—and a hundred other posts, some links after the jump.

From the journal Nature, October 2:

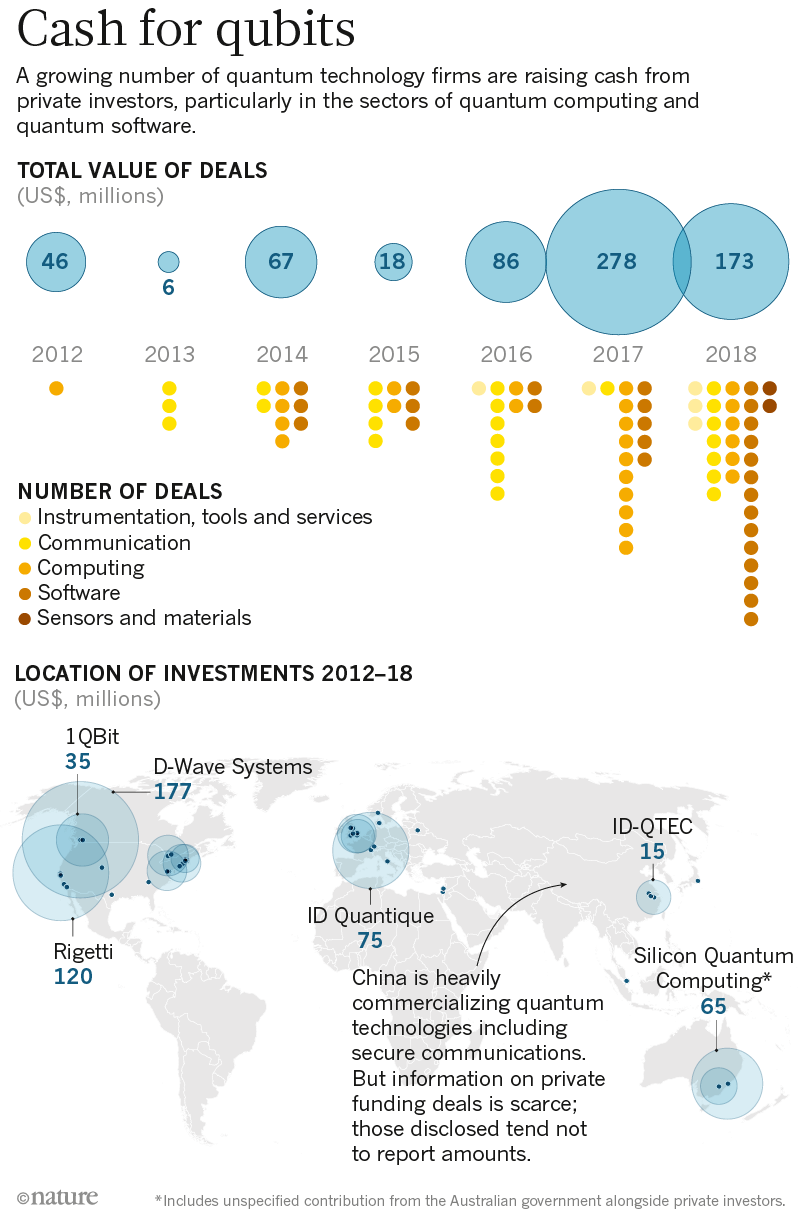

A Nature analysis explores the investors betting on quantum technology.

Robert Schoelkopf spent more than 15 years studying the building blocks of quantum computers until, in 2015, he decided it was time to start constructing one. The physicist and his colleagues at Yale University began pitching their start-up firm Quantum Circuits, Inc. to investors, hoping to persuade venture capitalists that the time was ripe to pour cash into a quantum-computing company. Within two years, the team had secured US$18 million. That was enough to build a specialist laboratory — which opened this January — in a science park near the university in New Haven, Connecticut, and to employ around 20 scientists and engineers.

For Schoelkopf, venture capital (VC) investing was unfamiliar territory. But he’s not the only quantum physicist to make a successful sales pitch. Governments and large technology firms have long nurtured quantum research, and in the past few years have announced billions of dollars for the field. As their support has ramped up, outside investors have looked to get in early on a fledgling industry.

