The piece below was written pre-market and doesn't address today's drawdown's but makes some interesting points.

From StockCharts:

Market Recap for Wednesday, September 5, 2018

There were a couple things that stood out to me regarding Wednesday's action. First, the recovery off the intraday low wasn't insignificant. However, the stocks driving most of the recovery were in defensive areas. Utilities (XLU, +1.40%) and consumer staples (XLP, +1.15%) were the only two sectors to gain more than 1% and both are defensive groups. Second, while the rebound in our major indices was fairly strong after heavy first hour selling, the NASDAQ's rebound was not strong at all and the reason was clear. Technology (XLK, -1.25%) and consumer discretionary (XLY, -1.08%) were the only sectors to see much selling at all and both were down more than 1%. So there seemed to be quite a bit of rotation from aggressive areas to defensive areas. Keep in mind that both the XLK and XLY recently spiked into all-time record high territory so profit taking is to be expected. I wouldn't jump off the nearest bridge because these two groups underperformed for a day, but continuation of this trend during the bearish month of September is worth monitoring.

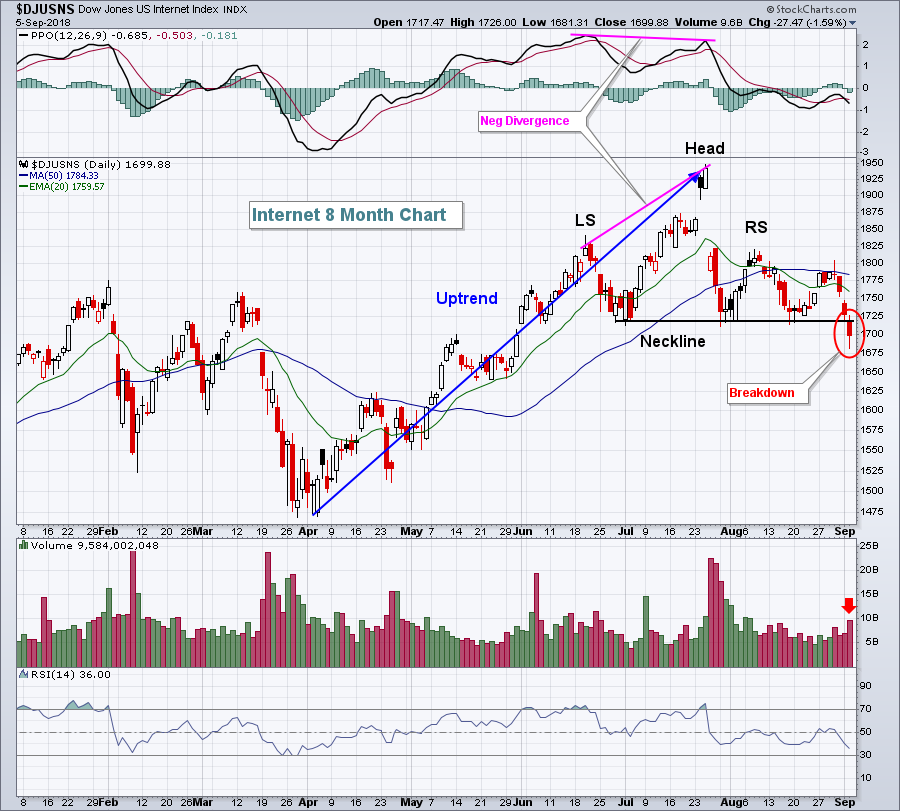

Software ($DJUSSW) and internet ($DJUSNS) were the primary reasons that technology was so weak. And there are reasons to fear further selling in both industry groups. Let's start with the DJUSNS:

Those who are bearish will no doubt point to this confirmed topping structure in a key area of technology. While I am not a believer that internet weakness will bring the entire market down (because other areas like semiconductors could step up - see Sector/Industry Watch below), I do share the bearish sentiment on this group currently. In fact, I'd be extremely careful owning any internet stock right now. (Disclosure: I do own GOOGL currently and will sell if Wednesday's intraday low is violated).

