It is not often that we steal a march on Mr. Bianco but I think we were ahead of him on this one.

Will the Fed buy the paper the Treasury will be forced to sell or will the Fed stand aside and let rates tank the new administration?

From Neue Zürcher Zeitung's TheMarket.ch, November 11:

Donald Trump’s election and the Republican red sweep are setting financial markets in motion. Jim Bianco, President and Macro Strategist at Bianco Research, believes that the change of power in Washington will give the US economy a fresh boost. However, it also poses the risk of inflation flaring up again, which will be a challenge for investors.

Things are about to change. Donald Trump won the US presidential election by a surprisingly large margin and Republicans have a good chance of taking full control of Congress next year. Accordingly, financial markets are bracing themselves for a policy shake-up in terms of taxes, regulation, immigration and trade.

A key question remains what will happen when it comes to inflation and interest rates. As expected, the Federal Reserve lowered the benchmark Federal Funds Rate to a range between 4.5% and 4.75% at its meeting last week. However, the extent to which monetary policy will be eased further remains anyone’s guess.

Stocks are reacting euphorically to the change of power in Washington. On Friday, the S&P 500 climbed above 6000 for the first time. Meanwhile, tensions in the bond market are increasing. The yield on ten-year Treasuries has risen rapidly since mid-September and shortly exceeded 4.4% last week, bringing back unpleasant memories of the turmoil in 2022-23.

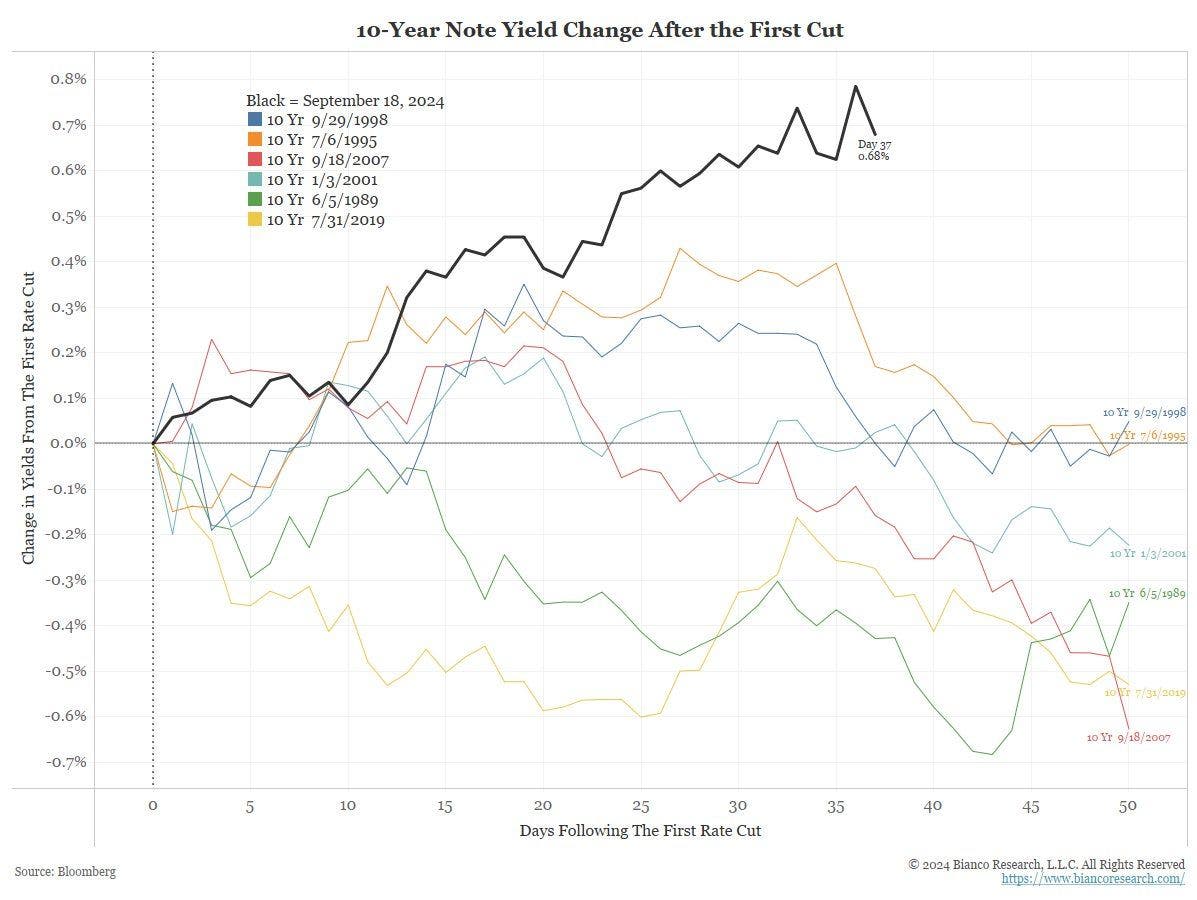

«I think the uptrend in yields that started with the Fed cut in mid-September is very much intact,» says Jim Bianco, founder and president of the Chicago based research boutique Bianco Research. «Once the euphoria subsides, the focus will shift to interest rates and investors realize that we’re heading towards an inflation problem in 2025, with interest rates just going up and up,» he warns.