By the start of this year, according to an analysis by Nature, private investors had funded at least 52 quantum-technology companies globally since 2012 — many of them spin-outs from university departments. (Academics have founded many more start-ups that have yet to close deals.) Although the value of some of the cash infusions remains secret, Nature’s analysis captures the scale of recent activity. It finds that, in 2017 and 2018, companies received at least $450 million in private funding — more than four times the $104 million disclosed over the previous two years (see ‘Cash for qubits’). VC makes up the bulk of this cash. Many firms in the VC hub of California’s Silicon Valley have already plunged in, and among the rest, “most are keeping a close eye on quantum”, says Christopher Monroe, a physicist at the University of Maryland in College Park who co-founded the quantum-computing firm IonQ in 2015.

Source: Nature analysis, including data from Quantum Computing Report, Boston Consulting Group, PitchBook and Crunchbase

Few doubt that quantum technologies will eventually yield useful and potentially revolutionary products. Alongside government investments, hundreds of firms are rushing to invest in the field, with big names such as IBM, Google, Alibaba, Hewlett Packard, Tencent, Baidu and Huawei all doing their own research. Google has reportedly now created a quantum computer that can solve specialized problems that would stump even the best classical computer — a landmark known as ‘quantum supremacy’. Secure encryption using quantum technology is already a commercial product, as are some quantum-enabled technologies that sense, image or measure at exquisitely precise scales. One firm, D-Wave Systems in Burnaby, Canada, even sells computers that exploit quantum effects, although these machines specialize in particular tasks known as optimization problems.....MUCH MORE

But venture capitalists tend to invest in what they hope will be game-changers, such as a multipurpose quantum computer that could handle many kinds of otherwise-unfeasible calculations. From the perspective of investors, the cash pumped into the field annually represents a small outlay so far — on a par with VC investments in artificial-intelligence (AI) firms before 2010, for instance. (By 2018, US VC investments in AI had boomed to $9.3 billion.) Still, these numbers are substantial for an immature field that doesn’t yet have much to sell. Despite this, some software firms are already marketing their work on quantum algorithms, which are written for hardware that does not yet exist....

Also at Nature, Oct. 2:

Beyond quantum supremacy: the hunt for useful quantum computers

Way back in 2017 Nature was posting (and we were linking): "Google's Quantum AI Laboratory set out investment opportunities on the road to the ultimate quantum machines" (GOOG).

And some other links:

March 2019

"Inside the high-stakes race to make quantum computers work"

March 2019

Quantum Computing That Is Actually Useful Gets A Bit Closer to Reality

October 2018

Computing: "D-Wave Launches Free Quantum Cloud Service"

October 2018

"10 Quantum Computing Startups Getting Funded in 2018"

Keeping in mind that Google is pretty fired up on D-Wave's architecture while Rigetti and Alibaba are developing proprietary systems....

September 2018

Cloud-Based Quantum Computing Is Almost Ready For Business

Thus sayeth Rigetti:...

March 2018

TASS: A multi-qubit quantum computer could be created in Russia within a year

March 2018

Quantum Computing: "Volkswagen Refining Machine Learning on D-Wave System"

"Google and VW partner on quantum computing to improve electric car batteries"

Volkswagen Using D-Wave Quantum Computer To Fight Beijing Traffic (plus the VW Level 5 autonomous vehicle)

February 2018

"The Argument Against Quantum Computers"

February 2018

Supremecy—Quantum Algorithms Struggle Against Old Foe: Clever Computers

January 2018

Breaking Bitcoin With a Quantum Computer

And the 2017 series:

Questions America Wants Answered: "Is Quantum Computing an Existential Threat to Blockchain Technology?"

Yeah, I Got Your Bitcoin Right Here: "‘Quantum Checks’ to Replace Cryptocurrencies in the Future?"

Computing: Will Quantum Devices Outperform Classical Computers by Year-end 2017? (thus achieving 'quantum supremecy')

The route to high-speed quantum computing is paved with error

"Google's Quantum AI Laboratory set out investment opportunities on the road to the ultimate quantum machines" (GOOG).

And many, many more.

Including 2015's

"Google says it has now proven that D-Wave’s quantum computer really works" (GOOG)

We have quite a few posts on D-Wave, links below, and through most of them our attitude was a dubious "Show me".

It appears they may have.