Facebook (FB) broke down beneath its post-earnings low and will likely move short-term to test gap support at 160, but eventually I see FB testing 150 to establish the right side of a bearish long-term head & shoulders neckline. FB is one of my least favorite stocks in the market right now as market participants scramble to figure out what the company's true valuation should be after a substantial lowering of their future operating margins. I know this might sound crazy, but I will not be surprised if FB is a $100 stock sometime in 2019. Personally, I believe it's an isolated occurrence in technology and many other very solid companies will hold up the NASDAQ. Anyhow, we'll see.

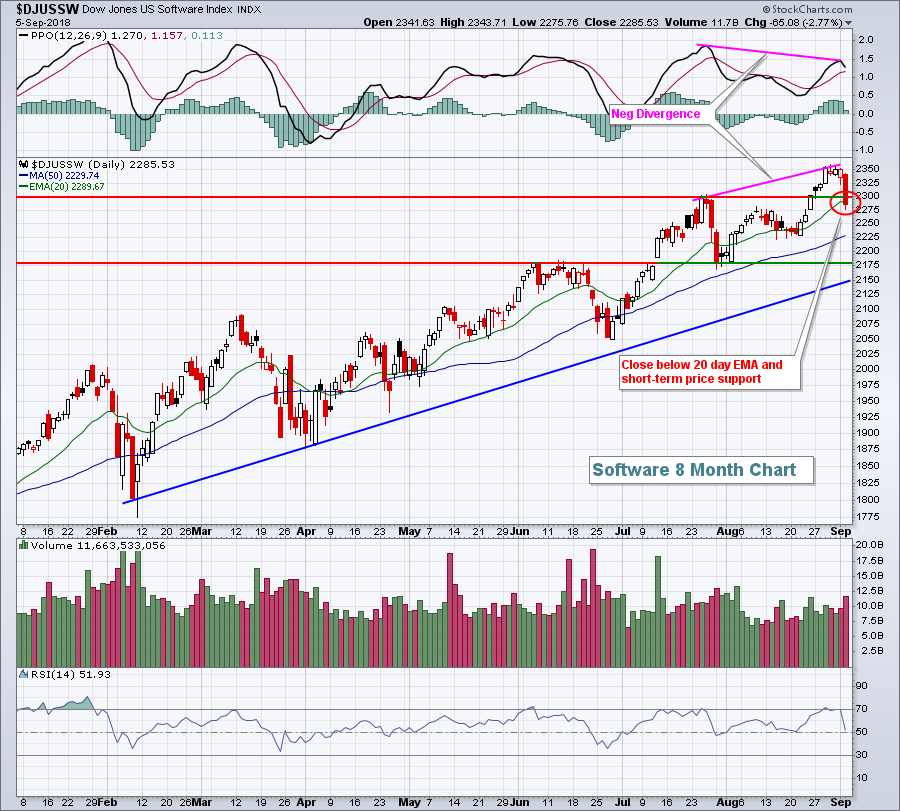

Then there was software yesterday, which lost rising 20 day EMA and price support with a negative divergence in play:

There's likely to be more short-term weakness in software, but if the group approaches its 50 day SMA or possibly moves beneath it, I expect the reward to risk to be extremely bullish for this group as we head into the fourth quarter. This is a group to watch for sure.

Pre-Market Action

Asian markets were weak overnight, but Europe appears to have weathered the short-term storm with mixed action. Thus far, the German DAX ($DAX) is holding onto psychological support at the 12000 level. Despite a weaker-than-expected ADP employment report this morning, Dow Jones futures are up 31 points with 30 minutes left to the opening bell.

Current Outlook

There is no disputing that technology (XLK) has been a primary driver behind the almost decade-long bull market. So when the sector begins to show any weakness whatsoever, it can cause short-term technical damage to the overall market. While the weakness in the XLK has been limited thus far to a 20 day EMA test on its daily chart, we should respect the near-term support on the 60 minute chart:

Trendline support is very clear and intersects somewhere near the 74.25 level. Price and gap support also reside at that 74.25 level. On the daily chart, the 20 day EMA is currently at 74.14. A break below this area wouldn't be long-term cause for concern, but knowing that September is historically bearish, the last thing the bulls want to see is a leader like the XLK failing to hold a short-term support zone. In my opinion, that 74.00 (where we bounced yesterday) to 74.25 support zone is big from a short-term trading perspective.......MORE