They are called junk for a reason.

We know the Fed can do this, we went over the options back in 2008. They can even buy equities if they get the okey-dokey from Congress. They can lend directly to businesses so yes, they can do this.

But that doesn't make it right.

Or smart.

Or anything more than My Little Crony.

From Zerohedge:

Back on March 23, when the Fed unveiled it would start buying investment grade corporate bonds, we said "now that the Fed is effectively all in, it will buy stocks and junk bonds next."

Two weeks later, we were right and this morning the Fed announced it would, as expected, start buying junk bonds (we have to wait for the next "market" - we use the term loosely because it is no longer a market which is terminally disconnected from fundamentals but a giant, Fed-fueled Ponzi scheme - crash before the Fed goes literally all in and starts buying stocks and pretty much anything else).

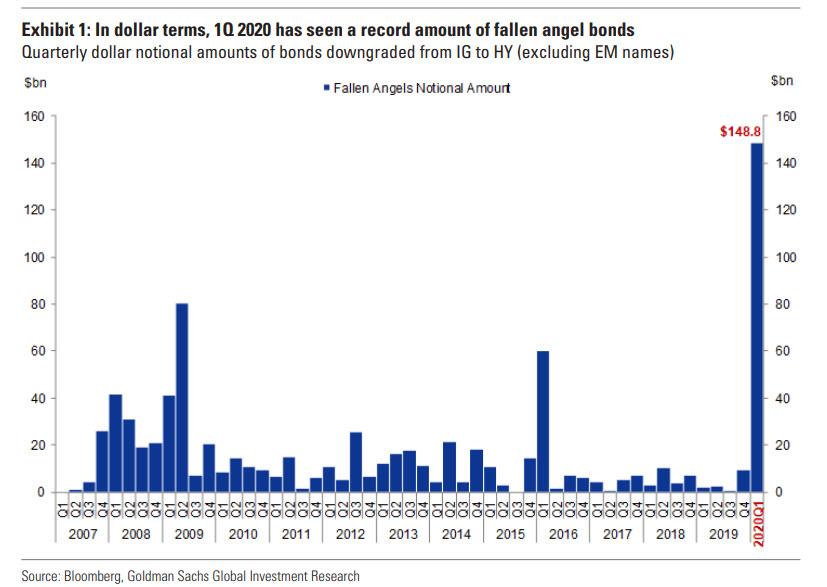

But let's back up. A few days ago, we pointed out that the day so many credit bears had been waiting for had arrived, when a record $150BN in investment grade bonds were downgraded to junk, becoming so-called fallen angels, and sparking concerns about what will happen to the $1.3 trillion junk bond market as hundreds of billions of formerly investment grade debt is downgraded to junk and violently reprices the entire high yield space.

Those concerns were answered this morning when as part of the Fed's expanded $2.3 trillion loan/bailout program, the Fed announced the expansion of its Primary and Secondary Market Corporate Credit Facilities, which will now purchase - drumroll - junk bonds.

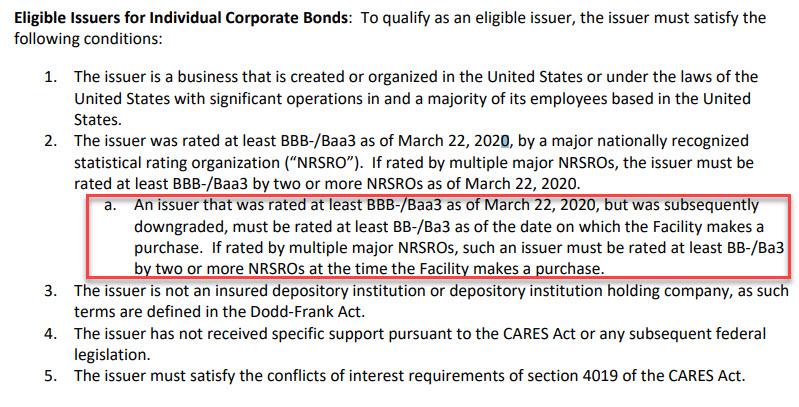

In the term sheet of the revised term sheet of the Secondary Market Corporate Credit Facility, the Fed now writes that "to qualify as an eligible issuer, the issuer must satisfy the following conditions"

The issuer was rated at least BBB-/Baa3 as of March 22, 2020, by a major nationally recognized statistical rating organization (“NRSRO”). If rated by multiple major NRSROs, the issuer must be rated at least BBB-/Baa3 by two or more NRSROs as of March 22, 2020.An issuer that was rated at least BBB-/Baa3 as of March 22, 2020, but was subsequently downgraded, must be rated at least BB-/Ba3 as of the date on which the Facility makes a purchase. If rated by multiple major NRSROs, such an issuer must be rated at least BB-/Ba3 by two or more NRSROs at the time the Facility makes a purchase.The section in question:

The same logic applies to Fed purchases in the Primary Market: going forward the Fed's Primary Market Corporate Credit Facility, where a Fed SPV will purchase qualifying bonds as the sole investor in a bond issuance; and purchase portions of syndicated loans or bonds at issuance, it will also include junk bonds and junk loans:.......MORE

Since there are no pure-play pitchfork manufacturers, I may have to set one up.

And then go borrow some loot from the Fed.

Related at ZH:

Watch: Powell Tells World "There's Really No Limit On What [Fed] Can Do"

Fed Unveils New Bailout Program, Will Provide Up To $2.3 Trillion In Loans To "Support Economy"