From/Via Zerohedge:

It has been years since European banks' dominated traditional investment-banking business lines like trading and M&A. But things weren't always this way. Before the financial crisis, and before regulators around the world started scrutinizing banks' derivatives businesses to try and curb risk.

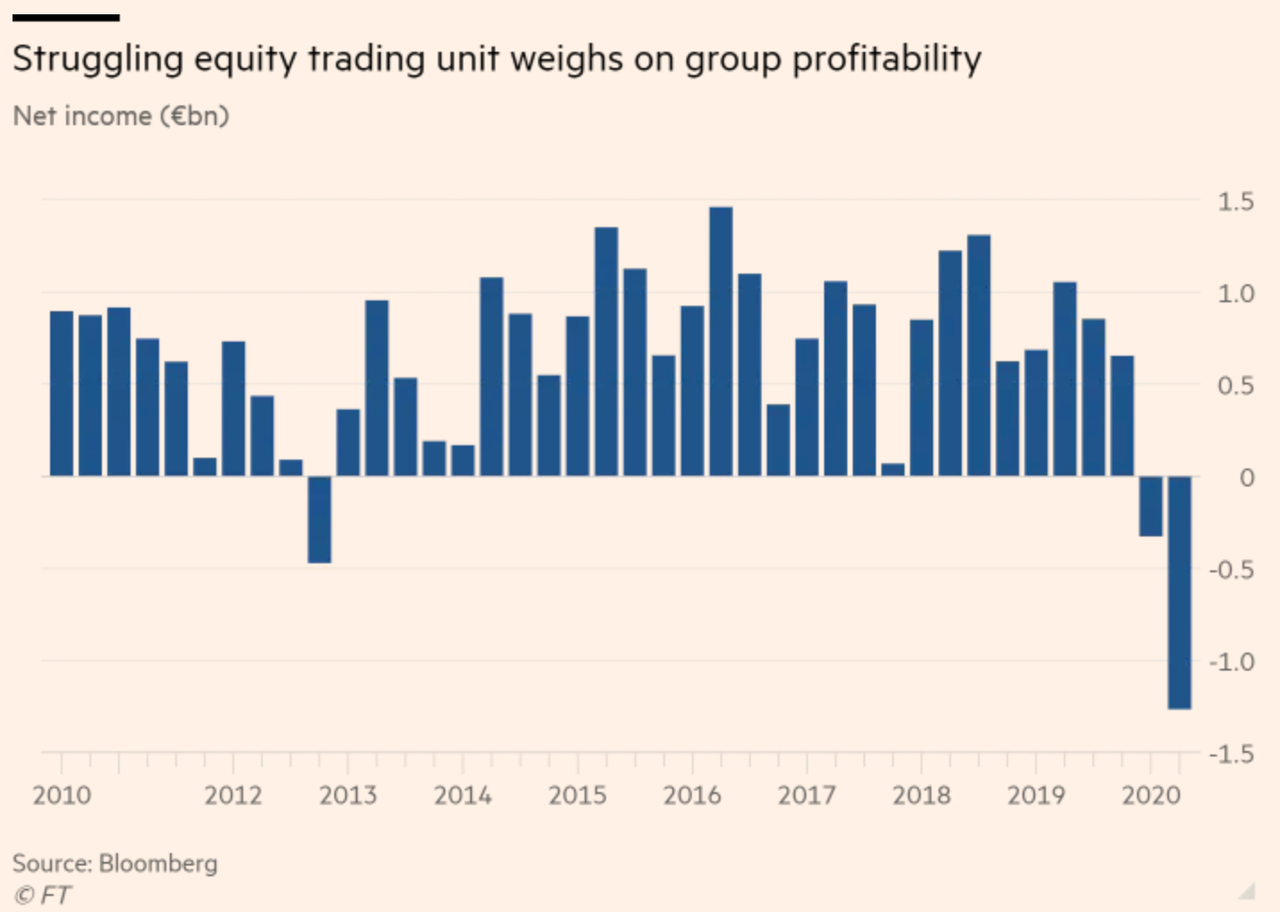

But while Deutsche Bank has become the poster-child for post-GFC decline - as its ambitions to become a global rival to JP Morgan crumbled to dust - Societe Generale, the French banking giant that reaped massive profits during the late 1990s and 2000s via its pioneering 'structured products' business, is also presiding over the twilight of a business line that was once the bank's profit center, but has been blamed for massive losses during the coronavirus downturn this spring.

