From Gizmodo,

September 25 will mark five years since Google first launched Shopping Express, the e-commerce offering meant to challenge Amazon’s dominance. But despite Google parent company Alphabet’s staffing brain trust and impressive coffers, Express has done little to reinvent fulfillment—in fact, according to several current and former workers, it’s been running much the same playbook as other on-demand gig economy offerings. Meanwhile, major retail partners like Target are beginning to opt out of what few boutique services it does offer, leaving Express’s contract workers scrambling in its wake.

Half a decade has given Google Express lots of time to experiment: with a subscription model (dropped last summer); with perishable groceries (ended after less than a year); with its own delivery hubs (shuttered). Tom Fallows, Express’s founder, quickly defected to Uber, and late last year, the team another lost another key executive, Brian Elliott, who departed for the greener pastures of Slack. More recent stories about the tenuous alliance to unseat Amazon cite Google as a bit player on the side of Walmart, rather than a tech giant dragging stodgy brick-and-mortars into the future of commerce....MUCH MORE

Express provides a revenue source for larger merchants, but a minor one at best: It only sees around 25 percent of the online traffic of Target, a fifth of Home Depot’s, and less than 9 percent of Walmart’s, according to Similarweb. While their lineup includes over 150 stores—some more recognizable than others—early partners, like American Eagle, Staples, Lucky, Office Depot, Blue Bottle Coffee, and REI have already disappeared from the list of partners, with little fanfare.

There’s good reason for Express’s failure to make a lasting mark. Amazon, Walmart, and other retailers have been waging a protracted war over warehousing and logistics while Express has almost no physical footprint of its own, instead leaching off the existing supply chains of its merchants and outsourcing labor to temps.

The standard tech sector model of “move fast and break things” works when engineers can be reassigned from the products they’re spinning up if they’re shown to be unsuccessful; when those projects increasingly rely on contract—who get left out to dry during these overhauls—it looks less like progress than abusive capitalism.

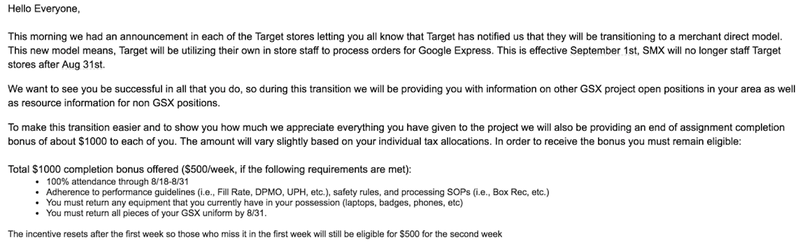

Here’s basically how Express works: Google contracts staffing agencies like Adecco and SMX for “Store Operators,” as well as delivery companies like On Trac and Lasership. The operators—on short-term assignments, with few benefits—are sent to partnered stores where they’re assigned one or more roles during their shift: pick, pay, or pack. What this means in practical terms is workers for whom Google takes no direct ownership walking the aisles of a Costco or a Home Depot to collect the items individual customers bought online, then paying for those items with the store’s point-of-sale system using a Google-branded credit card, and stuffing them into a box—a box which is then loaded into the van driven to your shipping address by someone else Google hires indirectly. That’s roughly the chain of events set in motion when you hit “checkout” at express.google.com or the Google Express app....