From IHS Markit, April 8:

Global PMI signals fastest rise in firms' input costs since 2008

Charges for goods and services both rise at steepest rates in PMI survey history

US sees sharpest price hikes, led by rising prices for consumer goods

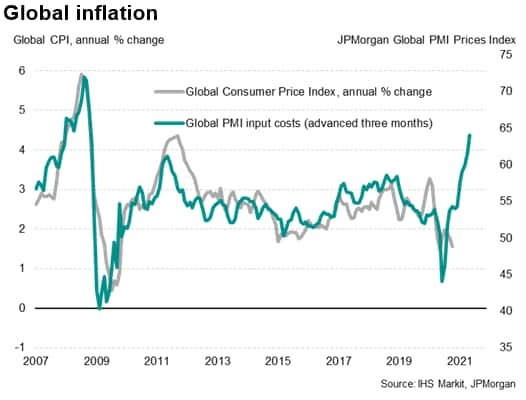

Inflationary pressures have risen worldwide to the highest for at least a decade as a surge in demand is accompanied by widespread supply constraints in the provision of goods and services. The survey data point to a steep rise in consumer price inflation across the world in coming months, most notably in the US, where prices charged for consumer goods rose especially sharply.

Steepest cost pressures since 2008

The input prices index from the JPMorgan Global Composite PMI, compiled by IHS Markit from its proprietary business surveys, rose to its highest since August 2008 in March, indicating by far the steepest rate of input cost inflation seen since the global financial crisis. Costs have now risen globally over the past ten months, having fallen sharply in April and May 2020 as demand collapsed amid the initial lockdowns due to the coronavirus disease 2019 (COVID-19) pandemic, with the rate of inflation rising markedly since the turn of the year.

The increase in costs has fed through to the steepest increase in average selling prices for goods and services for over a decade, the recent rate of increase greatly exceeding anything seen since comparable data were first available in late-2009....

....MUCH MORE

HT: The Financial Times' Claire Jones doing some crossover between the FT's Trade Secrets vertical and FT Alphaville at Alphaville's Further Reading post.