In an in-depth interview with The Market NZZ, which has been lightly edited, the investment strategist talks about the outlook for the US economy under Trump’s second term, the risk of inflation, the consequences for financial markets and how investors can prepare themselves.

«I don’t know if everybody is ready for the idea that by the end of the year the Fed’s whole interest rate cutting campaign will be mostly if not completely done»: Jim BiancoThe results of the US election have triggered meaningful moves across all asset classes; from equities, bonds and currencies all the way to commodities and crypto currencies. How do you think markets will behave in the coming weeks and months?

Let’s start with the big picture, let’s start where we were before election night. On September 18, the Fed started cutting interest rates and what followed was a rather interesting market reaction: We saw the fastest rise in the yield on 10-year Treasuries of any period after the first Fed cut on record, it was up almost 80 basis points in the next seven weeks. Inflation break-evens, a market measure of inflation expectations, rose by the most we’ve seen in at least 25 years. The Bloomberg U.S. Economic Surprise Index is at its highest level since February, indicating that economic data is much stronger than expected. All that suggests the economy is in a no-landing zone, growing at its potential, if not more, rather than in a soft-landing zone.

In other words, the Fed must be careful not to lose control over inflation again?

Yes, cutting rates now might be even worse than the policy error when the Fed thought inflation was largely ‹transitory›. They started off with a 50 basis points cut, signaling a pivot towards further meaningful easing of monetary policy. Chicago Fed President Austan Goolsbee essentially confirmed this the week after in late September, indicating that interest rates must be slashed by hundreds of basis points to reach a neutral policy stance. So I guess the market already started thinking to itself that all these rate cuts aren’t really needed in light of the robust economic data, and if the Fed is following through, it’s time to worry about inflation again because they might overstimulate the economy.

Next, markets had a strong reaction in the aftermath of the election.

The real surprise wasn’t Trump’s win, because a fair number of people expected that. The big shocker was that he pulled off a red wave, even securing the popular vote. The Senate is now definitely Republican; the House is still undetermined, but most people think that it’s going to stay Republican as well. Adding all that up, it’s a mandate for things to change, and then you look at what Trump is all about from an economic standpoint. He’s not really interested in cutting spending, neither is J.D. Vance. They’re interested in cutting taxes, and that sounds like bigger deficits. I think that’s why the bond market had such a bad reaction in the immediate aftermath of the election: The economy is already strong, the Fed is signaling substantial rate cuts on the horizon, and now we’re piling on all this fiscal stimulus through tax cuts and deregulation.

The rally in equities is reminiscent of Trump’s first win eight years ago. To what extent does the 2016 playbook hold clues for market behavior in coming weeks and months?

Of course, everybody is looking at 2016. But you have to keep in mind that the only thing in common with 2016 is that Trump won. Beyond that, there are many differences: Then, the Fed was raising rates, they’re cutting them now; valuations in the stock market were a lot lower than they are today, and interest rates as well; the Fed’s target rate was still well under 1%, and bond yields were much lower; crude oil prices were in the $20 to $30 range in 2016, they’re in the $70 to $80 range now. Inflation wasn’t even a word we considered, whereas inflation was the driving reason people voted Trump in for a second term. So actually, there are more differences than similarities with 2016....

....MUCH MORE

Inflation was going to restart regardless of who was in the White House.

And that was the essence of our thinking in March 2024:

...On the other hand, I'm not sure you would want to be President during the next four years, there are so many problems that have been growing and metastasizing just beneath the surface of the daily news that the person in the hot seat could end up just plain reviled....

Repeated and expounded upon two weeks later in "Hotshot Wharton professor sees $34 trillion debt triggering 2025 meltdown as mortgage rates spike above 7%: ‘It could derail the next administration’"

...If I were a Democrat strategist I would propose letting Donald Trump win a second term while concentrating on House and especially Senate (to bottle up judicial, including Supreme Court, nominees) races. A Trump win would give an excuse for riots (for the visuals) and if he is handcuffed by the Legislative branch to limit the range of possible responses, you go beyond polycrisis to the omnicrisis. Throw in a bit of Frances Fox Piven with her "overwhelm the system" and "motor voter" strategies and you could see one-party rule for thirty years....

Both posts wrapped together in July 22's "Your Quick 'Intentions of the Democratic Party' Cheat Sheet". There are many posts both before and after these but that's the gist of it.