just after 5am ET when Bloomberg blasted a flashing red headline for a report that China had told Evergrande to avoid a near-term dollar bond default...

... in which Bloomberg reported that according to "a person familiar with the matter", financial regulators in Beijing "issued a broad set of instructions to China Evergrande Group, telling the embattled developer to focus on completing unfinished properties and repaying individual investors while avoiding a near-term default on dollar bonds." The report added that "in a recent meeting with Evergrande representatives, regulators said the company should communicate proactively with bondholders to avoid a default but didn’t give more specific guidance."

And while even Bloomberg conceded that the regulatory guidance "offers few clues about what an Evergrande endgame might look like, it does suggest China’s government wants to avoid an imminent collapse of the developer that might roil financial markets and drag down economic growth."

In other words, even more good news, with Beijing explicitly demanding that Evergrande should make foreign creditors whole and the implication being that an Evergrande collapse may be avoided.

Or so the market though, until exactly one hour later when in a separate flashing red headline...

.. Bloomberg informed the world of a story published away in the WSJ, which delivered just the opposite news, namely that "China Makes Preparations for Evergrande’s Demise" and that "authorities are asking local governments to prepare for the potential downfall of China Evergrande Group." The report, which also cited anonymous "officials familiar with the discussions" who may or may not have major financial exposure to Evergrande - which we assume are different anonymous sources from the ones Bloomberg used - signaled "a reluctance to bail out the debt-saddled property developer while bracing for any economic and social fallout from the company’s travails."

The WSJ then notes that "officials characterized the actions being ordered as “getting ready for the possible storm,” but it also gives the suggestion that a nationalization of Evergrande is on the table, quoting those same officials as "saying that local-level government agencies and state-owned enterprises have been instructed to step in only at the last minute should Evergrande fail to manage its affairs in an orderly fashion."....

....MORE

The Party/Government has time to get their story straight. Per the earlier Marc to Market:

Asia Pacific

The Evergrande saga continues to play out, and the anxiety seen Monday and claims of a "Lehman moment" have died down. A dollar payment is due today, and recall that there is a grace period. The direct contagion outside of China seems limited, and many observers may underestimate the "non-market" mechanisms that can be deployed. Moreover, with next week's holiday, PBOC officials have plenty of cover for additional injections of liquidity into the banking system....

....MORE