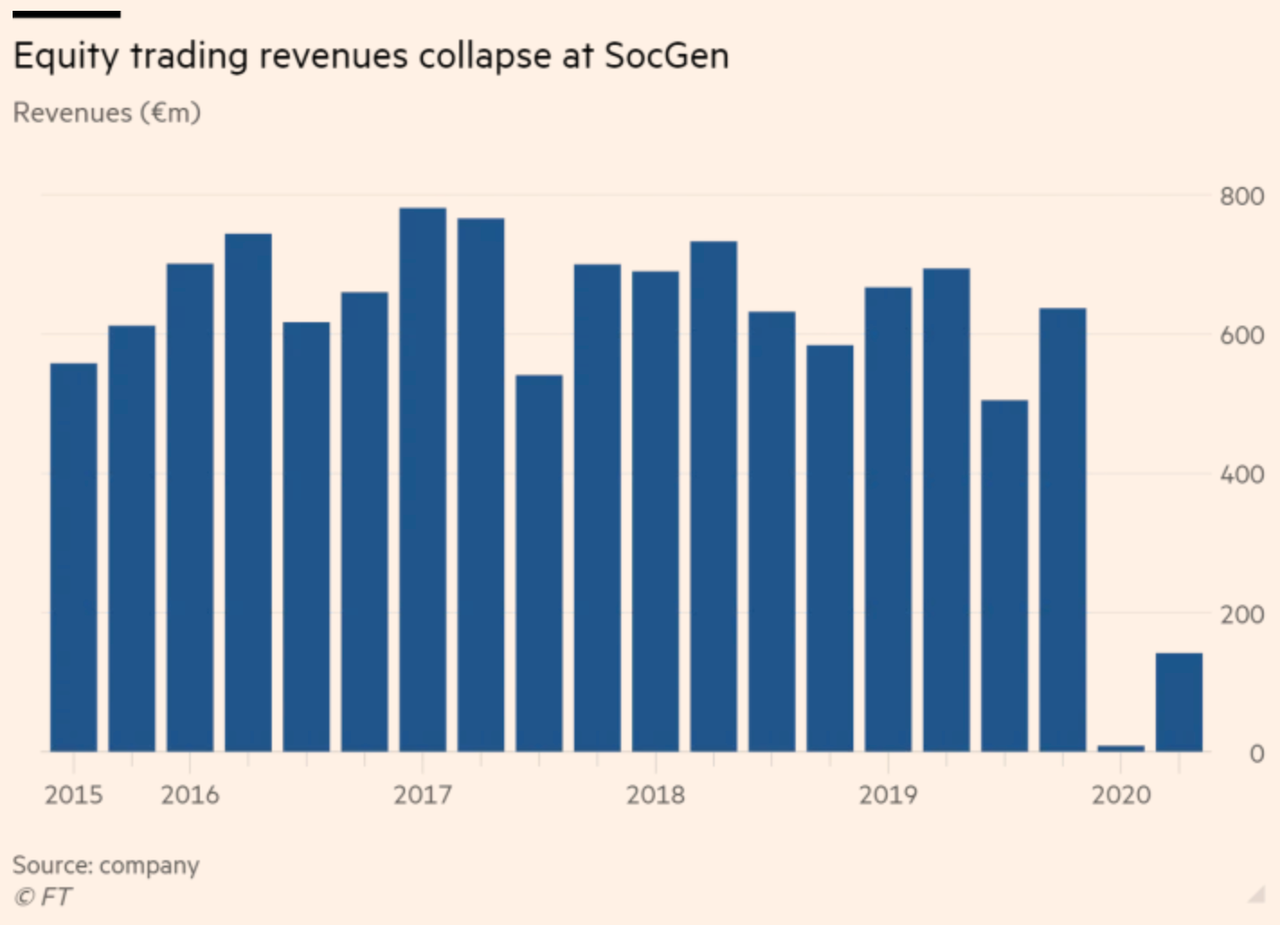

As the FT reminds us, the French bank fell to a shocking loss of €326 millions ($380 million) in the first quarter after revenue in its equity trading unit (long hailed as a key strength) collapsed almost 99% to just €9 million ($10.5 million) after the bank saw "the worst environment you can imagine" for its structured products business, CEO Frédéric Oudéa explained.

Another major loss was reported in August, after Q2 earnings were reported.

A loss that was attributed almost entirely to the group's

With shareholders revolting, Oudéa promised to cut back on the bank's structured products business, foregoing €250 million in revenue while targeting "cost savings" of €450 million ($523 million). The cuts are the biggest threat to a business line that set SocGen apart from its European peers, and helped establish the bank as a powerhouse in equity derivatives thanks to its 'structured products' business. These products, purchased by retail and institutional investors, charge relatively high fees, but purport to lock in moderate profits while smoothing out volatility.....MUCH MORE

30 years ago, however, the business was just the twinkle in the eye of a legendary French banker named Antoine Paille. 30 years ago, Paille was a 31-year-old software engineer with a big dream. He and a small team of engineers from a venerable French academy were bequeathed a basement office in downtown Paris, where they birthed the bank's structured products business. Here's the FT with more.

Thirty years ago, a group of maths and engineering graduates from Paris’s elite grandes écoles changed the direction of one of France’s oldest and most important banks.French banks, including SocGen, Natixis and BNP Paribas, eventually all became global leaders in these types of products, which encapsulated derivatives which promised to minimize volatility while maximizing the upside for clients. But in a world of low interest rates, and increasingly strenuous global competition, bankers were forced to make the products increasingly complex - and increasingly risky - just to keep up with the competition. "Correlation" offerings and "autocalls" soon dominated the landscape....

Under Antoine Paille, a 31-year-old software engineer, the small team was given a basement office a few streets from the Palais Garnier opera house in Paris with instructions to build a new business for Société Générale, the lender founded in the 19th century.

Mr Paille believed that SocGen’s dive into options and equity derivatives, which would eventually be packaged up for professional and retail investors into so-called structured products, could provide the bank with an advantage over its larger global competitors. He proved to be right.